- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1929

Asian Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global trade tensions show signs of easing, the Asian markets have experienced a boost in investor sentiment, with indices like China's CSI 300 and Japan's Nikkei 225 seeing positive movements. In this environment of cautious optimism, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥25.60 | CN¥50.19 | 49% |

| Alexander Marine (TWSE:8478) | NT$142.00 | NT$280.34 | 49.3% |

| Wuxi Lead Intelligent EquipmentLTD (SZSE:300450) | CN¥19.92 | CN¥39.10 | 49.1% |

| Rakus (TSE:3923) | ¥2154.50 | ¥4285.76 | 49.7% |

| Jiangshan Oupai Door Industry (SHSE:603208) | CN¥14.06 | CN¥27.47 | 48.8% |

| Newborn Town (SEHK:9911) | HK$8.17 | HK$16.06 | 49.1% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.50 | CN¥20.76 | 49.4% |

| Tonghua Dongbao Pharmaceutical (SHSE:600867) | CN¥7.23 | CN¥14.11 | 48.8% |

| China Ruyi Holdings (SEHK:136) | HK$2.04 | HK$4.07 | 49.9% |

| Everest Medicines (SEHK:1952) | HK$49.25 | HK$96.84 | 49.1% |

Let's dive into some prime choices out of the screener.

Chow Tai Fook Jewellery Group (SEHK:1929)

Overview: Chow Tai Fook Jewellery Group Limited is an investment holding company that manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally with a market cap of HK$103.67 billion.

Operations: The company's revenue is primarily derived from Mainland China, contributing HK$82.05 billion, and from Hong Kong, Macau, and other markets, which together account for HK$17.80 billion.

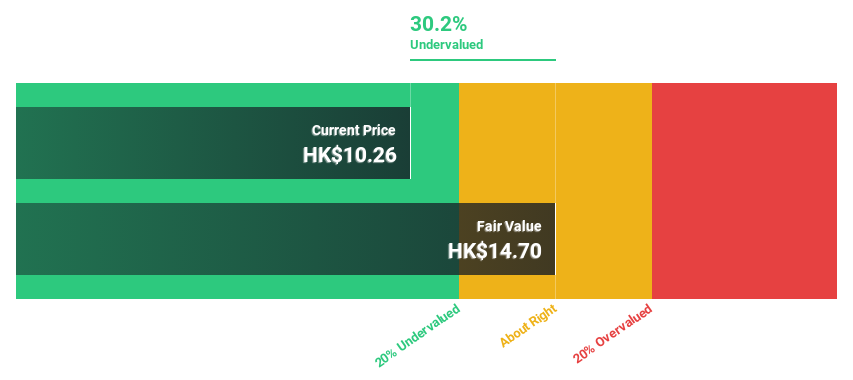

Estimated Discount To Fair Value: 29.9%

Chow Tai Fook Jewellery Group, trading at HK$10.38, is undervalued compared to its estimated fair value of HK$14.81, offering a potential opportunity for investors focused on cash flow valuation. Despite a lower profit margin of 4.5% and high debt levels, the company's earnings are expected to grow significantly at 22.1% annually over the next three years. Recent executive changes aim to enhance financial management and strategic oversight, potentially improving operational efficiencies further.

- The analysis detailed in our Chow Tai Fook Jewellery Group growth report hints at robust future financial performance.

- Take a closer look at Chow Tai Fook Jewellery Group's balance sheet health here in our report.

China Tobacco International (HK) (SEHK:6055)

Overview: China Tobacco International (HK) Company Limited operates in the tobacco industry and has a market cap of HK$17.29 billion.

Operations: The company's revenue segments include the Brazil Operation Business (HK$1.05 billion), Cigarettes Export Business (HK$1.57 billion), New Tobacco Products Export Business (HK$135.18 million), Tobacco Leaf Products Export Business (HK$2.06 billion), and Tobacco Leaf Products Import Business (HK$8.25 billion).

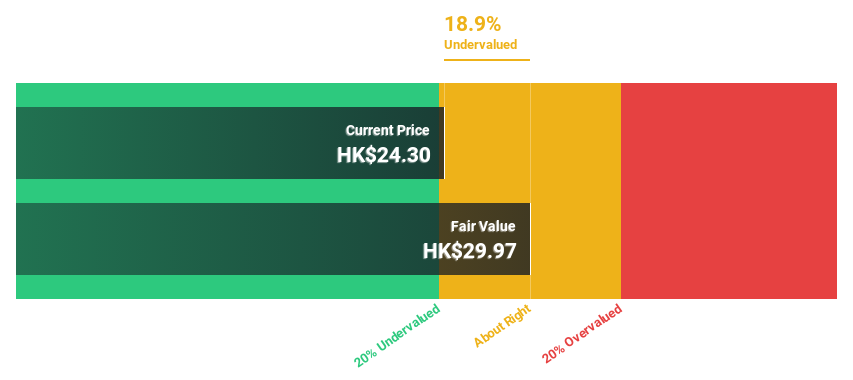

Estimated Discount To Fair Value: 12.8%

China Tobacco International (HK) is trading at HK$25, undervalued against its fair value estimate of HK$28.66, presenting a potential opportunity for cash flow-focused investors. Despite a high debt level and slower revenue growth forecast of 10.4% annually, the company reported strong earnings growth of 42.6% last year and expects continued profit increases at 10.91% per year, outpacing the Hong Kong market's average growth rate.

- The growth report we've compiled suggests that China Tobacco International (HK)'s future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of China Tobacco International (HK).

Wuxi Lead Intelligent EquipmentLTD (SZSE:300450)

Overview: Wuxi Lead Intelligent Equipment Co., Ltd. develops, manufactures, and sells intelligent equipment in China with a market cap of CN¥30.97 billion.

Operations: Wuxi Lead Intelligent Equipment Co., Ltd. generates revenue through the development, manufacturing, and sale of intelligent equipment in China.

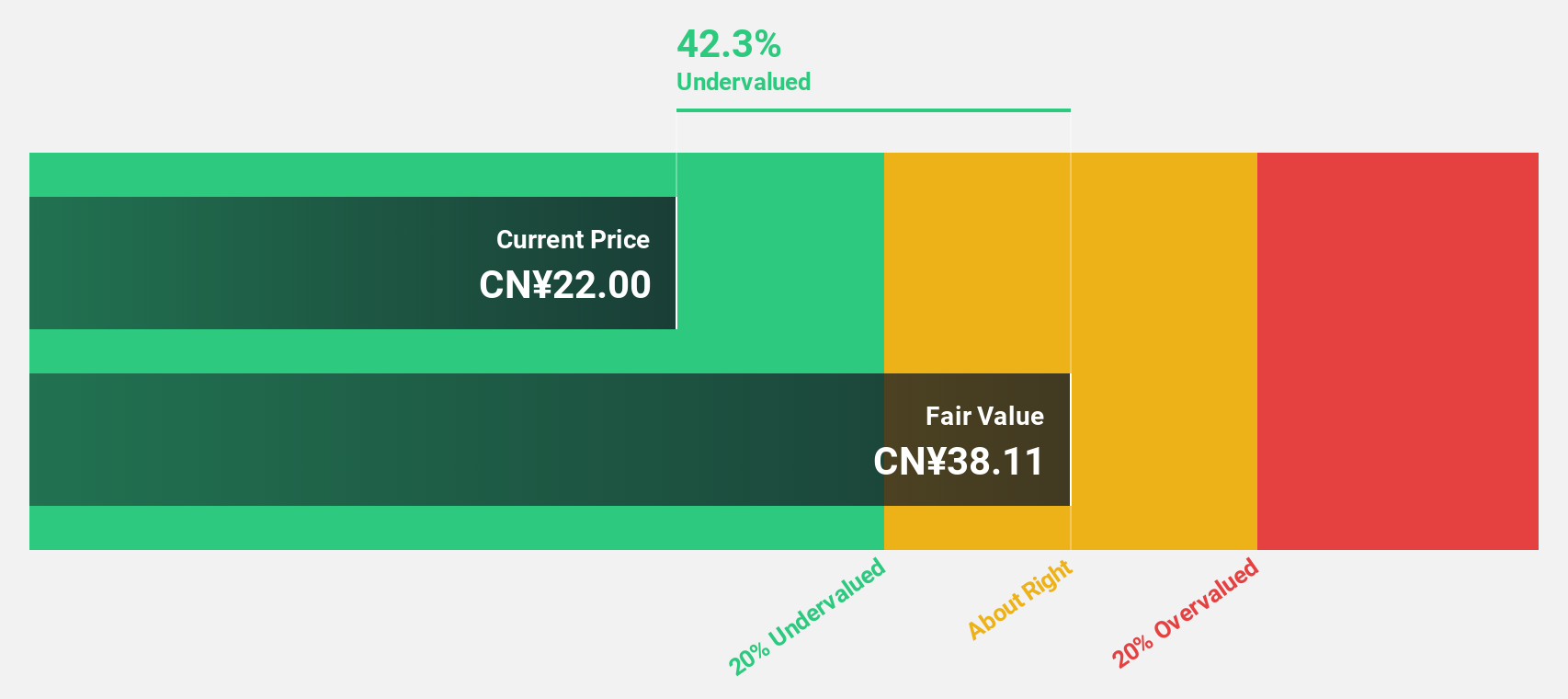

Estimated Discount To Fair Value: 49.1%

Wuxi Lead Intelligent EquipmentLTD, trading at CNY 19.92, is significantly undervalued compared to its estimated fair value of CNY 39.1, offering potential for cash flow-focused investors. Despite recent declines in net income and profit margins due to large one-off items, the company is forecasted to experience robust revenue growth of 21.4% annually and earnings growth of 67.8%, both surpassing market averages in China over the next few years.

- Our growth report here indicates Wuxi Lead Intelligent EquipmentLTD may be poised for an improving outlook.

- Dive into the specifics of Wuxi Lead Intelligent EquipmentLTD here with our thorough financial health report.

Turning Ideas Into Actions

- Embark on your investment journey to our 275 Undervalued Asian Stocks Based On Cash Flows selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Chow Tai Fook Jewellery Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1929

Chow Tai Fook Jewellery Group

An investment holding company, manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives