- Hong Kong

- /

- Infrastructure

- /

- SEHK:6117

Qiniu And 2 Other Asian Penny Stocks Worth Watching

Reviewed by Simply Wall St

As global markets navigate a period of interest rate adjustments and economic uncertainties, investors are increasingly looking towards smaller, potentially undervalued stocks for opportunities. Penny stocks, despite the term's old-fashioned connotations, continue to represent companies that may offer significant value due to their potential for growth and resilience. By focusing on those with strong financials and a clear path forward, investors can uncover promising prospects within this segment of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.10 | SGD445.82M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.96 | THB2.98B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.108 | SGD56.54M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.50 | SGD13.77B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$5.00 | HK$22.11B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.21 | ₱843.44M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 971 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Qiniu (SEHK:2567)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qiniu Limited provides Platform-as-a-Service with a focus on audiovisual cloud services for enterprise customers in Mainland China, and has a market cap of approximately HK$1.38 billion.

Operations: The company's revenue is primarily derived from its Platform-as-a-Service solutions, amounting to CN¥1.56 billion.

Market Cap: HK$1.38B

Qiniu Limited, with a market cap of approximately HK$1.38 billion, primarily generates revenue from its Platform-as-a-Service solutions, totaling CN¥1.56 billion. Despite being unprofitable and having a negative return on equity of -77.2%, Qiniu's short-term assets significantly exceed both its short- and long-term liabilities, indicating good liquidity management. The company has not experienced meaningful shareholder dilution recently and is trading at a good relative value compared to peers in the industry. However, it faces challenges with increased debt levels over the past five years and requires careful cash flow management to maintain its 1.2-year runway amidst declining earnings growth rates.

- Dive into the specifics of Qiniu here with our thorough balance sheet health report.

- Gain insights into Qiniu's future direction by reviewing our growth report.

Tian An China Investments (SEHK:28)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, and the United Kingdom with a market cap of approximately HK$6.82 billion.

Operations: The company's revenue is primarily derived from Property Development (HK$7.61 billion), followed by Healthcare (HK$1.54 billion) and Property Investment (HK$573.86 million).

Market Cap: HK$6.82B

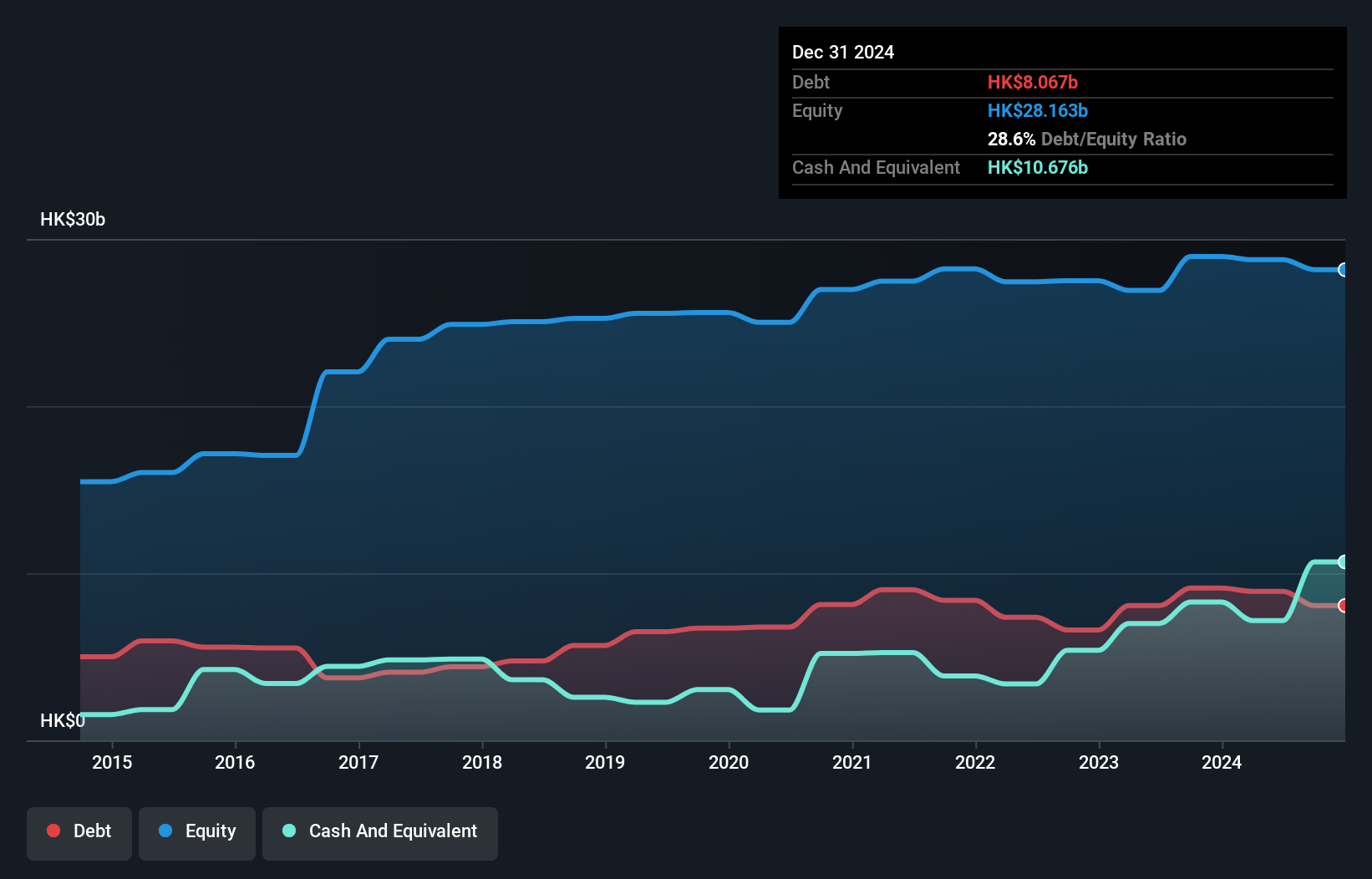

Tian An China Investments, with a market cap of approximately HK$6.82 billion, demonstrates strong financial stability through its substantial short-term assets (HK$21.2 billion) exceeding both short- and long-term liabilities. The company has shown impressive earnings growth of 186.8% over the past year, significantly outpacing the industry average decline of 13.3%. While trading at a considerable discount to estimated fair value, Tian An's high-quality earnings and reduced debt levels enhance its appeal among penny stocks in Asia. However, it maintains a low return on equity at 6.8%, suggesting potential areas for improvement despite robust interest coverage by EBIT (230.3x).

- Click here and access our complete financial health analysis report to understand the dynamics of Tian An China Investments.

- Learn about Tian An China Investments' historical performance here.

Rizhao Port Jurong (SEHK:6117)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rizhao Port Jurong Co., Ltd. operates port facilities in Rizhao, China, with a market capitalization of HK$1.23 billion.

Operations: The company generates revenue of CN¥728.01 million from rendering stevedoring and storage goods and ancillary services.

Market Cap: HK$1.23B

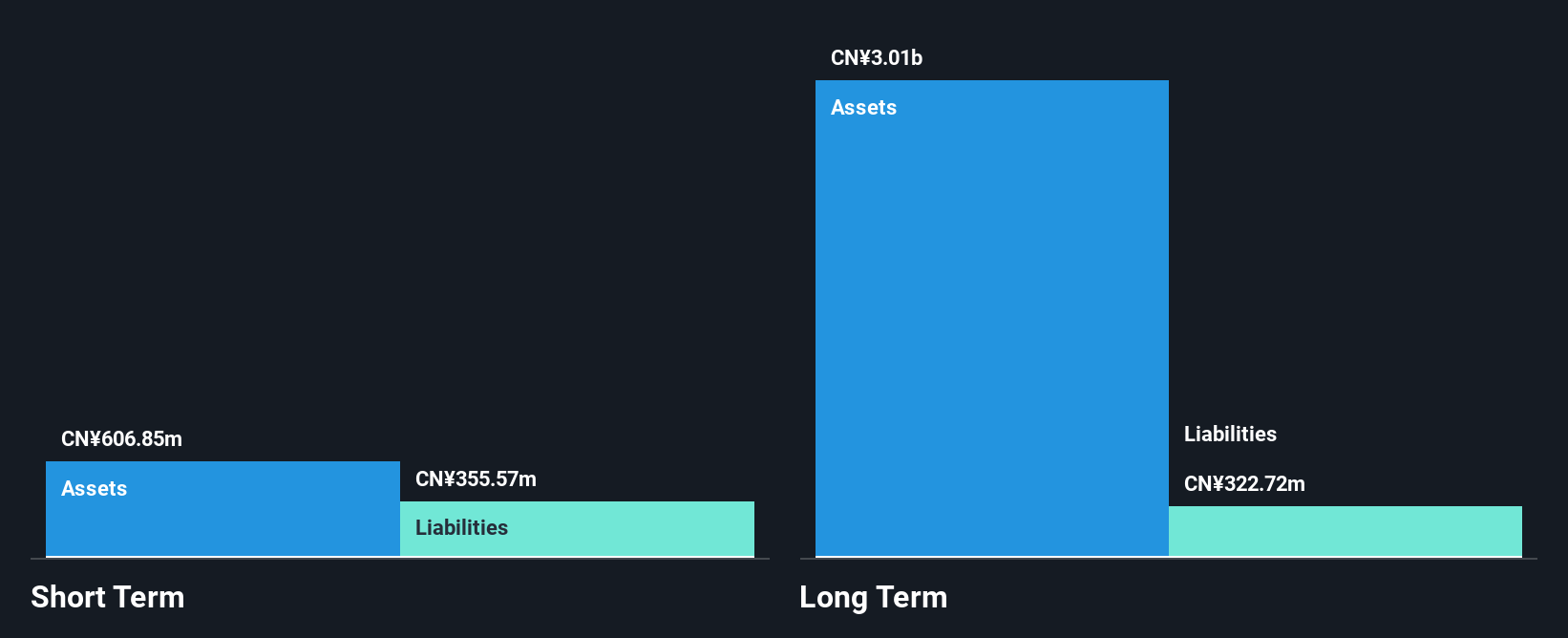

Rizhao Port Jurong, with a market cap of HK$1.23 billion, operates debt-free and maintains stable weekly volatility at 6%. Despite negative earnings growth over the past year and a low return on equity of 5.7%, it has high-quality earnings and its short-term assets exceed both short- and long-term liabilities. Recent developments include adjustments to property lease agreements with Rizhao Port Group to meet rising demand for temporary berthing services, potentially boosting revenue. Proposed changes in company bylaws are pending shareholder approval at an upcoming extraordinary general meeting, reflecting ongoing corporate governance adjustments.

- Click to explore a detailed breakdown of our findings in Rizhao Port Jurong's financial health report.

- Assess Rizhao Port Jurong's previous results with our detailed historical performance reports.

Next Steps

- Access the full spectrum of 971 Asian Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6117

Rizhao Port Jurong

Engages in the port operations in Rizhao, the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)