- Hong Kong

- /

- Consumer Services

- /

- SEHK:1448

ABC arbitrage Leads The Way With 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling inflation and strong bank earnings in the U.S., investors are exploring opportunities beyond traditional large-cap stocks. Penny stocks, although an outdated term, continue to capture attention for their potential to offer value and growth. By focusing on companies with solid financials and clear growth strategies, investors can uncover promising opportunities within this niche market segment.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$41.79B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £150.76M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,713 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ABC arbitrage (ENXTPA:ABCA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ABC arbitrage SA, with a market cap of €298.47 million, develops arbitrage strategies for liquid assets globally through its subsidiaries.

Operations: The company generates €42.38 million in revenue from its arbitrage trading segment.

Market Cap: €298.47M

ABC arbitrage SA, with a market cap of €298.47 million, develops arbitrage strategies and generates €42.38 million in revenue from its trading segment. The management team is experienced, and the company maintains high-quality earnings despite a decline in profit margins from 43.3% to 39%. Trading at 42.3% below estimated fair value suggests potential undervaluation, though low return on equity (10.5%) may be a concern for investors seeking higher returns. ABC's financial stability is evident with short-term assets exceeding liabilities and no debt obligations, yet negative earnings growth over recent years highlights challenges in profitability improvement.

- Click here and access our complete financial health analysis report to understand the dynamics of ABC arbitrage.

- Review our growth performance report to gain insights into ABC arbitrage's future.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$8.99 billion, operates in the People's Republic of China offering burial and funeral services through its subsidiaries.

Operations: The company generates revenue primarily from burial services (CN¥1.78 billion) and funeral services (CN¥357.97 million), supplemented by other services (CN¥73.22 million).

Market Cap: HK$8.99B

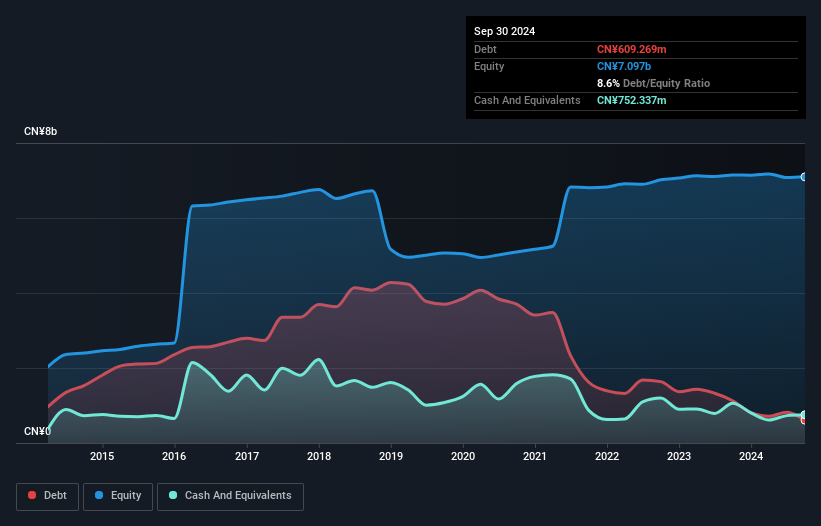

Fu Shou Yuan International Group, with a market cap of HK$8.99 billion, demonstrates financial stability through its strong balance sheet, where short-term assets (CN¥4.2 billion) surpass both short and long-term liabilities. The company covers its debt well with operating cash flow and has more cash than total debt, indicating prudent financial management despite low return on equity (11.1%). Although earnings growth was negative last year (-27.5%), the company has maintained high-quality earnings historically and forecasts suggest an 11.79% annual growth in profits, supported by seasoned board oversight but a relatively new management team.

- Click to explore a detailed breakdown of our findings in Fu Shou Yuan International Group's financial health report.

- Understand Fu Shou Yuan International Group's earnings outlook by examining our growth report.

Guizhou Xinbang Pharmaceutical (SZSE:002390)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guizhou Xinbang Pharmaceutical Co., Ltd. engages in the research, development, manufacturing, and sale of Chinese herbal medicines and other pharmaceutical products both in China and internationally, with a market cap of CN¥7.91 billion.

Operations: No revenue segments have been reported.

Market Cap: CN¥7.91B

Guizhou Xinbang Pharmaceutical, with a market cap of CN¥7.91 billion, exhibits financial resilience through its strong balance sheet, as short-term assets (CN¥5.1 billion) exceed both short and long-term liabilities. The company's debt is well covered by operating cash flow and it has more cash than total debt, reflecting sound fiscal management despite low return on equity (4%). While the company has achieved profitability over the past five years with significant earnings growth, recent negative earnings growth (-5.5%) poses challenges in comparison to industry averages. A stable dividend plan was recently affirmed for 2024.

- Dive into the specifics of Guizhou Xinbang Pharmaceutical here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Guizhou Xinbang Pharmaceutical's track record.

Taking Advantage

- Access the full spectrum of 5,713 Penny Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1448

Fu Shou Yuan International Group

Provides burial and funeral services in the People’s Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives