Even after rising 3.5% this past week, InnoCare Pharma (HKG:9969) shareholders are still down 61% over the past year

Taking the occasional loss comes part and parcel with investing on the stock market. Unfortunately, shareholders of InnoCare Pharma Limited (HKG:9969) have suffered share price declines over the last year. The share price is down a hefty 61% in that time. We wouldn't rush to judgement on InnoCare Pharma because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 37% in the last three months. Of course, this share price action may well have been influenced by the 15% decline in the broader market, throughout the period.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

Our analysis indicates that 9969 is potentially undervalued!

InnoCare Pharma isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

InnoCare Pharma grew its revenue by 1,061% over the last year. That's well above most other pre-profit companies. In contrast the share price is down 61% over twelve months. Yes, the market can be a fickle mistress. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). Generally speaking investors would consider a stock like this less risky once it turns a profit. But when do you think that will happen?

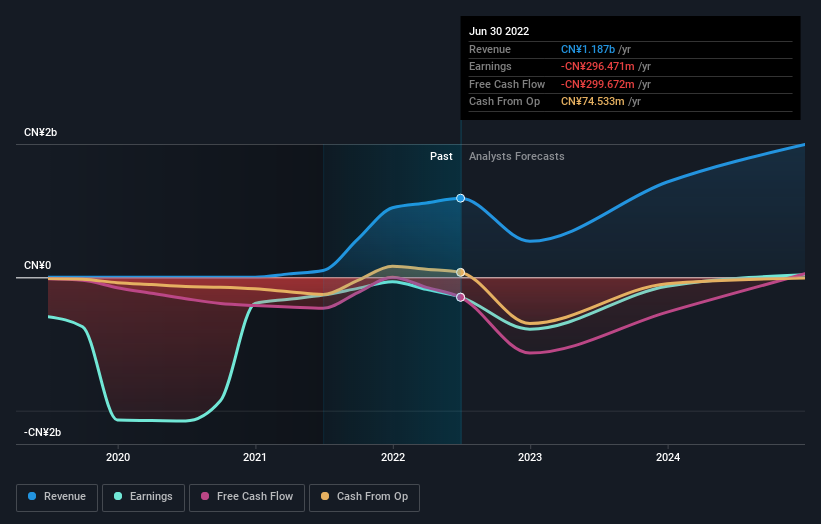

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think InnoCare Pharma will earn in the future (free profit forecasts).

A Different Perspective

InnoCare Pharma shareholders are down 61% for the year, even worse than the market loss of 25%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 37%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand InnoCare Pharma better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for InnoCare Pharma you should know about.

InnoCare Pharma is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you're looking to trade InnoCare Pharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9969

InnoCare Pharma

A biopharmaceutical company, engages in discovering, developing, and commercializing drugs for the treatment of cancer and autoimmune diseases in China.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives