- Hong Kong

- /

- Real Estate

- /

- SEHK:1396

Shareholders Will Probably Not Have Any Issues With Guangdong - Hong Kong Greater Bay Area Holdings Limited's (HKG:1396) CEO Compensation

Key Insights

- Guangdong - Hong Kong Greater Bay Area Holdings to hold its Annual General Meeting on 20th of June

- Salary of CN¥1.52m is part of CEO Fei He's total remuneration

- The overall pay is comparable to the industry average

- Guangdong - Hong Kong Greater Bay Area Holdings' EPS declined by 14% over the past three years while total shareholder return over the past three years was 62%

Despite strong share price growth of 62% for Guangdong - Hong Kong Greater Bay Area Holdings Limited (HKG:1396) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 20th of June. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

Check out our latest analysis for Guangdong - Hong Kong Greater Bay Area Holdings

Comparing Guangdong - Hong Kong Greater Bay Area Holdings Limited's CEO Compensation With The Industry

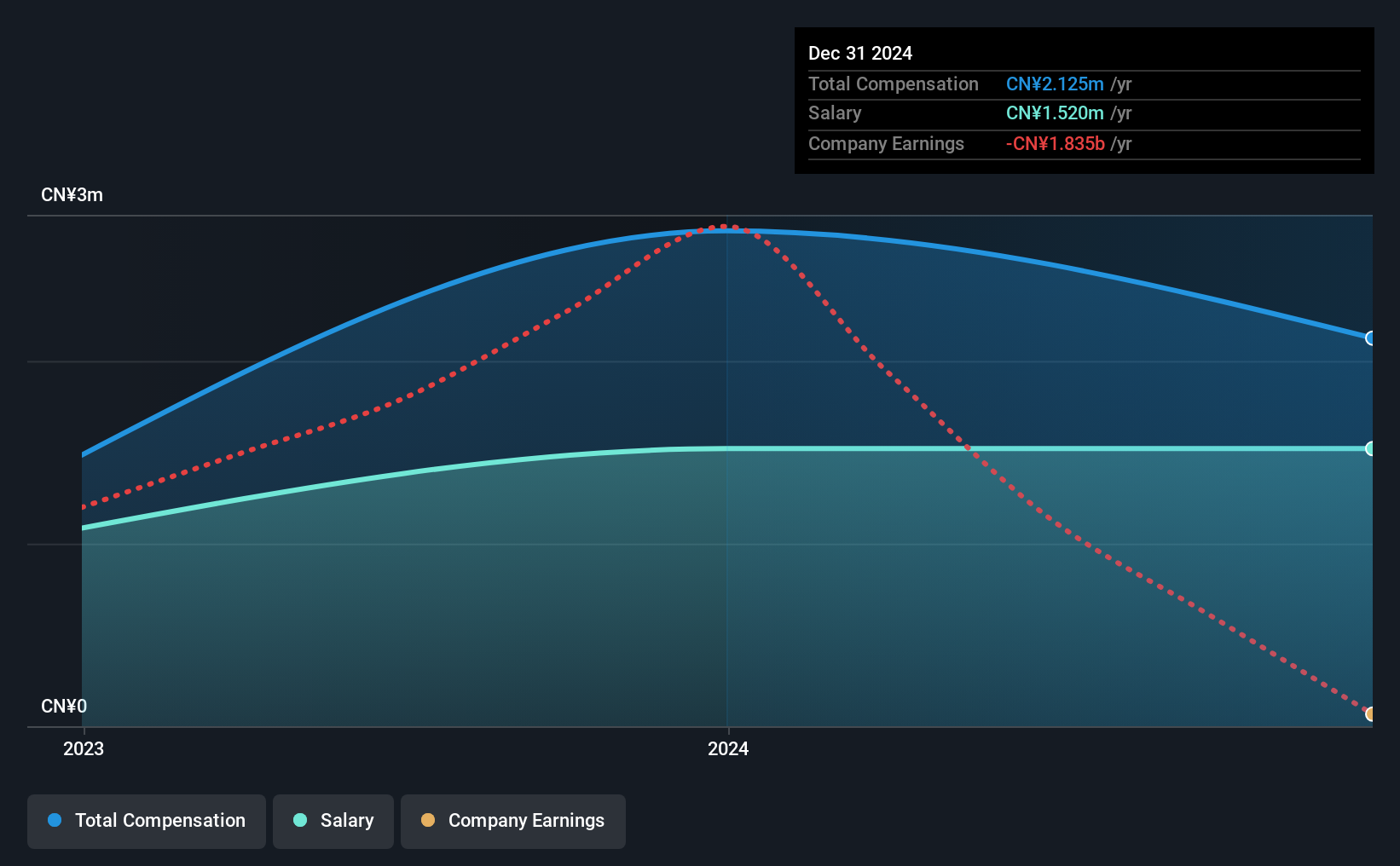

At the time of writing, our data shows that Guangdong - Hong Kong Greater Bay Area Holdings Limited has a market capitalization of HK$3.1b, and reported total annual CEO compensation of CN¥2.1m for the year to December 2024. We note that's a decrease of 22% compared to last year. Notably, the salary which is CN¥1.52m, represents most of the total compensation being paid.

For comparison, other companies in the Hong Kong Real Estate industry with market capitalizations ranging between HK$1.6b and HK$6.3b had a median total CEO compensation of CN¥2.7m. From this we gather that Fei He is paid around the median for CEOs in the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥1.5m | CN¥1.5m | 72% |

| Other | CN¥605k | CN¥1.2m | 28% |

| Total Compensation | CN¥2.1m | CN¥2.7m | 100% |

Speaking on an industry level, nearly 82% of total compensation represents salary, while the remainder of 18% is other remuneration. It's interesting to note that Guangdong - Hong Kong Greater Bay Area Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Guangdong - Hong Kong Greater Bay Area Holdings Limited's Growth Numbers

Over the last three years, Guangdong - Hong Kong Greater Bay Area Holdings Limited has shrunk its earnings per share by 14% per year. In the last year, its revenue is down 26%.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Guangdong - Hong Kong Greater Bay Area Holdings Limited Been A Good Investment?

We think that the total shareholder return of 62%, over three years, would leave most Guangdong - Hong Kong Greater Bay Area Holdings Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Guangdong - Hong Kong Greater Bay Area Holdings that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1396

Guangdong - Hong Kong Greater Bay Area Holdings

Develops, operates, and sells residential properties, and commercial trade and logistics centers in Mainland China.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)