- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1401

Sprocomm Intelligence (HKG:1401) Has Debt But No Earnings; Should You Worry?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Sprocomm Intelligence Limited (HKG:1401) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Sprocomm Intelligence

What Is Sprocomm Intelligence's Debt?

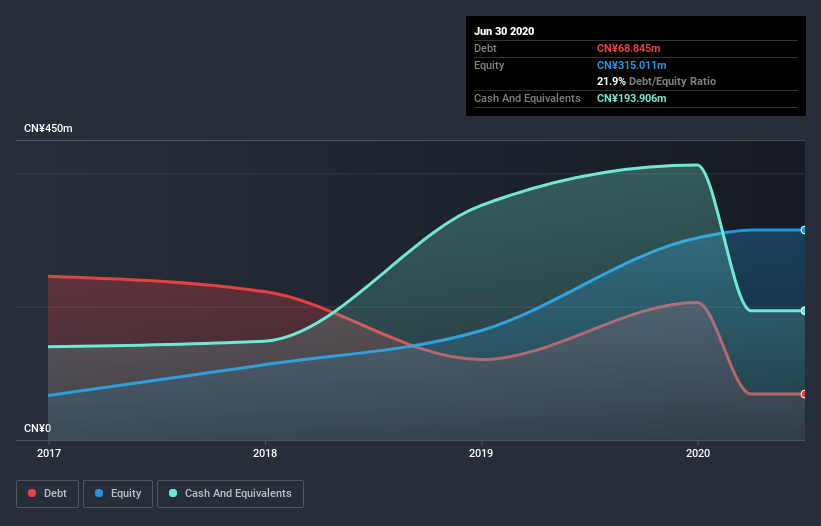

You can click the graphic below for the historical numbers, but it shows that Sprocomm Intelligence had CN¥68.8m of debt in June 2020, down from CN¥120.7m, one year before. However, it does have CN¥193.9m in cash offsetting this, leading to net cash of CN¥125.1m.

How Healthy Is Sprocomm Intelligence's Balance Sheet?

According to the last reported balance sheet, Sprocomm Intelligence had liabilities of CN¥873.2m due within 12 months, and liabilities of CN¥55.5m due beyond 12 months. Offsetting these obligations, it had cash of CN¥193.9m as well as receivables valued at CN¥467.5m due within 12 months. So it has liabilities totalling CN¥267.2m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Sprocomm Intelligence has a market capitalization of CN¥626.5m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Sprocomm Intelligence also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Sprocomm Intelligence will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Sprocomm Intelligence made a loss at the EBIT level, and saw its revenue drop to CN¥2.8b, which is a fall of 6.0%. We would much prefer see growth.

So How Risky Is Sprocomm Intelligence?

While Sprocomm Intelligence lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of CN¥38m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Sprocomm Intelligence (including 2 which is are significant) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Sprocomm Intelligence or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1401

Future Machine

An investment holding company, engages in the research and development, design, manufacture, and sale of mobile phones, PCBAs for mobile phones, and IoT related products in the People’s Republic of China, India, Algeria, Bangladesh, and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026