- Hong Kong

- /

- Real Estate

- /

- SEHK:131

Do Insiders Own Lots Of Shares In Cheuk Nang (Holdings) Limited (HKG:131)?

A look at the shareholders of Cheuk Nang (Holdings) Limited (HKG:131) can tell us which group is most powerful. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

Cheuk Nang (Holdings) is not a large company by global standards. It has a market capitalization of HK$1.9b, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutional investors have not yet purchased much of the company. Let's delve deeper into each type of owner, to discover more about Cheuk Nang (Holdings).

See our latest analysis for Cheuk Nang (Holdings)

What Does The Institutional Ownership Tell Us About Cheuk Nang (Holdings)?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

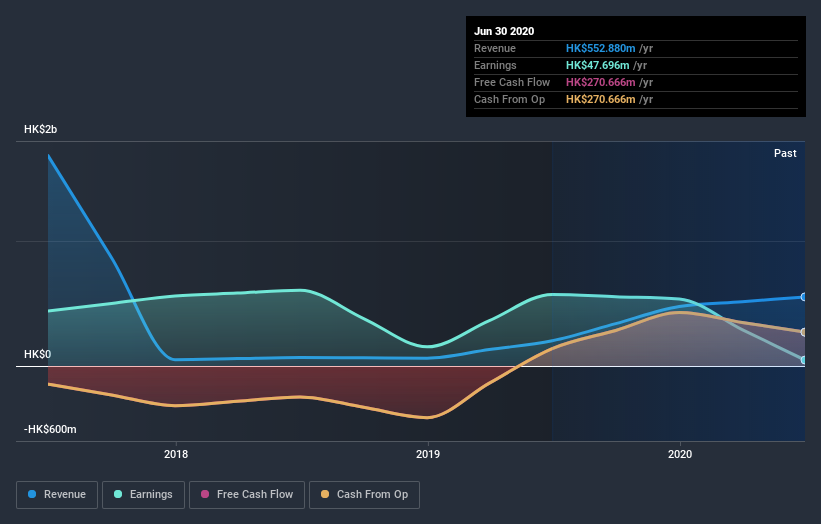

Institutions have a very small stake in Cheuk Nang (Holdings). That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. It is not uncommon to see a big share price rise if multiple institutional investors are trying to buy into a stock at the same time. So check out the historic earnings trajectory, below, but keep in mind it's the future that counts most.

Cheuk Nang (Holdings) is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is the CEO Sze-Tsung Chao with 74% of shares outstanding. This essentially means that they have significant control over the outcome or future of the company, which is why insider ownership is usually looked upon favourably by prospective buyers. Meanwhile, the second and third largest shareholders, hold 1.0% and 0.3%, of the shares outstanding, respectively. Interestingly, the third-largest shareholder, Ding-Yue Lee is also a Member of the Board of Directors, again, indicating strong insider ownership amongst the company's top shareholders.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Cheuk Nang (Holdings)

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own the majority of Cheuk Nang (Holdings) Limited. This means they can collectively make decisions for the company. That means they own HK$1.4b worth of shares in the HK$1.9b company. That's quite meaningful. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

With a 24% ownership, the general public have some degree of sway over Cheuk Nang (Holdings). While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Cheuk Nang (Holdings) you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Cheuk Nang (Holdings), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:131

Cheuk Nang (Holdings)

An investment holding company, engages in the investment, development, management, and trading of properties in the People’s Republic of China, Macau, Hong Kong, and Malaysia.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives