- Hong Kong

- /

- Real Estate

- /

- SEHK:1821

3 Undervalued Stocks Including CGN Mining That Could Offer Value

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of fluctuating consumer confidence and economic data, investors are keenly observing opportunities that may arise amidst these shifts. In such an environment, identifying undervalued stocks can be particularly appealing, as they often present potential for value appreciation when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBTM New Materials Group (SHSE:600114) | CN¥15.65 | CN¥31.16 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$5.93 | CA$11.83 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.77 | €5.51 | 49.7% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Medley (TSE:4480) | ¥3835.00 | ¥7645.06 | 49.8% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.77 | 49.8% |

| Cicor Technologies (SWX:CICN) | CHF60.00 | CHF119.29 | 49.7% |

| Progress Software (NasdaqGS:PRGS) | US$65.15 | US$129.87 | 49.8% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

CGN Mining (SEHK:1164)

Overview: CGN Mining Company Limited focuses on the development and trading of natural uranium resources for nuclear power plants, with a market capitalization of approximately HK$12.39 billion.

Operations: The company generates revenue primarily through its natural uranium trading segment, which accounts for HK$8.50 billion.

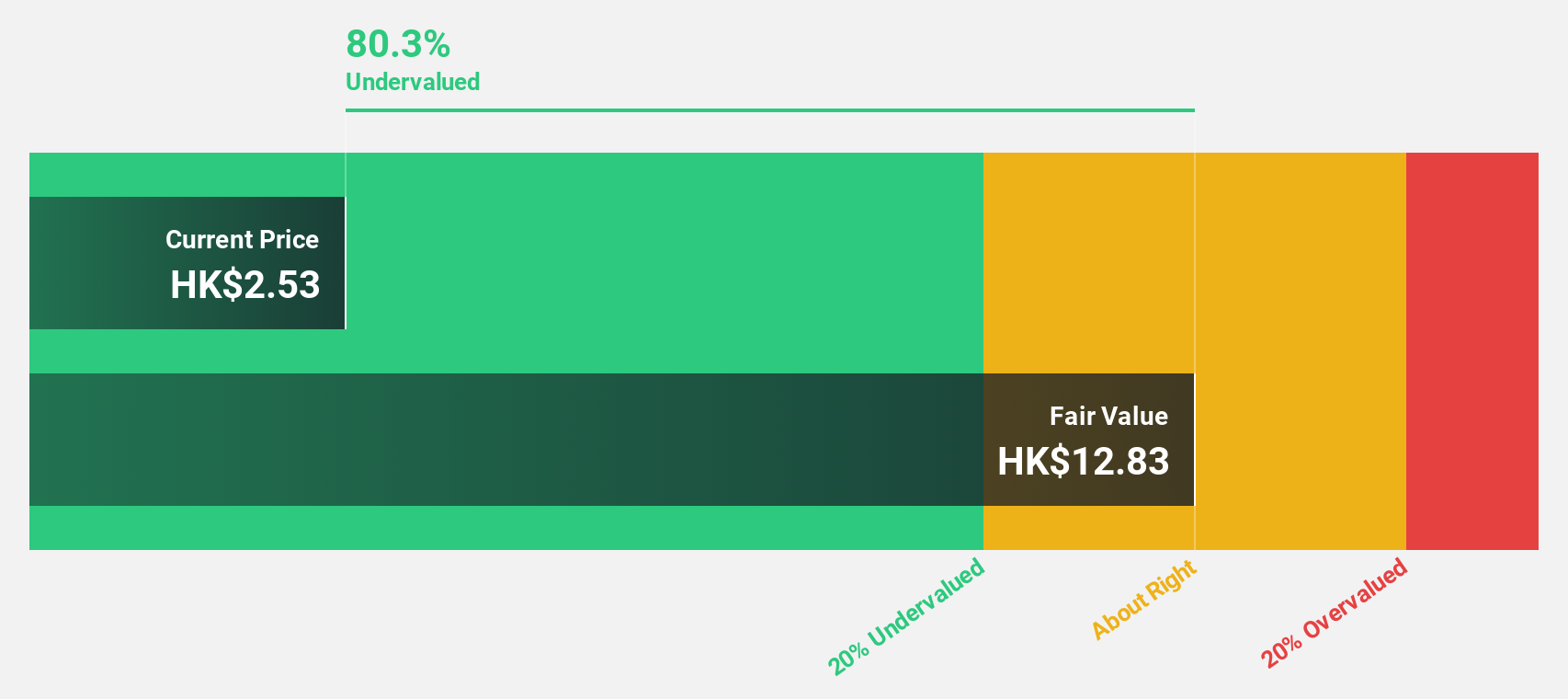

Estimated Discount To Fair Value: 46.4%

CGN Mining is trading at HK$1.64, significantly below its estimated fair value of HK$3.06, suggesting it may be undervalued based on discounted cash flow analysis. Despite a decline in profit margins from 8.1% to 5.1%, earnings have grown by 26.8% over the past year and are forecast to grow at an impressive rate of 39.2% annually, outpacing the Hong Kong market's expected growth rate of 11.1%. However, debt coverage by operating cash flow remains a concern.

- Our comprehensive growth report raises the possibility that CGN Mining is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in CGN Mining's balance sheet health report.

ESR Group (SEHK:1821)

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, and Europe with a market cap of HK$50.69 billion.

Operations: The company's revenue segments are comprised of Fund Management at $627.98 million and New Economy Development at $113.33 million, offset by an Investment loss of -$106.44 million and Elimination of Intersegment Sales amounting to -$12.49 million.

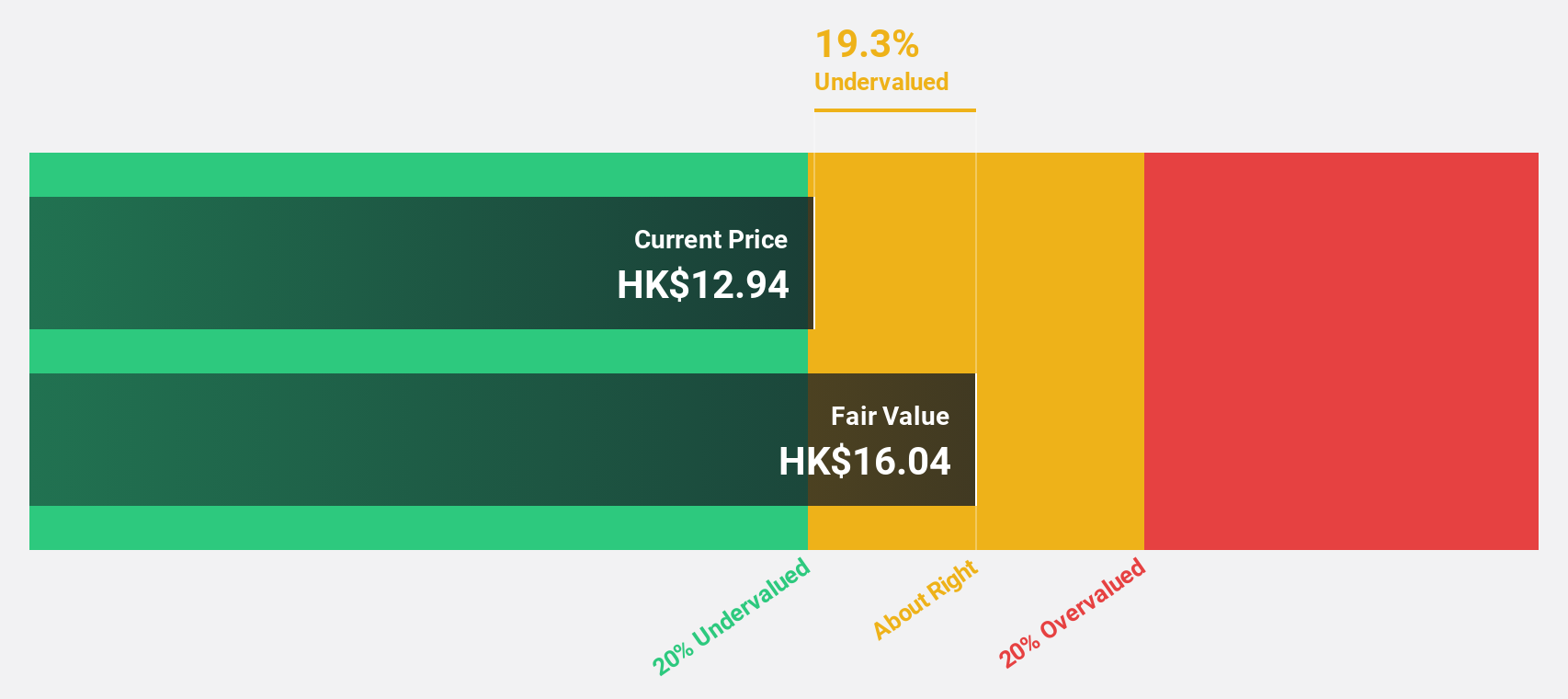

Estimated Discount To Fair Value: 32.3%

ESR Group is trading at HK$11.96, below its estimated fair value of HK$17.66, highlighting potential undervaluation based on discounted cash flow analysis. Earnings are forecast to grow 85.9% annually, with revenue expected to rise 15.8% per year, surpassing the Hong Kong market's growth rate of 7.6%. However, interest payments are not well covered by earnings and return on equity is projected to be low at 5.1% in three years' time.

- Insights from our recent growth report point to a promising forecast for ESR Group's business outlook.

- Unlock comprehensive insights into our analysis of ESR Group stock in this financial health report.

iFAST (SGX:AIY)

Overview: iFAST Corporation Ltd. operates as a provider of investment products and services across Singapore, Hong Kong, Malaysia, China, and the United Kingdom with a market capitalization of SGD2.21 billion.

Operations: The company generates revenue from its investment products and services offered in various regions, including Singapore, Hong Kong, Malaysia, China, and the United Kingdom.

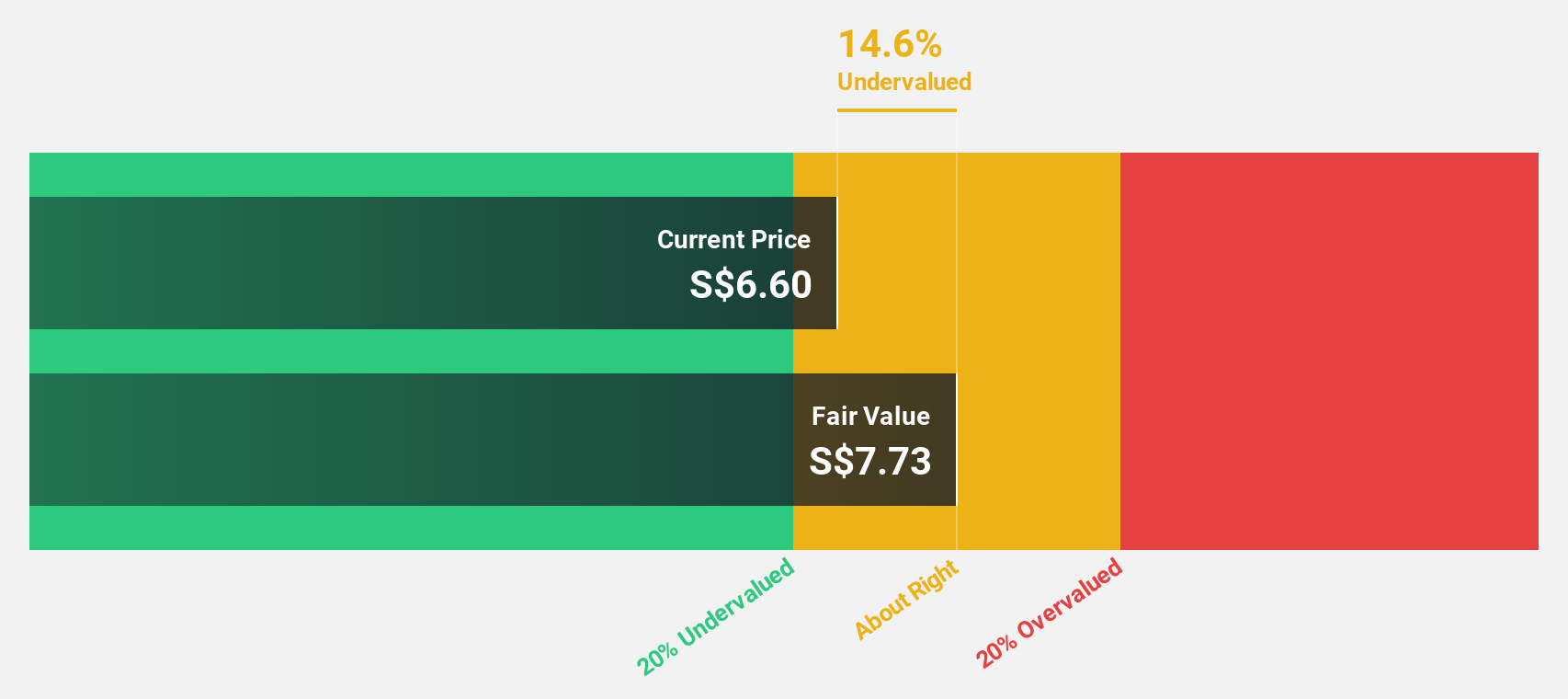

Estimated Discount To Fair Value: 13.2%

iFAST Corporation Ltd. is trading at S$7.43, slightly below its fair value estimate of S$8.56, indicating modest undervaluation based on cash flow analysis. The company reported strong Q3 2024 results with revenue of S$99.14 million and net income of S$16.81 million, both significantly up from the previous year. Earnings are forecast to grow 14.75% annually, outpacing the Singapore market average, though growth isn't considered significant by analysts' standards.

- The analysis detailed in our iFAST growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of iFAST.

Turning Ideas Into Actions

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 883 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1821

ESR Group

Operates as a real asset owner and manager in Greater China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe, and internationally.

Reasonable growth potential and overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026