- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1931

Hong Kong's Hidden Stock Gems To Watch In September 2024

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties and investors seek stability, the Hong Kong market has shown resilience despite facing its own challenges. The Hang Seng Index recently experienced a decline, reflecting broader regional concerns, yet opportunities remain for discerning investors willing to explore lesser-known stocks. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial. Let's uncover three hidden gems in Hong Kong that could offer promising prospects in September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Chongqing Machinery & Electric | 28.07% | 8.82% | 11.12% | ★★★★★☆ |

| HBM Holdings | 52.89% | 66.59% | 31.70% | ★★★★★☆ |

| TIL Enviro | 47.97% | -23.09% | -8.84% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★★☆

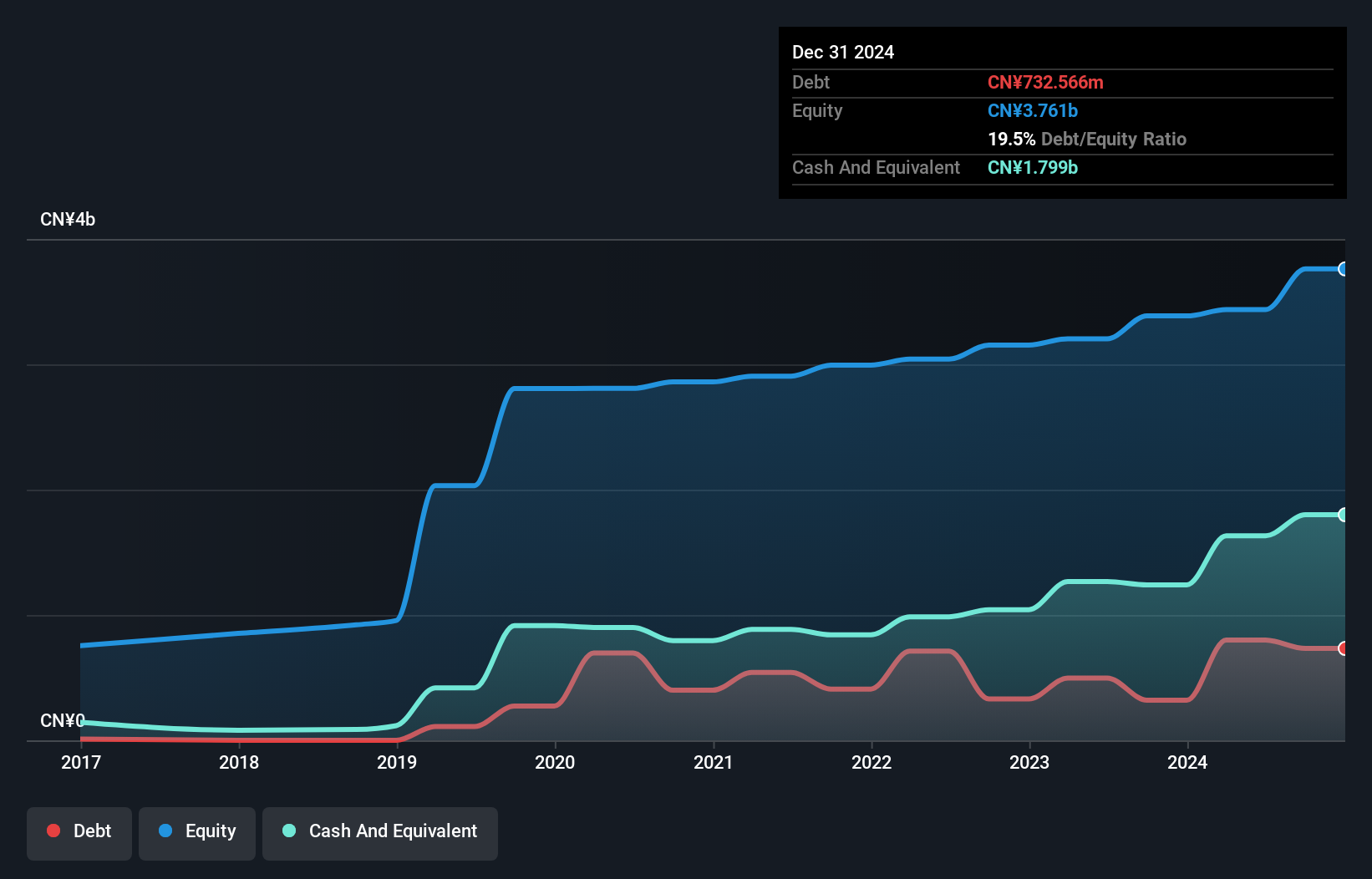

Overview: IVD Medical Holding Limited is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally, with a market cap of HK$2.13 billion.

Operations: The company generates revenue primarily from its distribution business (CN¥2.86 billion), followed by after-sales services (CN¥196.47 million) and self-branded products (CN¥9.05 million).

IVD Medical Holding, a smaller player in the healthcare sector, has shown promising financial performance despite recent shareholder dilution. The company's earnings grew by 12.3% over the past year, outpacing the industry's -11.6%. Recent half-year results reported sales of CNY 1.35 billion and net income of CNY 125.29 million, with basic earnings per share at CNY 0.0927 compared to last year's CNY 0.0762. Additionally, IVD's EBIT covers interest payments by a substantial margin (20.8x).

YesAsia Holdings (SEHK:2209)

Simply Wall St Value Rating: ★★★★★★

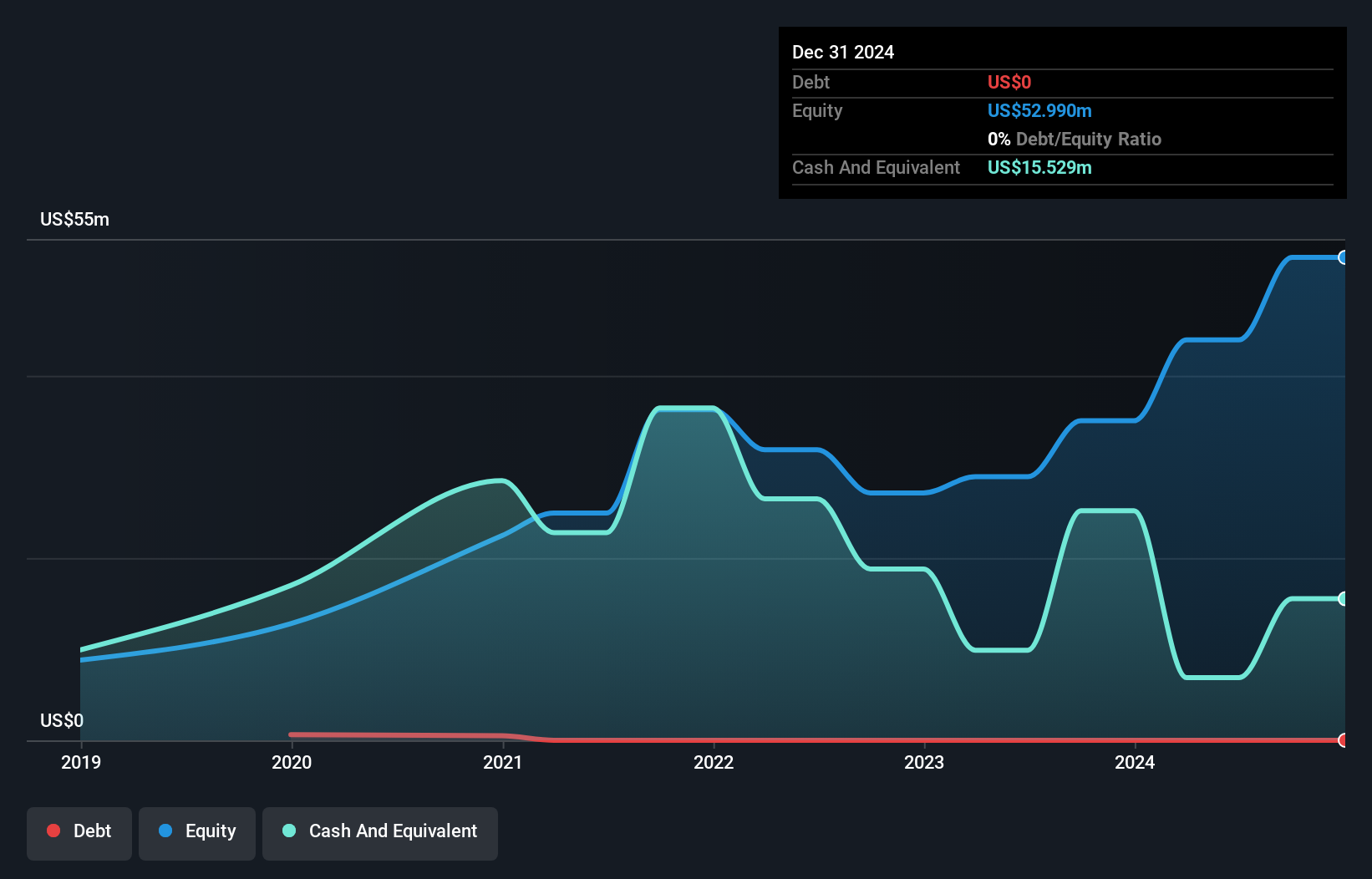

Overview: YesAsia Holdings Limited, with a market cap of HK$2.47 billion, is an investment holding company involved in the procurement, sale, and trading of Asian fashion and lifestyle, beauty, cosmetics, accessories, and entertainment products.

Operations: YesAsia Holdings generates revenue primarily from the sale of fashion, lifestyle, and beauty products (HK$270.65 million) and entertainment products (HK$2.56 million).

YesAsia Holdings has turned profitable in the past year, reporting a net income of US$11.11 million for the half-year ending June 2024, up from US$1.56 million a year ago. Their revenue surged to US$163.35 million from US$90.66 million in the same period last year, driven by increased sales of beauty products through YesStyle Platforms and AsianBeautyWholesale. The company is debt-free compared to five years ago when its debt-to-equity ratio was 2.9%.

Jinshang Bank (SEHK:2558)

Simply Wall St Value Rating: ★★★★★★

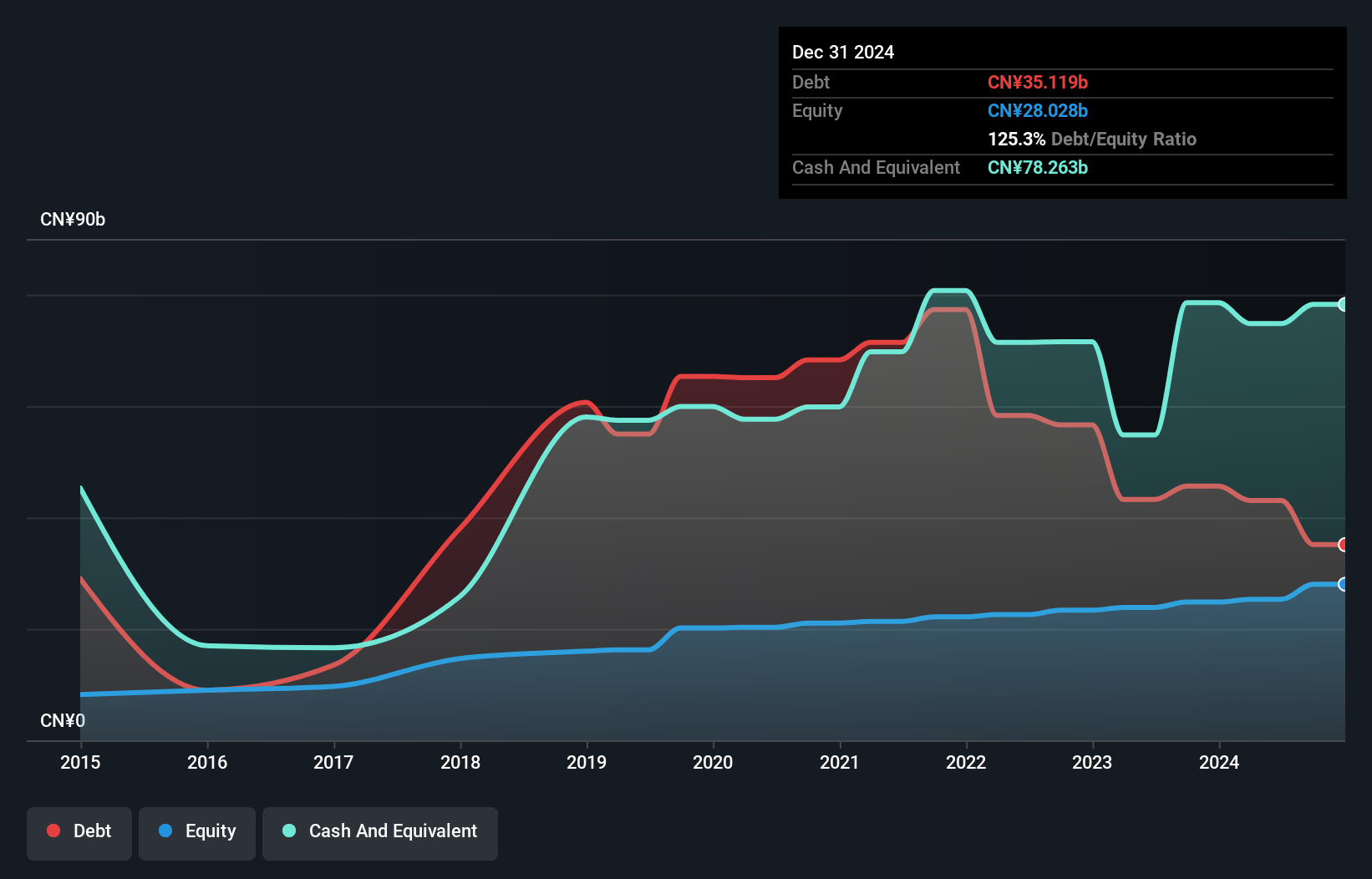

Overview: Jinshang Bank Co., Ltd. offers a range of banking products and services in China and has a market cap of HK$8.52 billion.

Operations: The bank's primary revenue streams include Corporate Banking (CN¥2.66 billion), Retail Banking (CN¥1.10 billion), and Treasury Business (CN¥593.83 million).

Jinshang Bank, with total assets of CN¥370.9B and equity of CN¥25.3B, reported net income for the half-year at CN¥1.03B, consistent with last year. Total deposits stand at CN¥290.3B against loans of CN¥194.6B, supported by a sufficient bad loan allowance (197%). Trading at 67% below estimated fair value and boasting high-quality earnings, Jinshang's growth outpaced the industry with a 5.2% rise in earnings over the past year.

- Take a closer look at Jinshang Bank's potential here in our health report.

Understand Jinshang Bank's track record by examining our Past report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 173 SEHK Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1931

IVD Medical Holding

An investment holding company, distributes In vitro diagnostic (IVD) products in Mainland China and internationally.

Solid track record with excellent balance sheet.