- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1373

Promising Penny Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling inflation and robust bank earnings, investors are increasingly optimistic about the potential for continued growth. Amidst these conditions, penny stocks—often small or emerging companies—remain an intriguing investment area due to their affordability and potential for significant returns. While the term 'penny stock' may seem outdated, these investments can still offer surprising value when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$41.79B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £150.76M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,713 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Goodbaby International Holdings (SEHK:1086)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Goodbaby International Holdings Limited is an investment holding company that engages in the research, development, design, manufacture, marketing, and sale of durable juvenile products across Europe, North America, Mainland China, and internationally with a market cap of HK$1.70 billion.

Operations: The company generates revenue from its Car Seats and Accessories segment, which amounts to HK$3.59 billion.

Market Cap: HK$1.7B

Goodbaby International Holdings has demonstrated significant revenue growth, reporting HK$6.49 billion for the nine months ending September 2024, up from HK$5.81 billion the previous year. The company's debt to equity ratio has improved over five years, now at a satisfactory 22.3%, with short-term assets covering both short and long-term liabilities comfortably. Despite a large one-off gain impacting recent earnings, profit margins have improved to 4.4%. However, earnings are forecasted to decline by an average of 5.9% annually over the next three years amidst management changes and low return on equity at 6.4%.

- Click to explore a detailed breakdown of our findings in Goodbaby International Holdings' financial health report.

- Gain insights into Goodbaby International Holdings' future direction by reviewing our growth report.

International Housewares Retail (SEHK:1373)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: International Housewares Retail Company Limited is an investment holding company involved in the retail sale and trading of housewares products, with a market cap of HK$770.12 million.

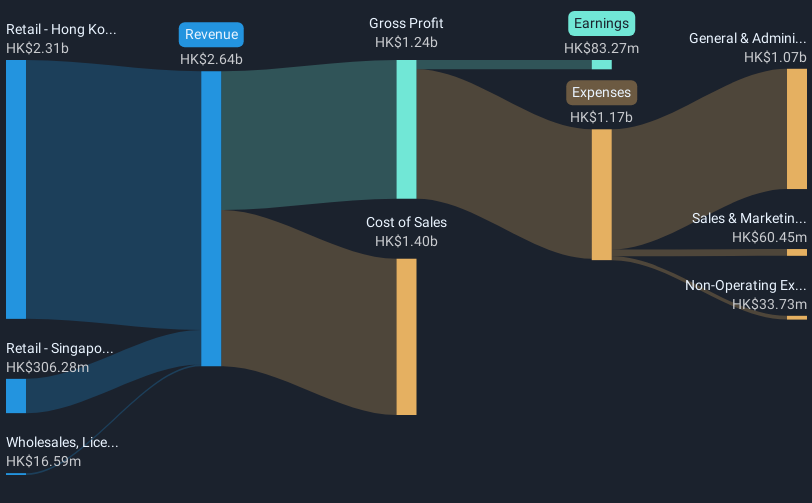

Operations: The company's revenue segments include Retail in Hong Kong and Macau generating HK$2.31 billion, Retail in Singapore with HK$306.28 million, and Wholesales, Licensing, and Others contributing HK$16.59 million.

Market Cap: HK$770.12M

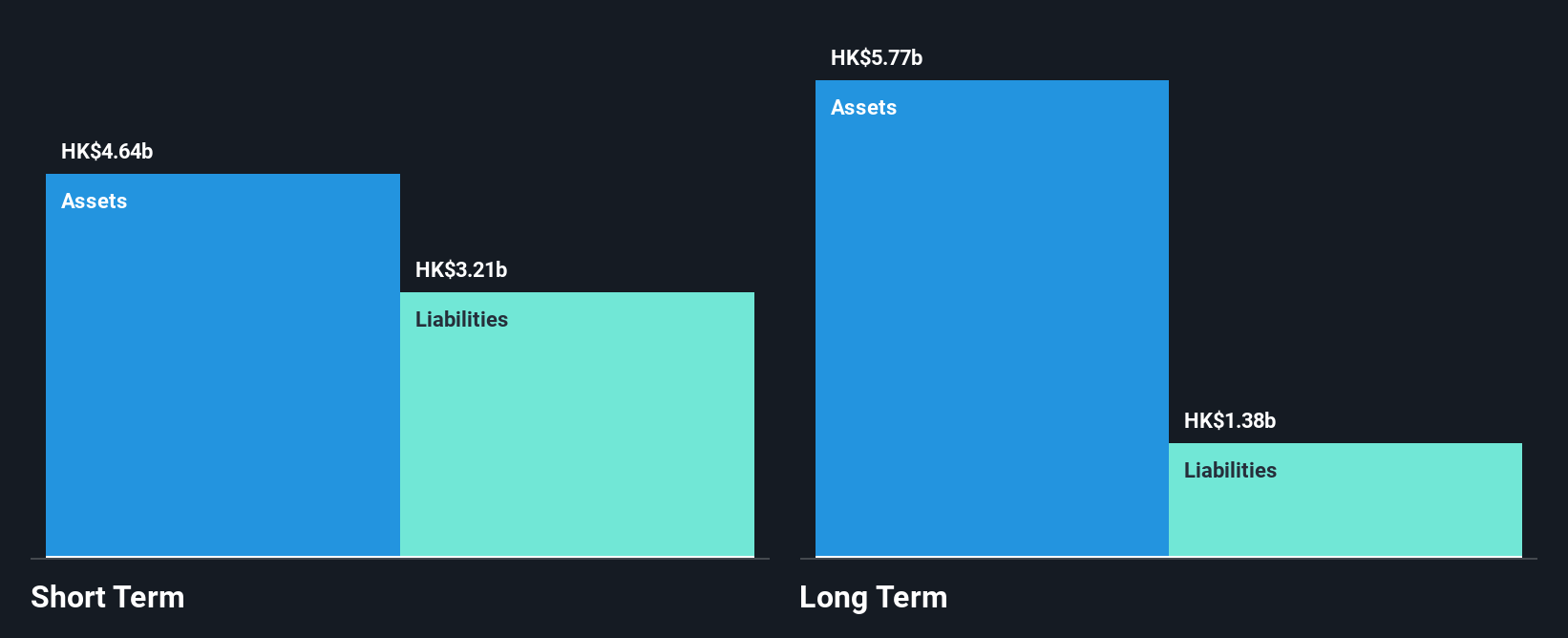

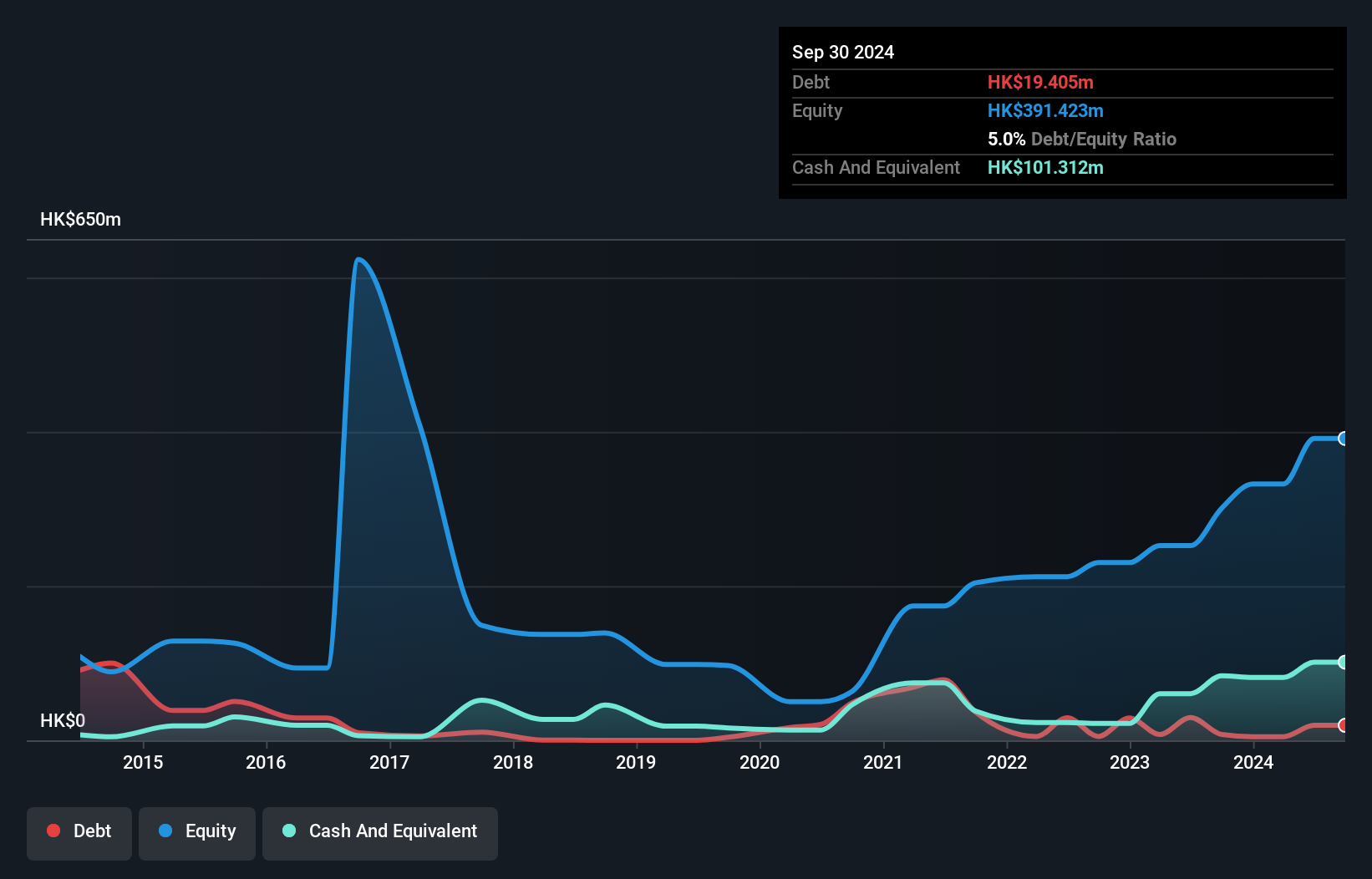

International Housewares Retail Company Limited faces challenges with declining earnings, reporting HK$1.27 billion in sales and HK$32.96 million in net income for the half-year ending October 2024, down from the previous year. Despite this, the company maintains a strong financial position with short-term assets exceeding both short and long-term liabilities and interest payments well covered by EBIT. Recent share repurchase plans aim to enhance shareholder value amidst an unstable dividend track record and low return on equity at 9.1%. The company's debt is minimal compared to cash flow, reflecting prudent financial management despite market pressures.

- Dive into the specifics of International Housewares Retail here with our thorough balance sheet health report.

- Understand International Housewares Retail's track record by examining our performance history report.

Legendary Education Group (SEHK:8195)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Legendary Education Group Limited is an investment holding company involved in designing, procuring, manufacturing, marketing, and retailing cashmere apparel, other apparel products, and accessories with a market cap of HK$735.27 million.

Operations: The company's revenue is primarily derived from its Financial Quotient and Investment Education Business (HK$196.45 million), Private Supplementary Education Business (HK$104.46 million), and Money Lending (HK$3.15 million) segments.

Market Cap: HK$735.27M

Legendary Education Group Limited shows a stable financial footing with short-term assets surpassing both short and long-term liabilities, although its operating cash flow remains negative. The company has experienced earnings growth of 30.7% over the past year, outpacing the luxury industry average. Recent cooperation with Victoria Harbour Education aims to expand its private supplementary education business in the PRC, potentially enhancing brand recognition and market competitiveness. While interest payments are well covered by EBIT, return on equity is relatively low at 12.4%. The upcoming shareholders meeting will address share scheme adjustments to support strategic initiatives.

- Navigate through the intricacies of Legendary Education Group with our comprehensive balance sheet health report here.

- Assess Legendary Education Group's previous results with our detailed historical performance reports.

Key Takeaways

- Explore the 5,713 names from our Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1373

International Housewares Retail

An investment holding company, engages in the retail sale and trading of housewares products.

Flawless balance sheet second-rate dividend payer.