Is OneConnect Financial Technology (HKG:6638) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, OneConnect Financial Technology Co., Ltd. (HKG:6638) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for OneConnect Financial Technology

What Is OneConnect Financial Technology's Net Debt?

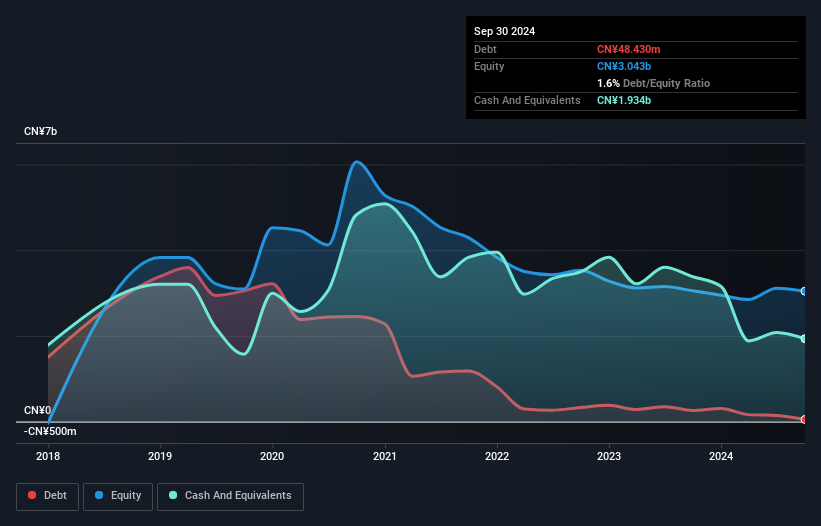

You can click the graphic below for the historical numbers, but it shows that OneConnect Financial Technology had CN¥48.4m of debt in September 2024, down from CN¥259.0m, one year before. But on the other hand it also has CN¥1.93b in cash, leading to a CN¥1.89b net cash position.

How Healthy Is OneConnect Financial Technology's Balance Sheet?

We can see from the most recent balance sheet that OneConnect Financial Technology had liabilities of CN¥1.68b falling due within a year, and liabilities of CN¥25.4m due beyond that. Offsetting these obligations, it had cash of CN¥1.93b as well as receivables valued at CN¥748.5m due within 12 months. So it can boast CN¥981.4m more liquid assets than total liabilities.

This surplus strongly suggests that OneConnect Financial Technology has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, OneConnect Financial Technology boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if OneConnect Financial Technology can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, OneConnect Financial Technology made a loss at the EBIT level, and saw its revenue drop to CN¥2.9b, which is a fall of 26%. That makes us nervous, to say the least.

So How Risky Is OneConnect Financial Technology?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that OneConnect Financial Technology had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of CN¥195m and booked a CN¥298m accounting loss. But the saving grace is the CN¥1.89b on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how OneConnect Financial Technology's profit, revenue, and operating cashflow have changed over the last few years.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6638

OneConnect Financial Technology

OneConnect Financial Technology Co., Ltd.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.