- Hong Kong

- /

- Semiconductors

- /

- SEHK:968

October 2024's Top Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, the S&P 500 Index has shown resilience, particularly in the utilities and real estate sectors, while small-cap stocks have outperformed. Investing in penny stocks—an area that remains relevant despite its somewhat outdated terminology—offers opportunities for growth typically found in smaller or newer companies. By identifying those with robust financials and clear growth potential, investors can uncover valuable prospects within this niche segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.95 | £184.64M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.19 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.595 | MYR2.98B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR128.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.28 | CN¥2.07B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.93 | MYR300.41M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$128.44M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.355 | £407.27M | ★★★★☆☆ |

Click here to see the full list of 5,772 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

SenseTime Group (SEHK:20)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SenseTime Group Inc. is an investment holding company that develops and sells artificial intelligence software platforms across China, Northeast Asia, Southeast Asia, and internationally, with a market cap of HK$55.88 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to CN¥3.71 billion.

Market Cap: HK$55.88B

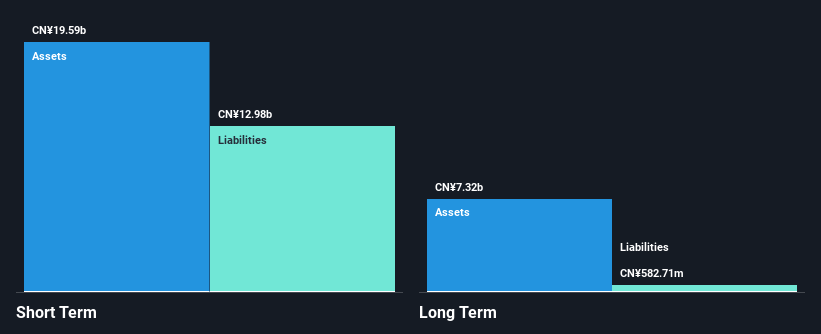

SenseTime Group Inc. has demonstrated resilience in its financial structure, with short-term assets of CN¥16.2 billion comfortably covering both short-term and long-term liabilities. Despite being unprofitable, the company has managed to reduce its losses by 14.4% annually over the past five years, showcasing an improvement trajectory. Recent earnings reports indicate a revenue increase to CN¥1.74 billion for the first half of 2024, although net losses remain significant at CN¥2.46 billion. The company's stock was recently removed from the Hang Seng China Enterprises Index, reflecting volatility concerns amidst shareholder dilution and high share price fluctuations.

- Get an in-depth perspective on SenseTime Group's performance by reading our balance sheet health report here.

- Assess SenseTime Group's future earnings estimates with our detailed growth reports.

Bosideng International Holdings (SEHK:3998)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bosideng International Holdings Limited operates in the apparel industry within the People’s Republic of China, with a market capitalization of approximately HK$53.45 billion.

Operations: The company's revenue is primarily derived from Down Apparels at CN¥19.54 billion, followed by Original Equipment Manufacturing (OEM) Management at CN¥2.70 billion, Ladieswear Apparels at CN¥819.80 million, and Diversified Apparels at CN¥235.33 million.

Market Cap: HK$53.45B

Bosideng International Holdings Limited, with a market cap of HK$53.45 billion, shows strong financial health and growth potential in the apparel sector. Its high-quality earnings and robust profit growth, evidenced by a 43.7% increase over the past year, underscore its competitive edge. The company's strategic partnership with Moose Knuckles aims to boost global expansion efforts and solidify its international presence. Despite an unstable dividend track record, Bosideng's seasoned management team and board provide experienced leadership as it continues to trade below estimated fair value while maintaining more cash than debt for operational flexibility.

- Click here and access our complete financial health analysis report to understand the dynamics of Bosideng International Holdings.

- Evaluate Bosideng International Holdings' prospects by accessing our earnings growth report.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces and sells solar glass products across the People’s Republic of China, Asia, North America, Europe, and internationally with a market cap of HK$29.96 billion.

Operations: The company generates revenue primarily from the sale of solar glass, amounting to HK$24.04 billion, and its solar farm business, including EPC services, which contributes HK$3.03 billion.

Market Cap: HK$29.96B

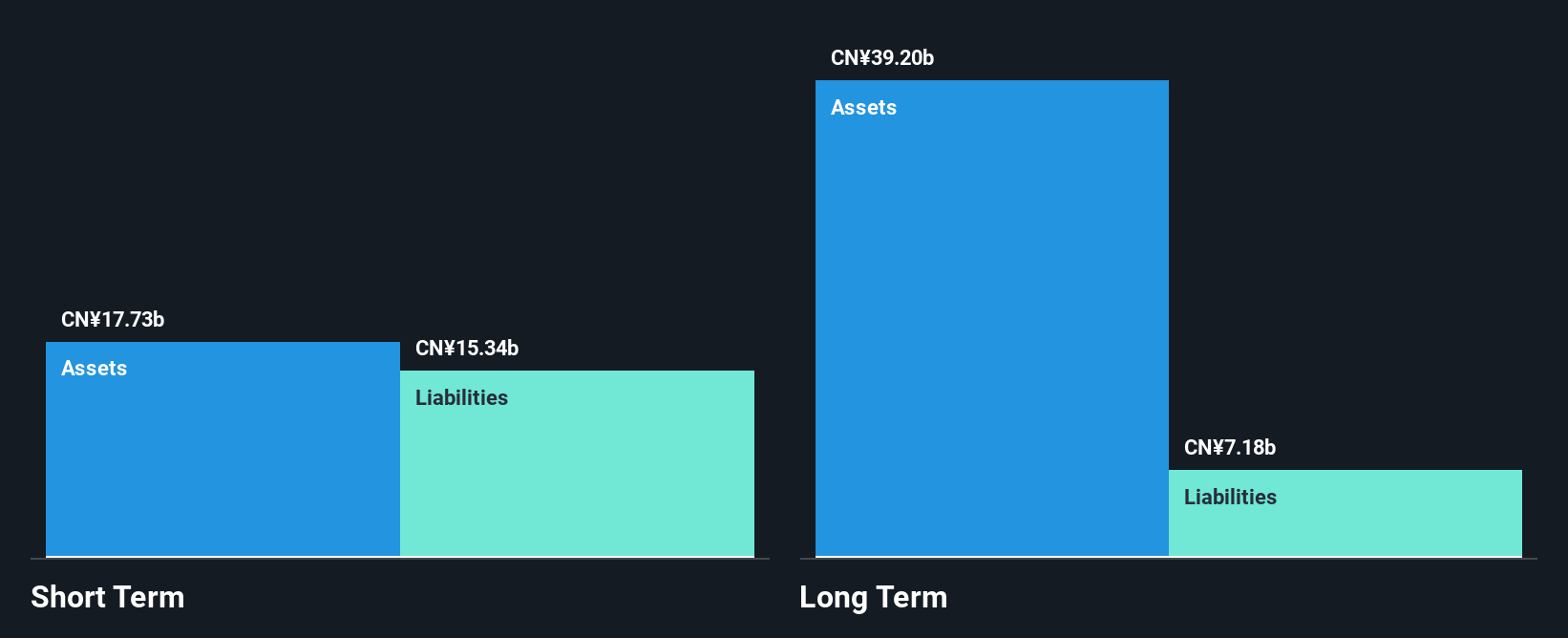

Xinyi Solar Holdings Limited, with a market cap of HK$29.96 billion, demonstrates financial strength through substantial revenue streams from solar glass sales and its solar farm business. Recent earnings results show significant growth, with net income rising to HK$1.96 billion for the first half of 2024. The company's price-to-earnings ratio suggests it is trading at a good value compared to the Hong Kong market average. Despite a dividend yield not fully covered by free cash flows, Xinyi Solar maintains strong asset coverage over liabilities and has reduced its debt-to-equity ratio over five years, indicating prudent financial management.

- Take a closer look at Xinyi Solar Holdings' potential here in our financial health report.

- Explore Xinyi Solar Holdings' analyst forecasts in our growth report.

Seize The Opportunity

- Unlock our comprehensive list of 5,772 Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:968

Xinyi Solar Holdings

An investment holding company, produces and sells solar glass products in the People’s Republic of China, rest of Asia, North America, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.