- Hong Kong

- /

- Real Estate

- /

- SEHK:1222

Wang On Group's (HKG:1222) Soft Earnings Don't Show The Whole Picture

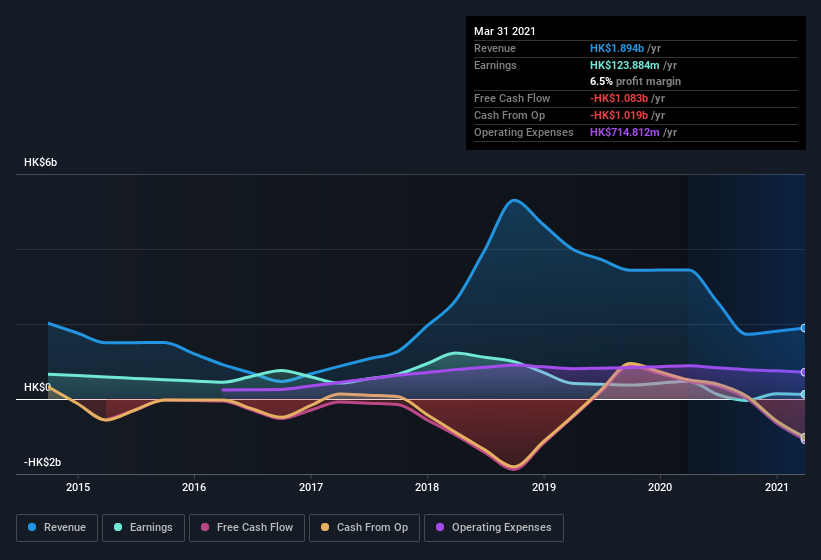

Wang On Group Limited's (HKG:1222) recent weak earnings report didn't cause a big stock movement. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

Check out our latest analysis for Wang On Group

The Power Of Non-Operating Revenue

At most companies, some revenue streams, such as government grants, are accounted for as non-operating revenue, while the core business is said to produce operating revenue. Where possible, we prefer rely on operating revenue to get a better understanding of how the business is functioning. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. Notably, Wang On Group had a significant increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from HK$462.6m to HK$583.2m. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Wang On Group.

How Do Unusual Items Influence Profit?

On top of the non-operating revenue spike, we should also consider the HK$447m impact of unusual items in the last year, which had the effect of suppressing profit. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. In the twelve months to March 2021, Wang On Group had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On Wang On Group's Profit Performance

In the last year Wang On Group's non-operating revenue really gave it a boost, but not in a way that is necessarily going to be sustained. But on the other hand, it also saw an unusual item depress its profit, suggesting the statutory profit number will actually improve next year, if the unusual expenses are not repeated, and all else stays equal. Based on these factors, it's hard to tell if Wang On Group's profits are a reasonable reflection of its underlying profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For instance, we've identified 5 warning signs for Wang On Group (2 are concerning) you should be familiar with.

Our examination of Wang On Group has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wang On Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1222

Wang On Group

An investment holding company, primarily engages in the property development and investment activities in Hong Kong, Mainland China, Macau, and internationally.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)