- Hong Kong

- /

- Real Estate

- /

- SEHK:191

Strong week for Lai Sun Garment (International) (HKG:191) shareholders doesn't alleviate pain of five-year loss

Lai Sun Garment (International) Limited (HKG:191) shareholders should be happy to see the share price up 21% in the last week. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Like a ship taking on water, the share price has sunk 92% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

On a more encouraging note the company has added HK$97m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Lai Sun Garment (International) isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Lai Sun Garment (International) reduced its trailing twelve month revenue by 0.7% for each year. While far from catastrophic that is not good. If a business loses money, you want it to grow, so no surprises that the share price has dropped 14% each year in that time. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. Fear of becoming a 'bagholder' may be keeping people away from this stock.

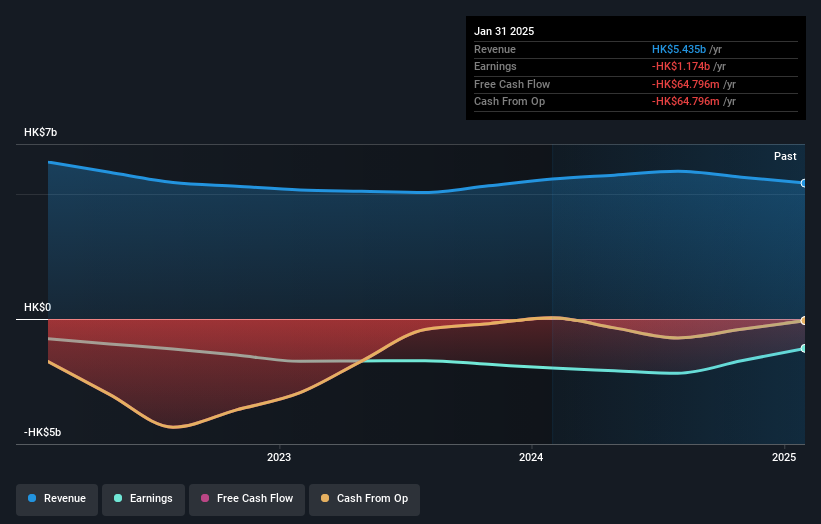

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About The Total Shareholder Return (TSR)?

We've already covered Lai Sun Garment (International)'s share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Lai Sun Garment (International) shareholders, and that cash payout explains why its total shareholder loss of 90%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Lai Sun Garment (International) shareholders are down 15% for the year, but the market itself is up 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 14% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Lai Sun Garment (International) better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Lai Sun Garment (International) (including 2 which are a bit concerning) .

Lai Sun Garment (International) is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:191

Lai Sun Garment (International)

An investment holding company, invests in and develops properties in Hong Kong, Mainland China, Macau, the United Kingdom, Vietnam, and internationally.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives