- Hong Kong

- /

- Retail Distributors

- /

- SEHK:860

Introducing Apollo Future Mobility Group (HKG:860), The Stock That Zoomed 144% In The Last Five Years

Apollo Future Mobility Group Limited (HKG:860) shareholders might be concerned after seeing the share price drop 12% in the last week. But in stark contrast, the returns over the last half decade have impressed. We think most investors would be happy with the 144% return, over that period. To some, the recent pullback wouldn't be surprising after such a fast rise. Ultimately business performance will determine whether the stock price continues the positive long term trend. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 73% decline over the last three years: that's a long time to wait for profits.

See our latest analysis for Apollo Future Mobility Group

Apollo Future Mobility Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Apollo Future Mobility Group saw its revenue grow at 6.2% per year. That's a pretty good long term growth rate. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 20% per year over five years. Given that the business has made good progress on the top line, it would be worth taking a look at the growth trend. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

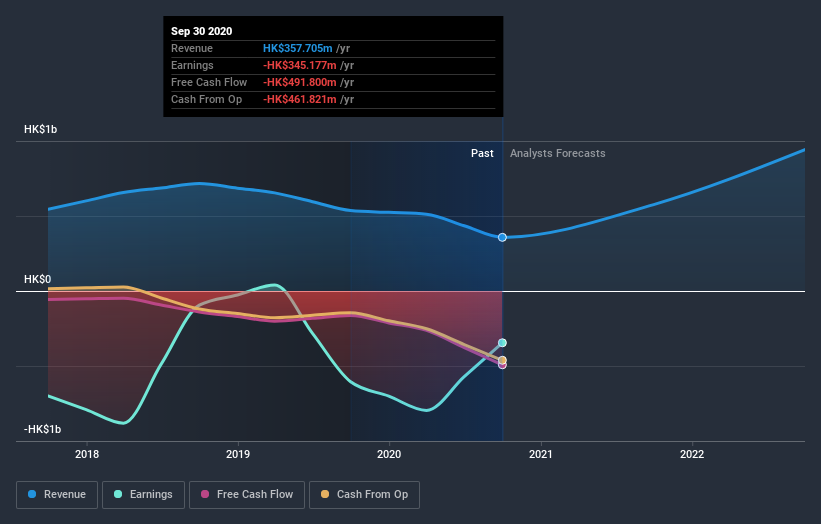

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on Apollo Future Mobility Group

A Different Perspective

Apollo Future Mobility Group provided a TSR of 15% over the last twelve months. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 20% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Apollo Future Mobility Group better, we need to consider many other factors. For instance, we've identified 4 warning signs for Apollo Future Mobility Group (2 are a bit unpleasant) that you should be aware of.

Apollo Future Mobility Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Apollo Future Mobility Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:860

Apollo Future Mobility Group

An investment holding company, engages in the trading, retail, and wholesale of jewelry products, watches, and other commodities.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives