FAR International Holdings Group Among 3 Penny Stocks Worth Considering

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with major indices experiencing fluctuations and economic indicators sending varied signals, investors are exploring diverse opportunities. Penny stocks, often representing smaller or newer companies, continue to capture interest due to their potential for significant returns when backed by strong financials. Despite being considered an outdated term by some, these stocks remain relevant as they can offer hidden value and growth prospects not always found in larger firms.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.96M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.64 | HK$41.63B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

FAR International Holdings Group (SEHK:2516)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FAR International Holdings Group Company Limited is an investment holding company that offers cross-border e-commerce logistics services in Mainland China, Hong Kong, the United States, the United Kingdom, and internationally, with a market cap of HK$600.60 million.

Operations: The company generates revenue from its Transportation - Air Freight segment, totaling CN¥2.80 billion.

Market Cap: HK$600.6M

FAR International Holdings Group has demonstrated impressive earnings growth of 131.2% over the past year, surpassing the logistics industry's average. Despite this, its high level of non-cash earnings raises questions about quality. The company maintains a strong financial position with more cash than total debt and adequate short-term asset coverage for liabilities. However, its board lacks experience and its return on equity remains low at 7.8%. Additionally, while shareholder dilution hasn't been significant recently, negative operating cash flow suggests challenges in covering debt obligations effectively.

- Dive into the specifics of FAR International Holdings Group here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into FAR International Holdings Group's track record.

Simplicity Holding (SEHK:8367)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Simplicity Holding Limited is an investment holding company that operates casual dining full-service restaurants in Hong Kong, with a market cap of HK$19.56 million.

Operations: The company's revenue is derived from Chinese cuisine (HK$14.25 million), Malaysian cuisine (HK$16.47 million), and aircraft's engine stand repairing and maintenance services (HK$59.40 million).

Market Cap: HK$19.56M

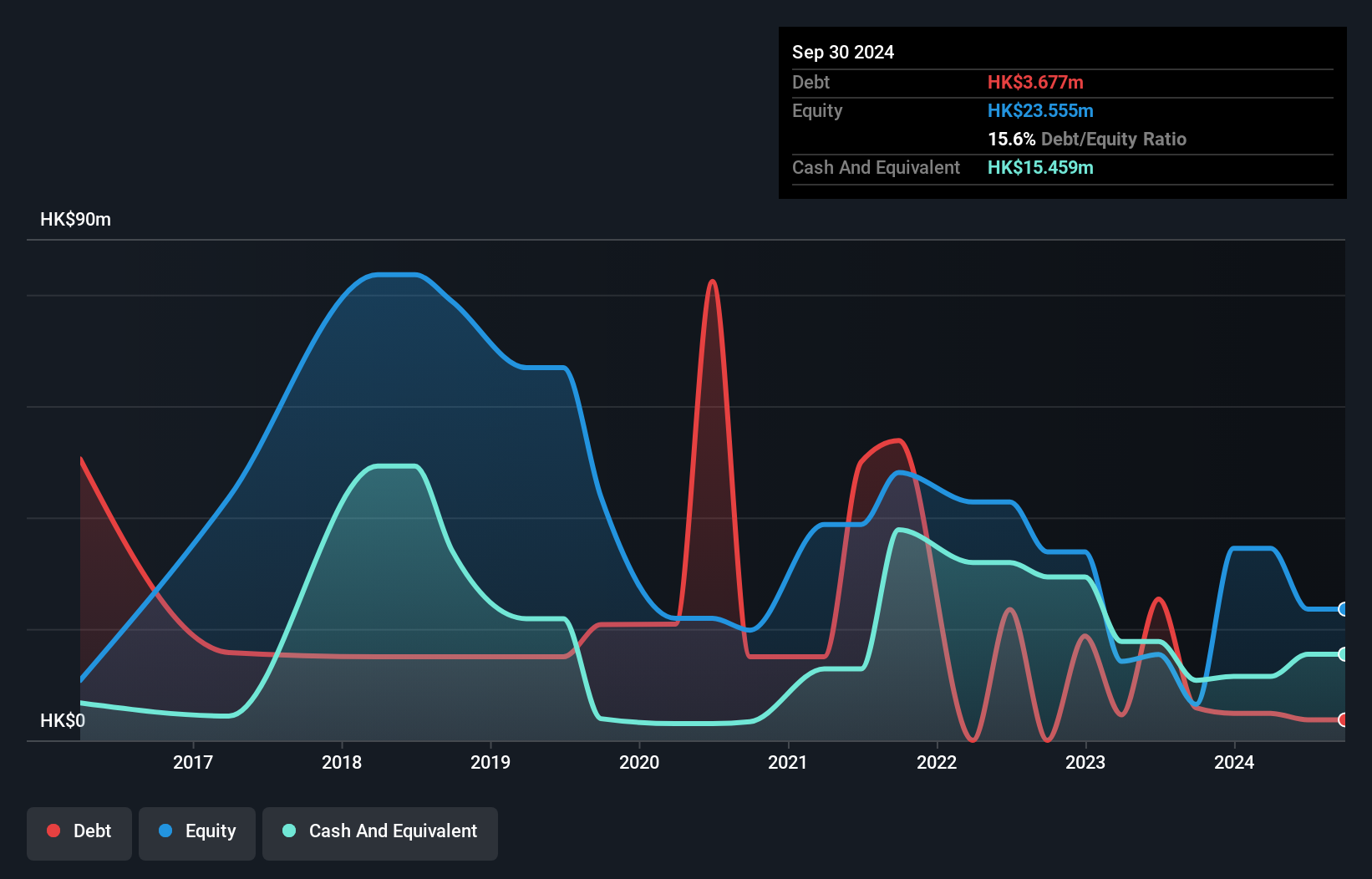

Simplicity Holding Limited has recently turned profitable, showcasing a high return on equity of 26.8%, although its share price remains highly volatile. Despite having more cash than debt and short-term assets exceeding long-term liabilities, the company faces challenges with short-term liabilities surpassing assets by HK$9.3 million. The board's inexperience, with an average tenure of 2.4 years, could impact strategic direction. Recent financials show a net loss increase to HK$10.89 million for the half-year ending September 2024 from HK$8.96 million previously, alongside efforts to raise capital through follow-on equity offerings totaling HKD 3.91 million at a discounted rate per share.

- Click here to discover the nuances of Simplicity Holding with our detailed analytical financial health report.

- Learn about Simplicity Holding's historical performance here.

Tianjin Chase Sun PharmaceuticalLtd (SZSE:300026)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tianjin Chase Sun Pharmaceutical Co., Ltd is involved in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥11.06 billion.

Operations: No specific revenue segments are reported for Tianjin Chase Sun Pharmaceutical Co., Ltd.

Market Cap: CN¥11.06B

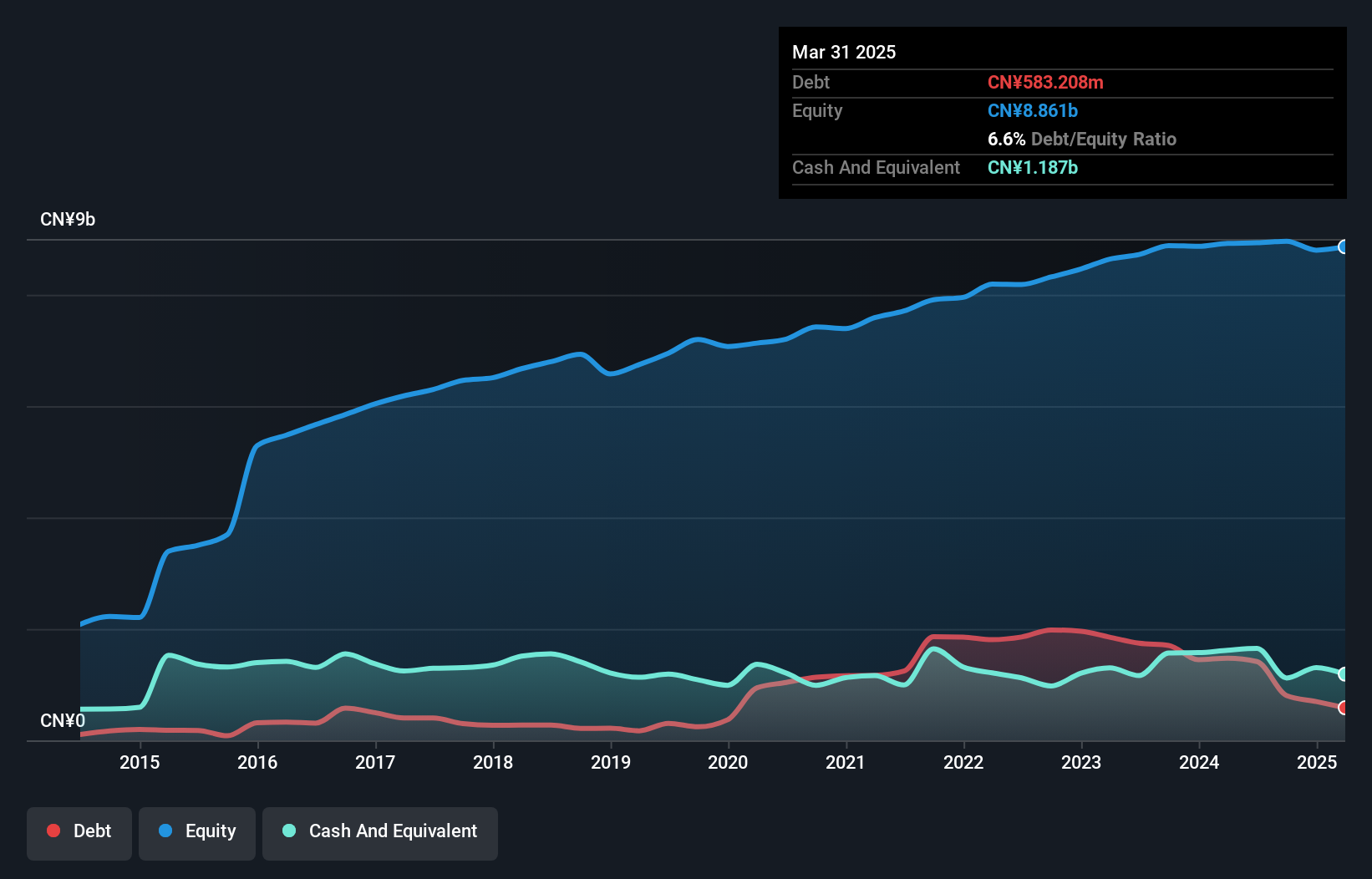

Tianjin Chase Sun Pharmaceutical Co., Ltd has faced declining earnings, with net income dropping to CN¥168.36 million from CN¥509.18 million year-over-year, impacted by a large one-off gain of CN¥143.3 million. Despite a low return on equity of 2%, the company's debt is well managed, covered by operating cash flow at 129.7%, and it holds more cash than total debt. The management team and board are experienced, with tenures averaging 7.8 and 5.4 years respectively, but profit margins have decreased to 2.9% from last year's 9.9%. Short-term assets significantly exceed liabilities, providing some financial stability amidst volatility in earnings growth forecasts.

- Navigate through the intricacies of Tianjin Chase Sun PharmaceuticalLtd with our comprehensive balance sheet health report here.

- Evaluate Tianjin Chase Sun PharmaceuticalLtd's prospects by accessing our earnings growth report.

Seize The Opportunity

- Click this link to deep-dive into the 5,815 companies within our Penny Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2516

FAR International Holdings Group

An investment holding company, provides cross-border e-commerce logistics services in Mainland China, Hong Kong, the United States, the United Kingdom, and internationally.

Adequate balance sheet slight.