- Hong Kong

- /

- Entertainment

- /

- SEHK:1003

Huanxi Media Group Leads The Pack Of 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, characterized by resilient labor markets and inflation concerns, investors are keenly observing opportunities across various sectors. Penny stocks, though often seen as relics of speculative trading days, continue to offer intriguing possibilities for those seeking growth in smaller or newer companies. When these stocks boast strong financial foundations, they can present compelling investment prospects; here we spotlight three such promising candidates that stand out for their potential long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.55 | £405.37M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Starflex (SET:SFLEX) | THB2.58 | THB2B | ★★★★☆☆ |

Click here to see the full list of 5,703 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Huanxi Media Group (SEHK:1003)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Huanxi Media Group Limited is an investment holding company involved in media and entertainment businesses in China and Hong Kong, with a market cap of approximately HK$1.70 billion.

Operations: The company's revenue primarily comes from its investment in film and TV programmes rights, amounting to HK$54.72 million.

Market Cap: HK$1.7B

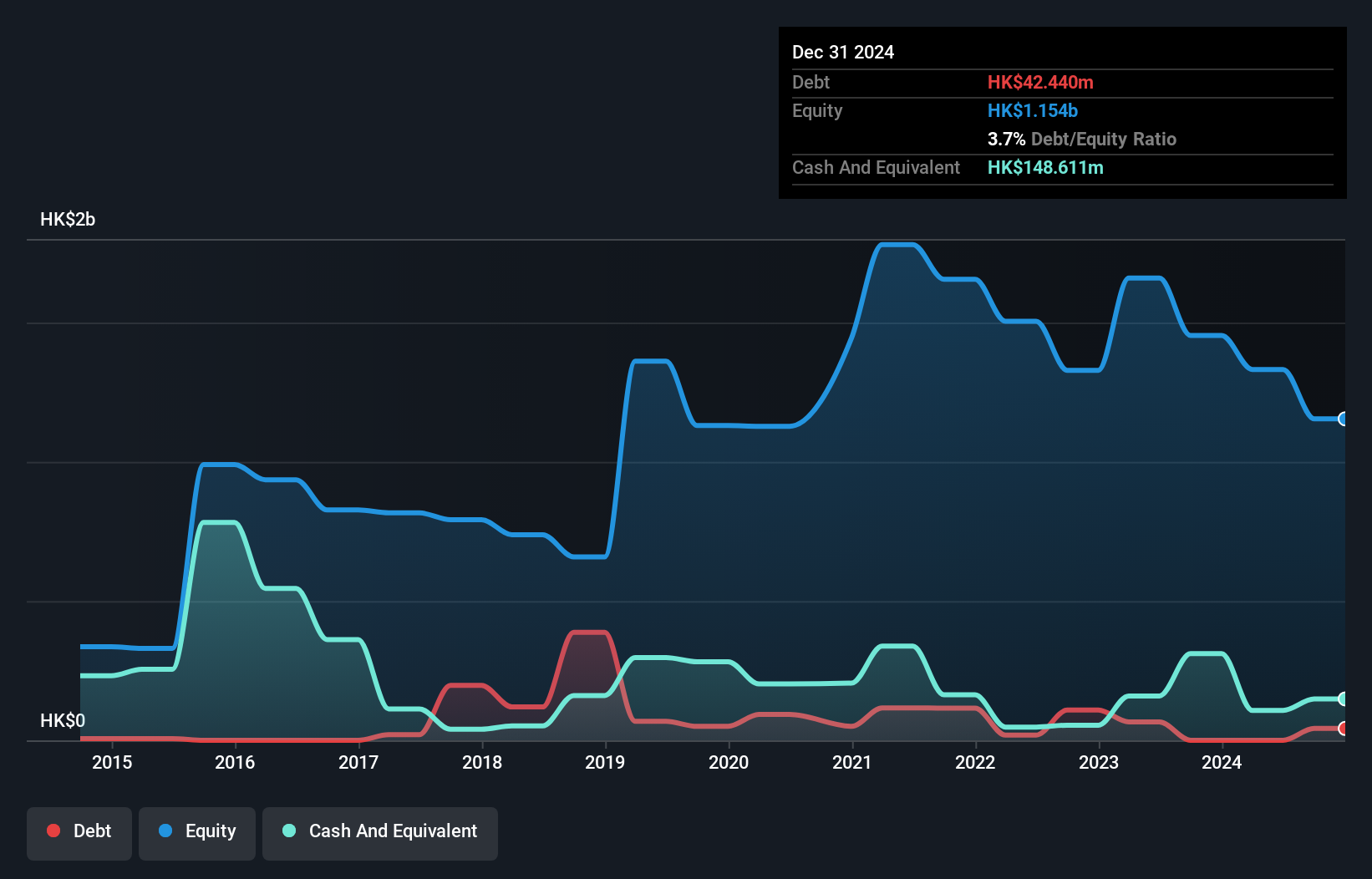

Huanxi Media Group, with a market cap of approximately HK$1.70 billion, is unprofitable but has managed to maintain a positive free cash flow, providing it with a cash runway exceeding three years. The company’s short-term assets of HK$1.4 billion comfortably cover its short-term liabilities of HK$735.4 million, and it has eliminated debt over the past five years. While revenue is forecasted to grow significantly at 43.44% annually, the company remains unprofitable with negative return on equity at -24.84%. The board is experienced with an average tenure of 9.3 years, offering stability in governance amidst financial challenges.

- Take a closer look at Huanxi Media Group's potential here in our financial health report.

- Learn about Huanxi Media Group's future growth trajectory here.

Shanghai Trendzone Holdings GroupLtd (SHSE:603030)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shanghai Trendzone Holdings Group Co., Ltd, along with its subsidiaries, offers integrated solutions in design, construction, production, and services both in China and internationally, with a market cap of CN¥3.25 billion.

Operations: Shanghai Trendzone Holdings Group Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥3.25B

Shanghai Trendzone Holdings Group Co., Ltd, with a market cap of CN¥3.25 billion, has recently turned profitable, though its earnings growth is challenging to compare historically due to this change. Despite reporting a net loss of CN¥34.4 million for the first nine months of 2024, the company maintains satisfactory debt levels with a net debt to equity ratio at 37.2%. Short-term assets totaling CN¥1.5 billion exceed both short and long-term liabilities, indicating solid liquidity management. However, high non-cash earnings and negative operating cash flow suggest potential challenges in covering interest payments and managing financial stability effectively.

- Click to explore a detailed breakdown of our findings in Shanghai Trendzone Holdings GroupLtd's financial health report.

- Explore historical data to track Shanghai Trendzone Holdings GroupLtd's performance over time in our past results report.

Beijing Watertek Information Technology (SZSE:300324)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing Watertek Information Technology Co., Ltd. operates in the information technology sector and has a market cap of CN¥5.68 billion.

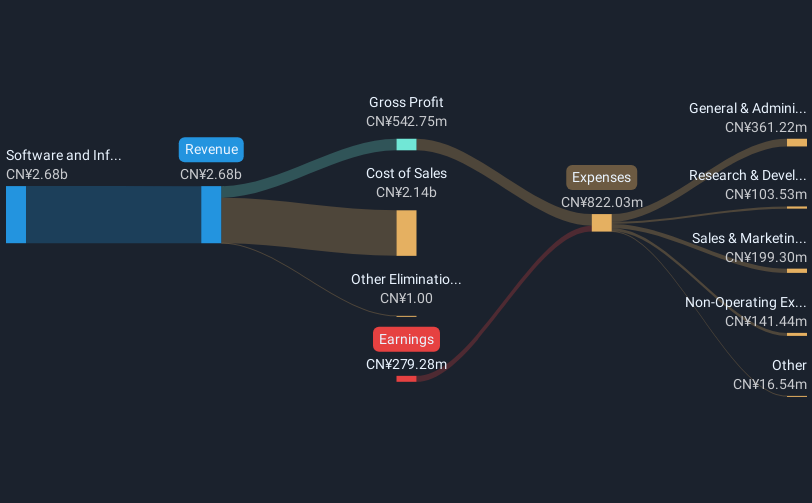

Operations: The company generates CN¥2.68 billion in revenue from its Software and Information Technology Services Industry segment.

Market Cap: CN¥5.68B

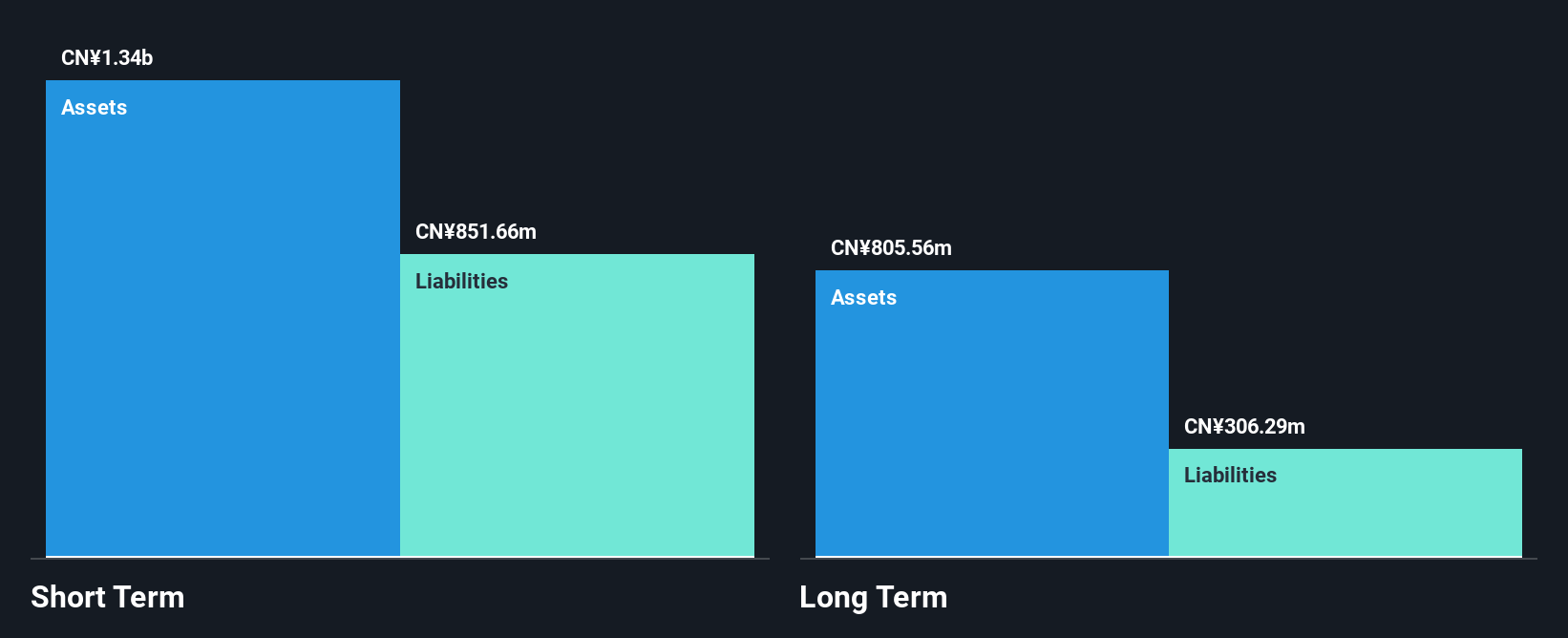

Beijing Watertek Information Technology Co., Ltd. operates with a market cap of CN¥5.68 billion and has experienced earnings declines, reporting a net loss of CN¥143.91 million for the first nine months of 2024, compared to the previous year's loss of CN¥132.7 million. Despite its unprofitability, the company maintains financial stability with short-term assets exceeding both short- and long-term liabilities and more cash than debt on its balance sheet. However, its share price remains highly volatile, reflecting uncertainty in investor sentiment amidst ongoing operational challenges in achieving profitability within the competitive IT sector.

- Click here to discover the nuances of Beijing Watertek Information Technology with our detailed analytical financial health report.

- Learn about Beijing Watertek Information Technology's historical performance here.

Summing It All Up

- Unlock more gems! Our Penny Stocks screener has unearthed 5,700 more companies for you to explore.Click here to unveil our expertly curated list of 5,703 Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huanxi Media Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1003

Huanxi Media Group

An investment holding company, engages in the media and entertainment, and related businesses in the People’s Republic of China and Hong Kong.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives