- Hong Kong

- /

- Real Estate

- /

- SEHK:9916

Earnings Working Against Xingye Wulian Service Group Co. Ltd.'s (HKG:9916) Share Price Following 30% Dive

The Xingye Wulian Service Group Co. Ltd. (HKG:9916) share price has fared very poorly over the last month, falling by a substantial 30%. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

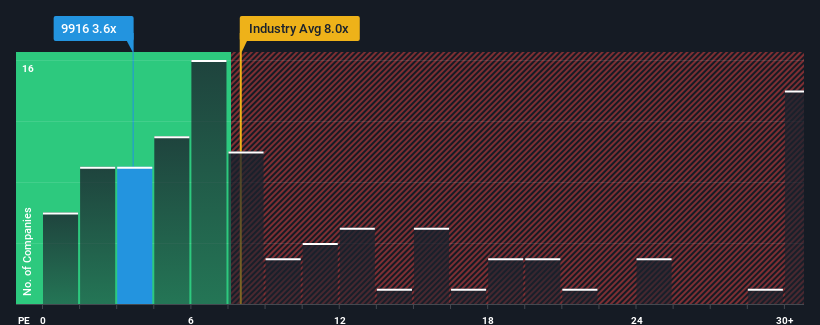

Even after such a large drop in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Xingye Wulian Service Group as a highly attractive investment with its 3.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Earnings have risen firmly for Xingye Wulian Service Group recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Xingye Wulian Service Group

Is There Any Growth For Xingye Wulian Service Group?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Xingye Wulian Service Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's bottom line. Still, incredibly EPS has fallen 25% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 23% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Xingye Wulian Service Group's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Xingye Wulian Service Group's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Xingye Wulian Service Group revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Xingye Wulian Service Group you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9916

Xingye Wulian Service Group

An investment holding company, provides property management, value-added, and property engineering services in the People’s Republic of China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives