- Hong Kong

- /

- Real Estate

- /

- SEHK:35

Some Shareholders Feeling Restless Over Far East Consortium International Limited's (HKG:35) P/S Ratio

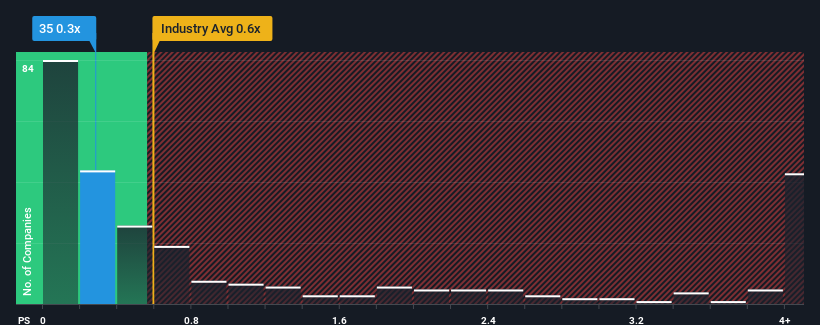

There wouldn't be many who think Far East Consortium International Limited's (HKG:35) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Real Estate industry in Hong Kong is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We've discovered 2 warning signs about Far East Consortium International. View them for free.View our latest analysis for Far East Consortium International

What Does Far East Consortium International's P/S Mean For Shareholders?

Recent times haven't been great for Far East Consortium International as its revenue has been falling quicker than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Far East Consortium International will help you uncover what's on the horizon.How Is Far East Consortium International's Revenue Growth Trending?

In order to justify its P/S ratio, Far East Consortium International would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 8.2% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 51% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.2% as estimated by the only analyst watching the company. With the industry predicted to deliver 6.6% growth, that's a disappointing outcome.

With this information, we find it concerning that Far East Consortium International is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Far East Consortium International's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of Far East Consortium International's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Far East Consortium International (1 shouldn't be ignored!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:35

Far East Consortium International

Engages in property development activities in the People’s Republic of China, Hong Kong, Malaysia, Singapore, Australia, New Zealand, the United Kingdom, the Czech Republic, and rest of Europe.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives