- Hong Kong

- /

- Retail Distributors

- /

- SEHK:6055

Reflecting on China Tobacco International (HK)'s (HKG:6055) Share Price Returns Over The Last Year

China Tobacco International (HK) Company Limited (HKG:6055) shareholders should be happy to see the share price up 11% in the last month. But that doesn't change the reality of under-performance over the last twelve months. The cold reality is that the stock has dropped 10% in one year, under-performing the market.

See our latest analysis for China Tobacco International (HK)

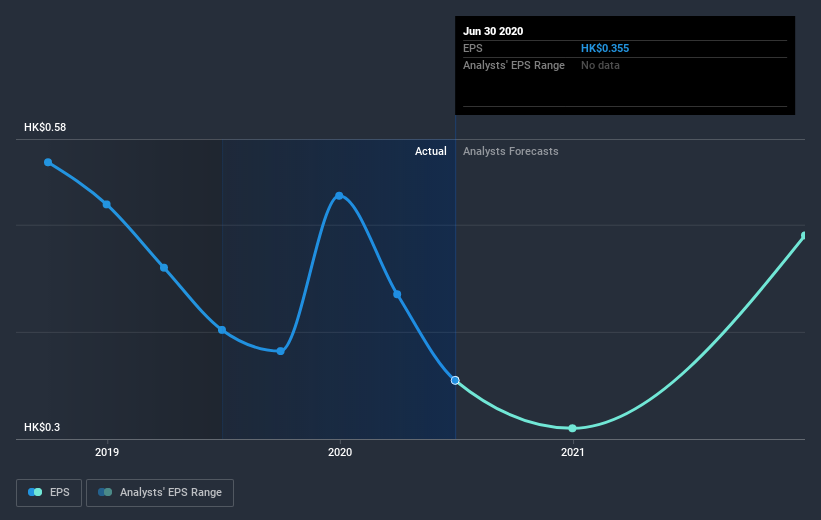

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately China Tobacco International (HK) reported an EPS drop of 12% for the last year. This proportional reduction in earnings per share isn't far from the 10% decrease in the share price. So it seems that the market sentiment has not changed much, despite the weak results. Rather, the share price is remains a similar multiple of the EPS, suggesting the outlook remains the same.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on China Tobacco International (HK)'s earnings, revenue and cash flow.

A Different Perspective

While China Tobacco International (HK) shareholders are down 9.3% for the year (even including dividends), the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 7.5% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Before deciding if you like the current share price, check how China Tobacco International (HK) scores on these 3 valuation metrics.

We will like China Tobacco International (HK) better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade China Tobacco International (HK), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6055

Outstanding track record with reasonable growth potential.

Market Insights

Community Narratives