- Hong Kong

- /

- Real Estate

- /

- SEHK:199

Subdued Growth No Barrier To ITC Properties Group Limited (HKG:199) With Shares Advancing 213%

ITC Properties Group Limited (HKG:199) shareholders have had their patience rewarded with a 213% share price jump in the last month. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

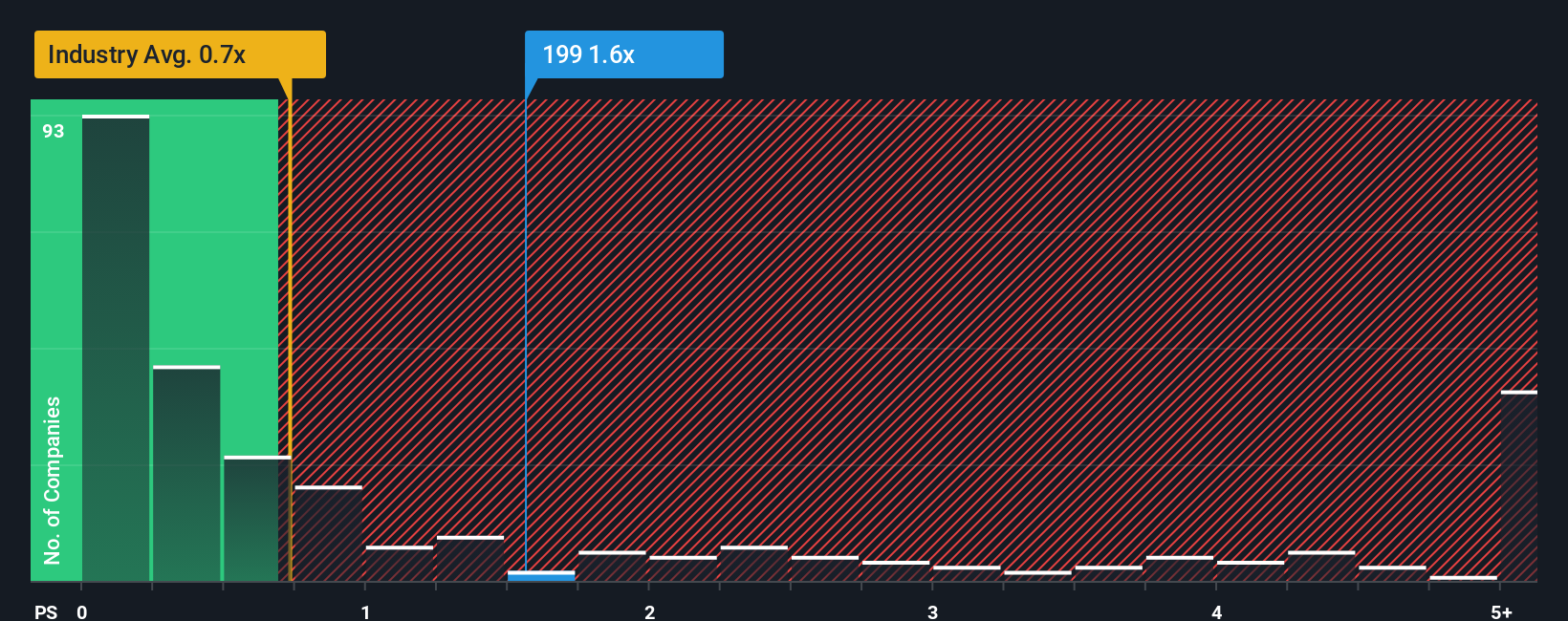

Since its price has surged higher, given close to half the companies operating in Hong Kong's Real Estate industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider ITC Properties Group as a stock to potentially avoid with its 1.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for ITC Properties Group

What Does ITC Properties Group's P/S Mean For Shareholders?

ITC Properties Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for ITC Properties Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is ITC Properties Group's Revenue Growth Trending?

In order to justify its P/S ratio, ITC Properties Group would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Revenue has also lifted 23% in aggregate from three years ago, mostly thanks to the incredible last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth, although potentially wondering why there's so much variation in revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 5.2% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it interesting that ITC Properties Group is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From ITC Properties Group's P/S?

ITC Properties Group's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We didn't expect to see ITC Properties Group trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware ITC Properties Group is showing 3 warning signs in our investment analysis, and 2 of those are potentially serious.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:199

ITC Properties Group

An investment holding company, primarily engages in the property development and investment activities in the Hong Kong, Macau, the United Kingdom, People’s Republic of China, Canada, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)