Unpleasant Surprises Could Be In Store For Haina Intelligent Equipment International Holdings Limited's (HKG:1645) Shares

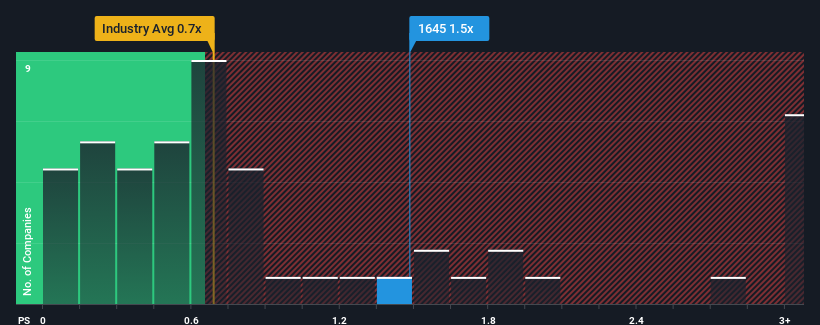

When you see that almost half of the companies in the Machinery industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.7x, Haina Intelligent Equipment International Holdings Limited (HKG:1645) looks to be giving off some sell signals with its 1.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Haina Intelligent Equipment International Holdings

How Has Haina Intelligent Equipment International Holdings Performed Recently?

Recent times have been quite advantageous for Haina Intelligent Equipment International Holdings as its revenue has been rising very briskly. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Haina Intelligent Equipment International Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Haina Intelligent Equipment International Holdings?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Haina Intelligent Equipment International Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 9.6% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's an unpleasant look.

In light of this, it's alarming that Haina Intelligent Equipment International Holdings' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Haina Intelligent Equipment International Holdings' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Haina Intelligent Equipment International Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Haina Intelligent Equipment International Holdings (2 don't sit too well with us!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Haina Intelligent Equipment International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1645

Haina Intelligent Equipment International Holdings

An investment holding company, engages in the design and production of automated machines for manufacturing disposable hygiene products.

Low risk with worrying balance sheet.

Market Insights

Community Narratives