3 SEHK Stocks Estimated To Be Trading At Discounts Of Up To 49.8%

Reviewed by Simply Wall St

The Hong Kong stock market has experienced a notable surge, with the Hang Seng Index gaining 13% following China's announcement of robust stimulus measures aimed at revitalizing its economy. This positive momentum presents potential opportunities for investors seeking undervalued stocks that may benefit from renewed economic optimism. In this context, identifying stocks trading at significant discounts could offer appealing prospects for those looking to capitalize on favorable market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$32.20 | HK$64.07 | 49.7% |

| FIT Hon Teng (SEHK:6088) | HK$2.33 | HK$4.30 | 45.8% |

| Alibaba Health Information Technology (SEHK:241) | HK$5.47 | HK$9.98 | 45.2% |

| China Ruyi Holdings (SEHK:136) | HK$2.17 | HK$4.16 | 47.8% |

| XD (SEHK:2400) | HK$26.15 | HK$47.82 | 45.3% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$30.00 | HK$56.35 | 46.8% |

| Nayuki Holdings (SEHK:2150) | HK$1.77 | HK$3.37 | 47.5% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$13.68 | HK$25.92 | 47.2% |

| Akeso (SEHK:9926) | HK$67.30 | HK$134.02 | 49.8% |

| Digital China Holdings (SEHK:861) | HK$2.96 | HK$5.85 | 49.4% |

Let's take a closer look at a couple of our picks from the screened companies.

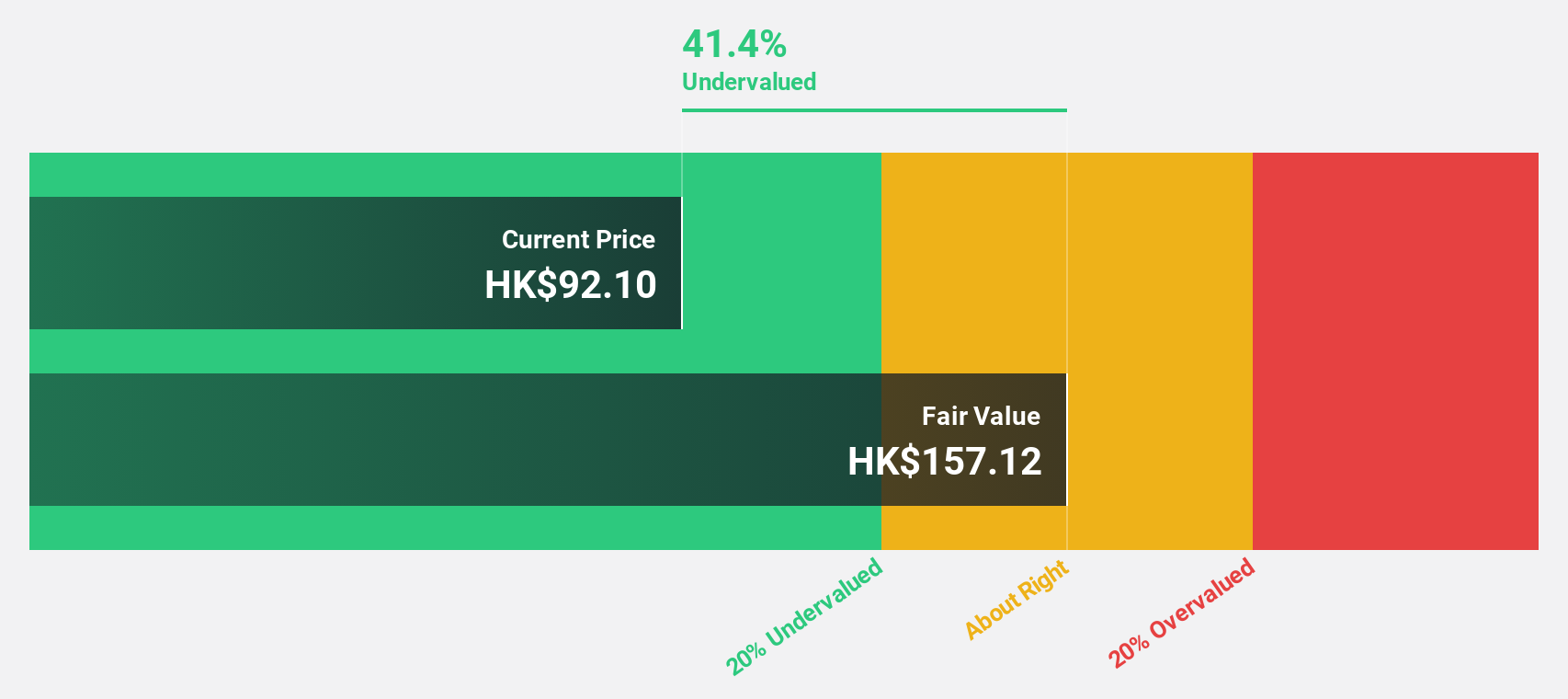

Techtronic Industries (SEHK:669)

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of approximately HK$220.63 billion.

Operations: The company's revenue is primarily derived from its Power Equipment segment, which accounts for $13.23 billion, followed by the Floorcare & Cleaning segment at $965.09 million.

Estimated Discount To Fair Value: 19%

Techtronic Industries is trading at HK$120.4, about 19% below its estimated fair value of HK$148.73, suggesting potential undervaluation based on discounted cash flow analysis. The company's earnings are forecast to grow at 15.3% annually, outpacing the Hong Kong market's growth rate of 12.2%. Recent financials show improved net income and sales for the first half of 2024, indicating robust operational performance despite modest revenue growth projections.

- According our earnings growth report, there's an indication that Techtronic Industries might be ready to expand.

- Get an in-depth perspective on Techtronic Industries' balance sheet by reading our health report here.

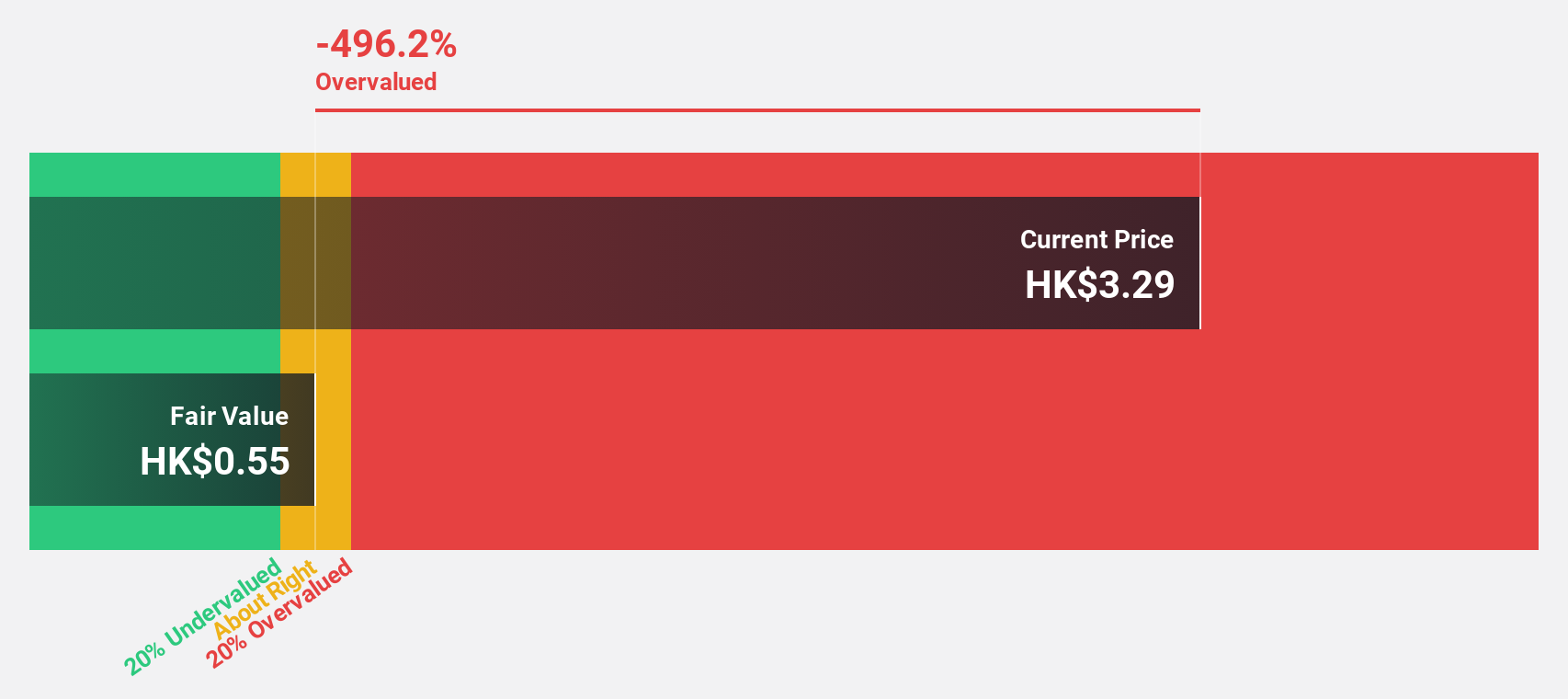

Ming Yuan Cloud Group Holdings (SEHK:909)

Overview: Ming Yuan Cloud Group Holdings Limited is an investment holding company that offers software solutions for property developers in China, with a market cap of HK$6.92 billion.

Operations: The company's revenue is primarily generated from Cloud Services, which accounts for CN¥1.32 billion, and On-premise Software and Services, contributing CN¥281.71 million.

Estimated Discount To Fair Value: 19.4%

Ming Yuan Cloud Group Holdings, trading at HK$3.81, is approximately 19.4% below its estimated fair value of HK$4.73, indicating potential undervaluation based on cash flows. Despite a net loss reduction from CNY 323.32 million to CNY 115.37 million in the first half of 2024, earnings are expected to grow significantly over the next three years as profitability improves above average market growth rates, although revenue growth remains moderate at 9.7% annually amidst share price volatility and recent leadership changes.

- Our growth report here indicates Ming Yuan Cloud Group Holdings may be poised for an improving outlook.

- Dive into the specifics of Ming Yuan Cloud Group Holdings here with our thorough financial health report.

Akeso (SEHK:9926)

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on researching, developing, manufacturing, and commercializing antibody drugs with a market cap of HK$58.27 billion.

Operations: The company's revenue from the research, development, production, and sale of biopharmaceutical products is CN¥1.87 billion.

Estimated Discount To Fair Value: 49.8%

Akeso, trading at HK$67.3, is significantly undervalued with a fair value estimate of HK$134.02. The company's revenue is projected to grow 32.6% annually, outpacing the Hong Kong market's average growth rate. Recent drug approvals, including ebronucimab and cadonilimab for various indications in China, highlight its expanding product portfolio and potential revenue streams despite past shareholder dilution and recent net losses reported for H1 2024.

- The analysis detailed in our Akeso growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Akeso.

Where To Now?

- Reveal the 39 hidden gems among our Undervalued SEHK Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:909

Ming Yuan Cloud Group Holdings

An investment holding company, provides software solutions for property developers in China.

Excellent balance sheet with reasonable growth potential.