As global markets continue to experience a surge in optimism, driven by hopes for softer tariffs and enthusiasm surrounding artificial intelligence, major indices like the S&P 500 have reached record highs. In this environment, high-growth tech stocks are capturing investor attention due to their potential for innovation and expansion, particularly as sectors related to AI infrastructure gain momentum.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1224 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Paradox Interactive (OM:PDX)

Simply Wall St Growth Rating: ★★★★★☆

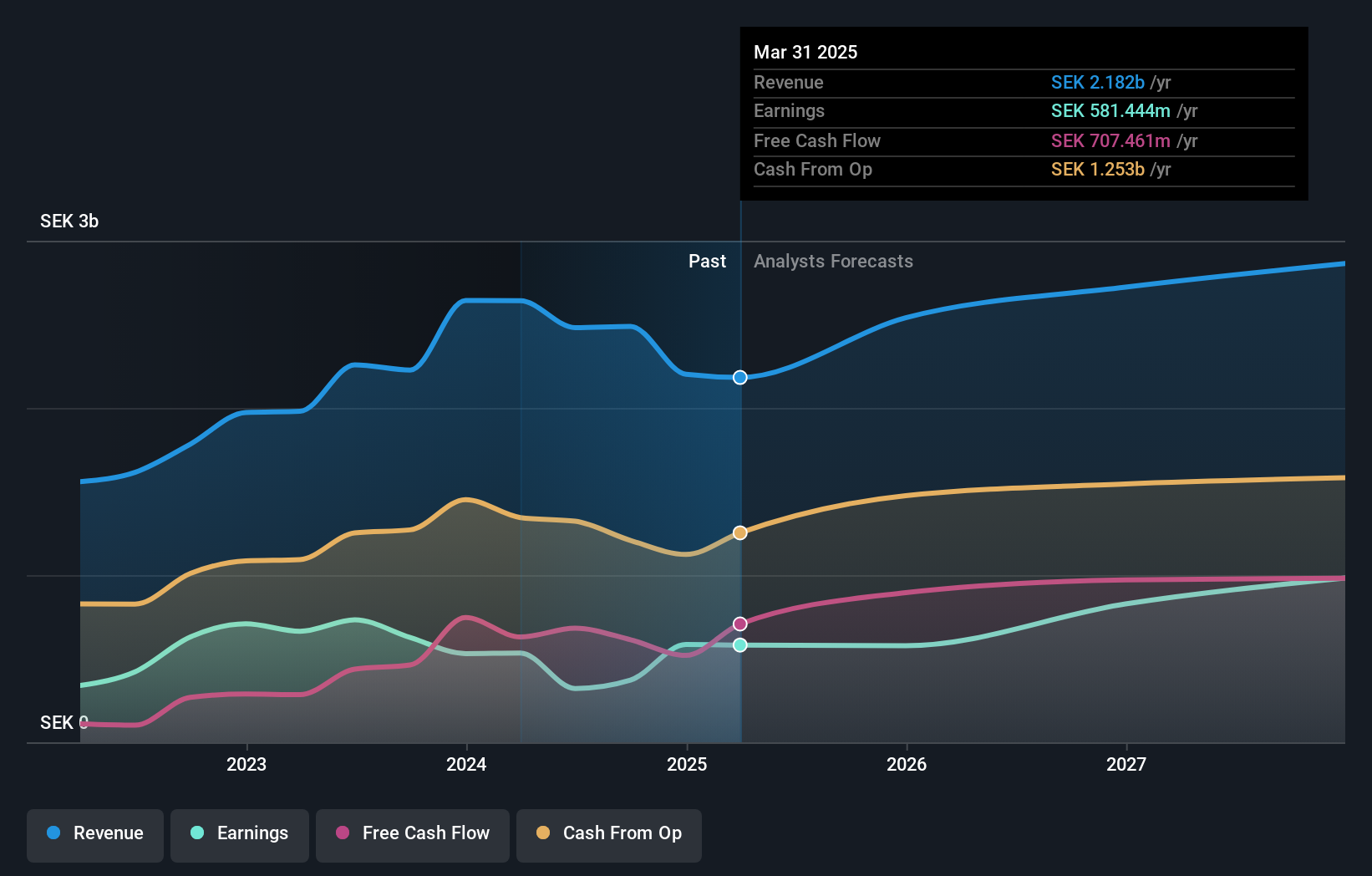

Overview: Paradox Interactive AB (publ) is a company that develops and publishes strategy and management games for PC and consoles across various regions including North and Latin America, Europe, the Middle East, Africa, and the Asia Pacific, with a market capitalization of approximately SEK21.97 billion.

Operations: The company generates revenue primarily through its computer graphics segment, amounting to SEK2.49 billion. It focuses on developing and publishing strategy and management games for both PC and consoles across multiple regions worldwide.

Paradox Interactive, a Swedish game developer, is navigating a challenging landscape with mixed financial outcomes. Despite experiencing a 40.6% dip in earnings over the past year, the company's strategic focus on expanding its gaming portfolio with launches like "First Contact" and "Galactic Paragons" for Stellaris: Console Edition demonstrates resilience and innovation. These expansions, priced at $29.99/€29.99/£24.99 each, enhance user engagement through new story packs and gameplay mechanics that deepen interstellar exploration narratives—critical as the firm aims to outpace Sweden's market growth forecast of 1.1% with its own 9%. Moreover, Paradox continues to invest in R&D significantly; however, specific figures were not disclosed in the provided data but are essential for sustaining long-term competitiveness by fostering product innovation and diversification.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

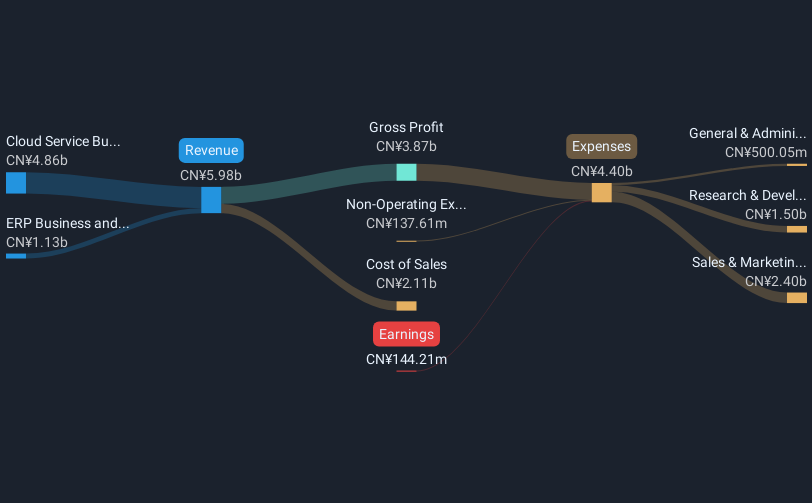

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning sector with a market capitalization of HK$36.46 billion.

Operations: Kingdee focuses on enterprise resource planning, primarily generating revenue through its Cloud Service Business (CN¥4.86 billion) and ERP Business (CN¥1.13 billion).

Kingdee International Software Group, a key player in the software industry, is demonstrating robust growth dynamics. The company's revenue is growing at an annual rate of 13.7%, outpacing the Hong Kong market's average of 7.7%. This growth is supported by significant investments in R&D, which are crucial for maintaining competitive advantage and fostering innovation within its offerings. Kingdee's earnings are also expected to surge by 40.3% annually, reflecting strong operational efficiency and market demand for its products. Despite current unprofitability, these financial trends suggest promising future prospects as the company moves towards profitability over the next three years, aligning with broader industry shifts towards software as a service (SaaS) models that promise recurring revenue streams.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

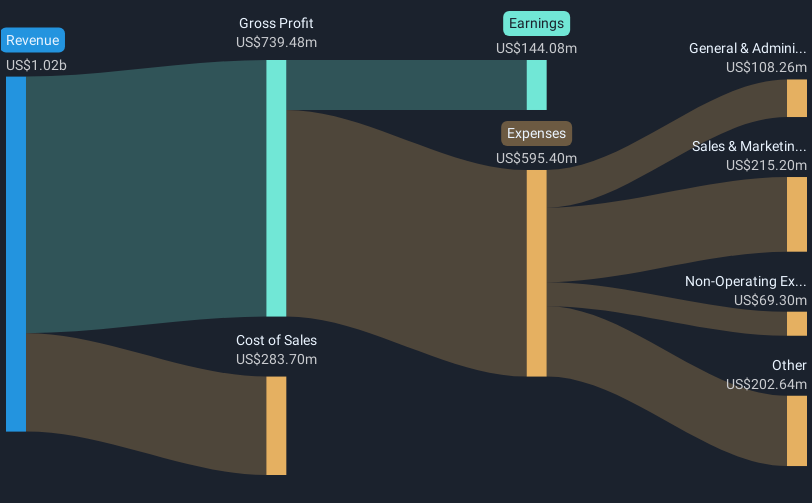

Overview: Temenos AG specializes in creating and distributing integrated banking software systems for financial institutions globally, with a market cap of CHF5.63 billion.

Operations: The company generates revenue primarily from licensing its banking software, along with maintenance and service fees. Its cost structure includes research and development, sales and marketing, as well as general administrative expenses. The business has exhibited a notable trend in its net profit margin over recent periods.

Temenos, a leader in banking software solutions, has recently secured several strategic clients including CEC Bank and AHAM Capital, enhancing its market presence through advanced SaaS offerings. These partnerships underscore the company's commitment to delivering top-tier financial technology on a global scale. Temenos' recent integration of generative AI technologies with NVIDIA highlights its innovative approach, aiming to provide banks with powerful tools for data analysis and customer interaction. With an annual revenue growth of 7.3% and earnings growth projected at 12% per year, Temenos is positioned above the Swiss market averages for both metrics (4.4% and 11.2%, respectively). This performance is bolstered by substantial R&D investments that drive continuous product enhancement and client satisfaction in a competitive sector.

- Click here and access our complete health analysis report to understand the dynamics of Temenos.

Assess Temenos' past performance with our detailed historical performance reports.

Seize The Opportunity

- Click here to access our complete index of 1224 High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:268

Kingdee International Software Group

An investment holding company, engages in the enterprise resource planning business.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives