- Hong Kong

- /

- Real Estate

- /

- SEHK:1995

Aboitiz Power And 2 Other Compelling Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets experience fluctuations with U.S. consumer confidence dipping and major stock indexes showing mixed results, investors are increasingly looking for stability amid economic uncertainties. In such an environment, dividend stocks like Aboitiz Power offer a compelling option for those seeking regular income and potential portfolio resilience, making them an attractive consideration in today's market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.85% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Aboitiz Power (PSE:AP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aboitiz Power Corporation operates in the Philippines through its subsidiaries, focusing on power generation, distribution, and electricity retail, with a market cap of ₱271.66 billion.

Operations: Aboitiz Power Corporation's revenue is primarily derived from its power generation segment, contributing ₱126.49 billion, and its power distribution segment, which adds ₱55.87 billion.

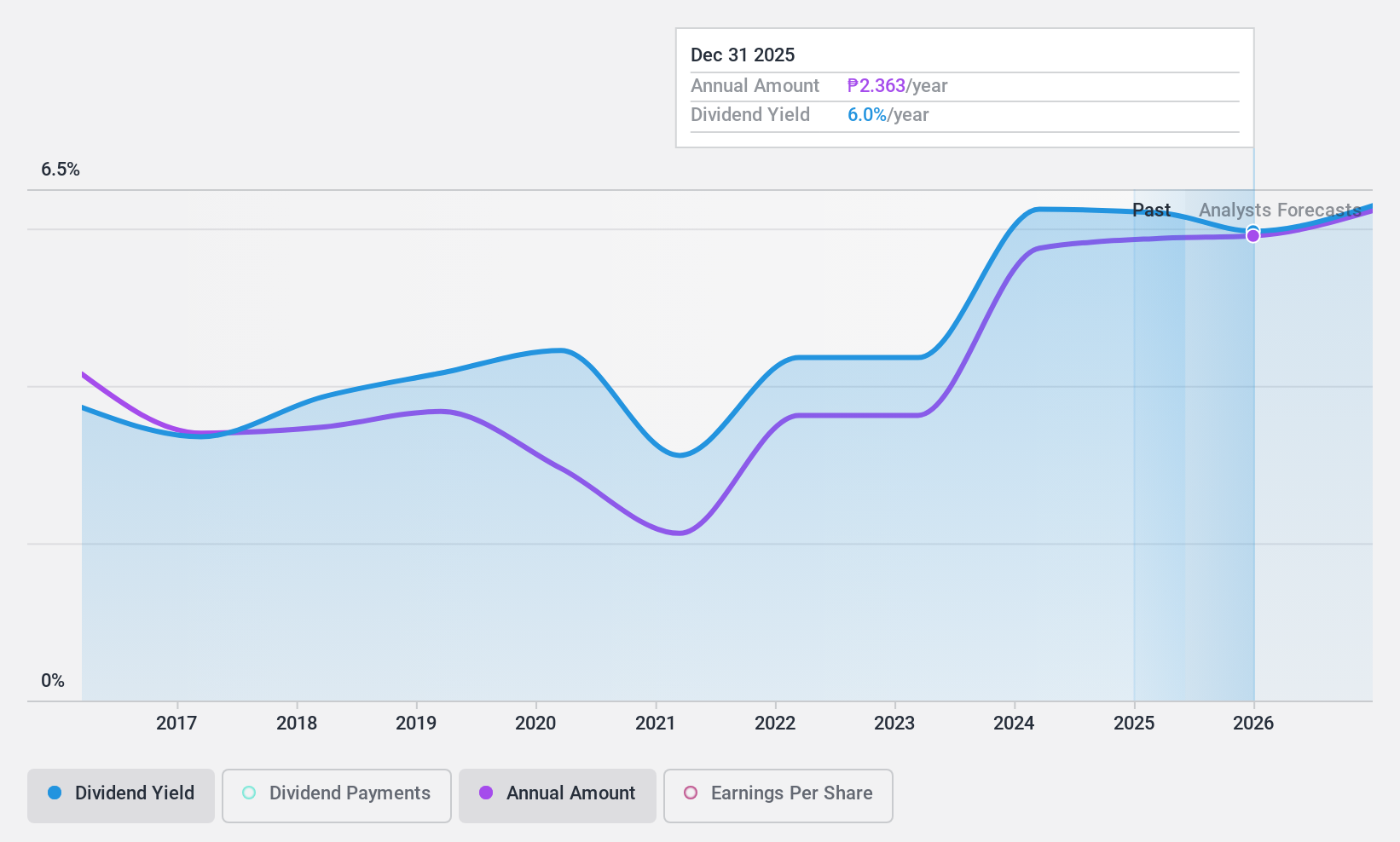

Dividend Yield: 6%

Aboitiz Power's dividend payments have been historically volatile, with a past record of over 20% annual drops. Despite this, the company maintains a reasonable payout ratio of 49.5%, indicating dividends are well-covered by earnings and cash flows. Recent financials show stable net income growth, with PHP 10.15 billion in Q3 2024 compared to PHP 8.92 billion the previous year, supporting dividend sustainability despite its lower yield relative to top-tier Philippine stocks.

- Take a closer look at Aboitiz Power's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Aboitiz Power shares in the market.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ever Sunshine Services Group Limited is an investment holding company offering property management services in the People's Republic of China, with a market cap of HK$3.37 billion.

Operations: The company generates CN¥6.72 billion in revenue from its property management services segment in the People's Republic of China.

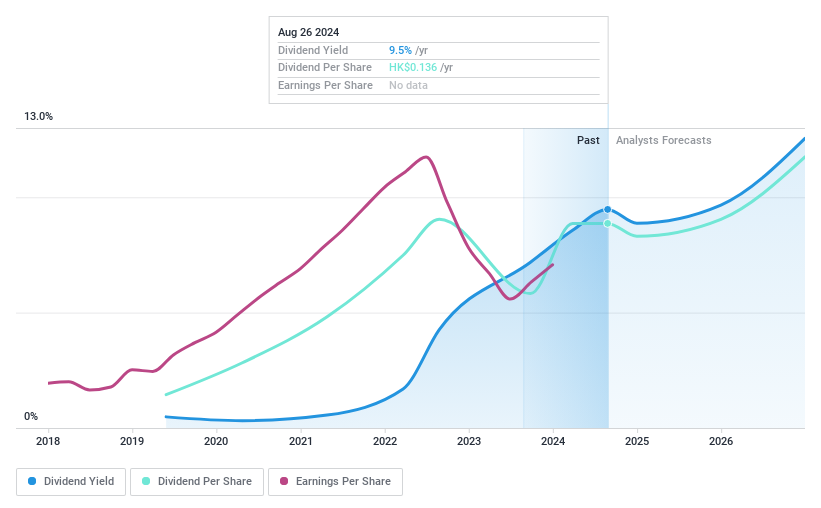

Dividend Yield: 8.5%

Ever Sunshine Services Group's dividend yield is among the top 25% in Hong Kong, supported by a sustainable payout ratio of 60.9%. However, its dividend history is short and volatile, with payments over six years showing instability. Despite this, earnings growth of 33.8% last year and a low cash payout ratio of 31.7% suggest dividends are well-covered by cash flows, though reliability remains a concern for investors seeking stable income streams.

- Unlock comprehensive insights into our analysis of Ever Sunshine Services Group stock in this dividend report.

- The analysis detailed in our Ever Sunshine Services Group valuation report hints at an deflated share price compared to its estimated value.

Xinjiang Xintai Natural Gas (SHSE:603393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang Xintai Natural Gas Co., Ltd. is involved in the transmission, distribution, and sale of natural gas in China with a market cap of CN¥12.79 billion.

Operations: Xinjiang Xintai Natural Gas Co., Ltd. generates revenue through its operations in the transmission, distribution, and sale of natural gas within China.

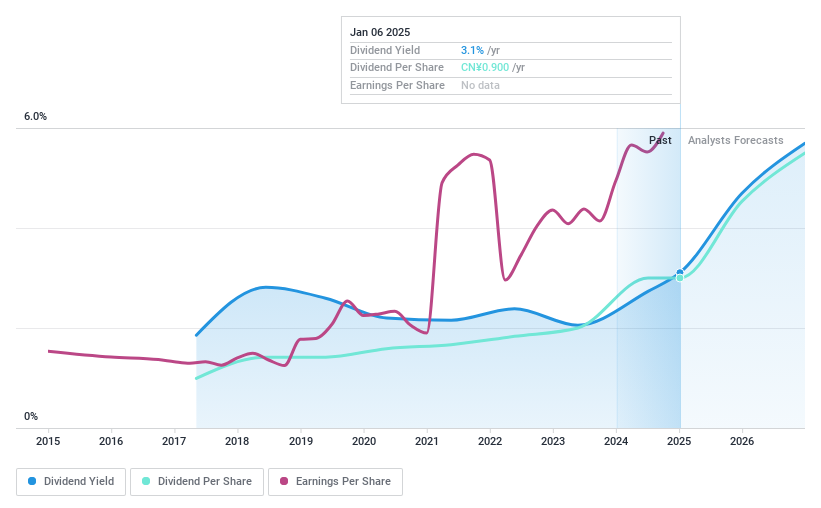

Dividend Yield: 3%

Xinjiang Xintai Natural Gas offers a compelling dividend profile with a payout ratio of 30.5%, indicating dividends are well-covered by earnings. The company has seen substantial earnings growth, reporting CNY 881.86 million in net income for the first nine months of 2024, up from CNY 676.91 million the previous year. Although its dividend yield is among the top quartile in China at 3.05%, its eight-year dividend history may be considered brief by some investors seeking long-term reliability.

- Dive into the specifics of Xinjiang Xintai Natural Gas here with our thorough dividend report.

- The valuation report we've compiled suggests that Xinjiang Xintai Natural Gas' current price could be quite moderate.

Taking Advantage

- Gain an insight into the universe of 1958 Top Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ever Sunshine Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1995

Ever Sunshine Services Group

An investment holding company, provides property management services in the People's Republic of China.

Flawless balance sheet with solid track record and pays a dividend.