- Hong Kong

- /

- Semiconductors

- /

- SEHK:3800

GCL Technology Holdings (HKG:3800) delivers shareholders stellar 29% CAGR over 5 years, surging 6.0% in the last week alone

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, you can make far more than 100% on a really good stock. Long term GCL Technology Holdings Limited (HKG:3800) shareholders would be well aware of this, since the stock is up 235% in five years. And in the last week the share price has popped 6.0%. But this might be partly because the broader market had a good week last week, gaining 2.6%.

Since the stock has added HK$2.0b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for GCL Technology Holdings

Because GCL Technology Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

For the last half decade, GCL Technology Holdings can boast revenue growth at a rate of 16% per year. That's well above most pre-profit companies. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 27% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. GCL Technology Holdings seems like a high growth stock - so growth investors might want to add it to their watchlist.

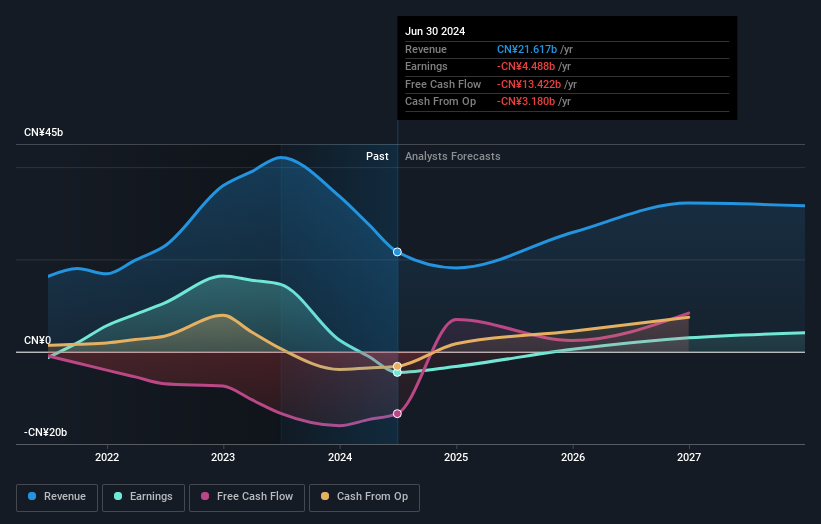

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

GCL Technology Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What About The Total Shareholder Return (TSR)?

We've already covered GCL Technology Holdings' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that GCL Technology Holdings' TSR of 251% over the last 5 years is better than the share price return.

A Different Perspective

GCL Technology Holdings shareholders are up 17% for the year. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 29% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3800

GCL Technology Holdings

Manufactures and sells polysilicon and wafers products in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives