Is Shandong Xinhua Pharmaceutical (HKG:719) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Shandong Xinhua Pharmaceutical Company Limited (HKG:719) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Shandong Xinhua Pharmaceutical

What Is Shandong Xinhua Pharmaceutical's Debt?

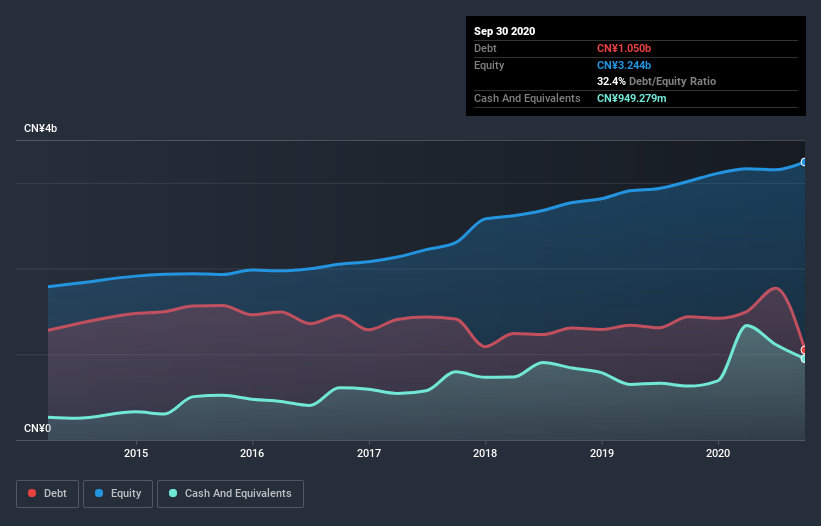

The image below, which you can click on for greater detail, shows that Shandong Xinhua Pharmaceutical had debt of CN¥988.4m at the end of September 2020, a reduction from CN¥1.44b over a year. However, it also had CN¥949.3m in cash, and so its net debt is CN¥39.1m.

A Look At Shandong Xinhua Pharmaceutical's Liabilities

Zooming in on the latest balance sheet data, we can see that Shandong Xinhua Pharmaceutical had liabilities of CN¥2.12b due within 12 months and liabilities of CN¥1.34b due beyond that. Offsetting this, it had CN¥949.3m in cash and CN¥694.5m in receivables that were due within 12 months. So it has liabilities totalling CN¥1.81b more than its cash and near-term receivables, combined.

Shandong Xinhua Pharmaceutical has a market capitalization of CN¥4.50b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. But either way, Shandong Xinhua Pharmaceutical has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Shandong Xinhua Pharmaceutical's debt of just 0.051 times EBITDA is really very modest. And EBIT easily covered the interest expense 8.3 times over, lending force to that view. On the other hand, Shandong Xinhua Pharmaceutical's EBIT dived 13%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Shandong Xinhua Pharmaceutical will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Shandong Xinhua Pharmaceutical's free cash flow amounted to 23% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Shandong Xinhua Pharmaceutical's EBIT growth rate and conversion of EBIT to free cash flow definitely weigh on it, in our esteem. But its net debt to EBITDA tells a very different story, and suggests some resilience. We think that Shandong Xinhua Pharmaceutical's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Shandong Xinhua Pharmaceutical is showing 3 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Shandong Xinhua Pharmaceutical, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:719

Shandong Xinhua Pharmaceutical

Develops, manufactures, and sells bulk pharmaceuticals, preparations, and chemical products in the People’s Republic of China, the Americas, Europe, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives