High Growth Tech Stocks To Watch In Hong Kong This September 2024

Reviewed by Simply Wall St

As global markets experience heightened volatility and economic slowdown concerns weigh on investor sentiment, the Hang Seng Index in Hong Kong has not been immune to these pressures. Despite this challenging backdrop, high-growth tech stocks continue to capture attention due to their potential for innovation and market disruption. Identifying a good stock in such a dynamic environment often involves looking for companies with strong fundamentals, robust growth prospects, and the ability to adapt quickly to changing market conditions.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| Innovent Biologics | 21.45% | 59.82% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 32.82% | 54.95% | ★★★★★★ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China, with a market cap of HK$168.81 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic operations (CN¥117.32 billion) and a smaller portion from overseas markets (CN¥3.57 billion). The company focuses on live streaming and online marketing services in China.

Kuaishou Technology's recent earnings report highlights a robust performance with Q2 sales reaching ¥30.98 billion, up from ¥27.74 billion the previous year, and net income soaring to ¥3.98 billion from ¥1.48 billion. The company's R&D expenses have been substantial, contributing to innovations like Kling AI, which has seen significant upgrades and now offers a subscription model in mainland China starting at RMB66 per month. With earnings forecasted to grow 18.8% annually and revenue expected to rise by 9%, Kuaishou is positioning itself strongly within the tech landscape.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs to address unmet medical needs in China and internationally, with a market cap of HK$38.66 billion.

Operations: Kelun-Biotech generates revenue primarily from its pharmaceuticals segment, amounting to CN¥1.88 billion. The company is involved in the entire lifecycle of novel drug development, from research and manufacturing to commercialization, targeting both domestic and international markets.

Sichuan Kelun-Biotech Biopharmaceutical's recent half-year earnings report shows a significant revenue increase to ¥1.38 billion from ¥1.05 billion, with net income reaching ¥310.23 million compared to a previous loss of ¥31.13 million. The company's R&D expenditure is noteworthy, fueling advancements like sacituzumab tirumotecan (sac-TMT), which has shown promising clinical results in various cancers, including a 56.3% objective response rate in TNBC patients treated with sac-TMT versus 5.6% for standard treatments, and an 8.53% forecasted annual earnings growth rate highlights its potential within the biotech sector.

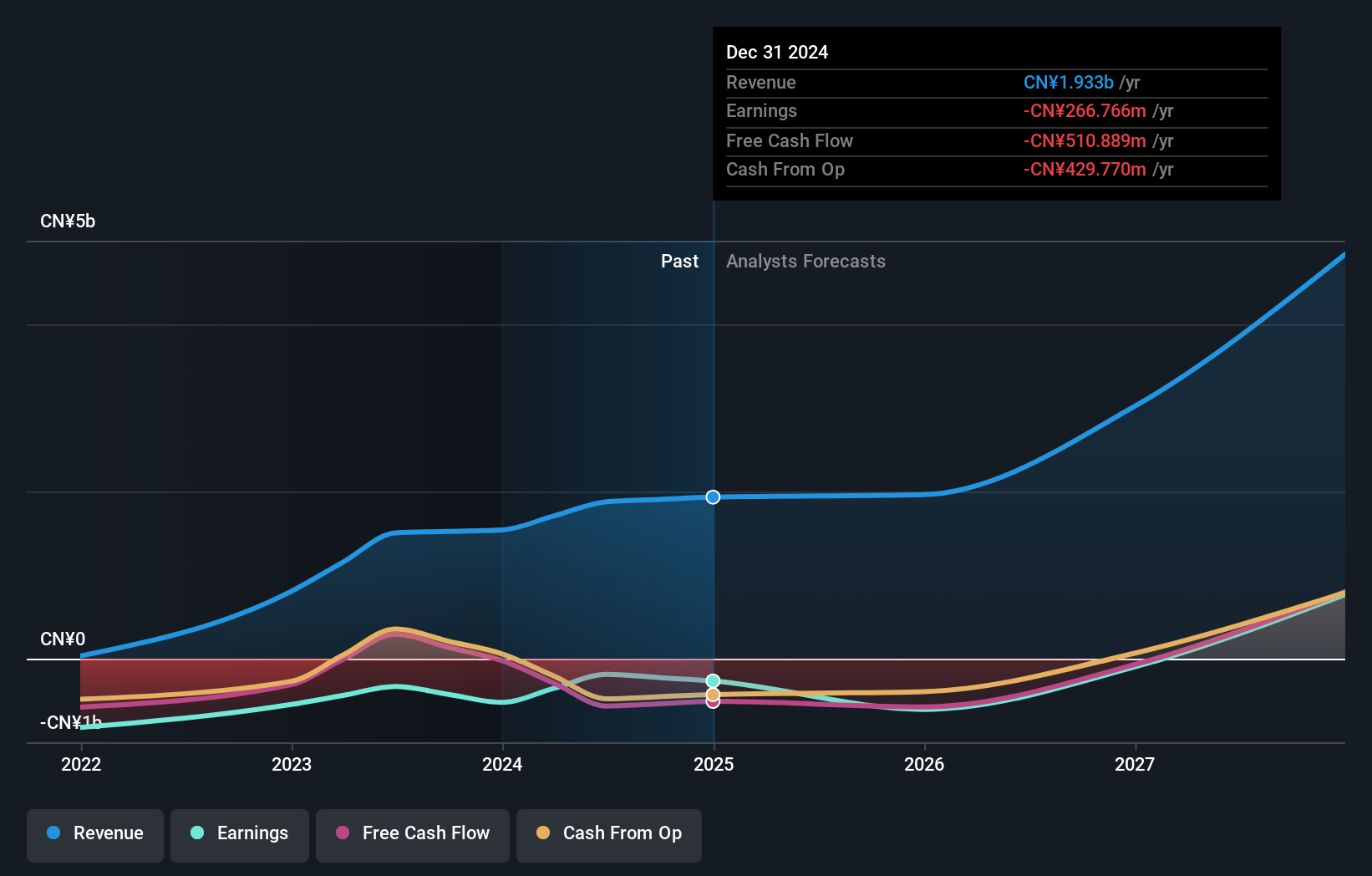

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$48.23 billion.

Operations: The company generates revenue primarily through the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1.87 billion. The focus is on antibody drugs within the biopharmaceutical sector.

Akeso's recent half-year earnings report shows a revenue drop to ¥1.02 billion from ¥3.68 billion, with a net loss of ¥238.59 million compared to last year's net income of ¥2.53 billion. Despite these figures, Akeso's R&D expenditure underscores its commitment to innovation, particularly in developing ivonescimab—a first-in-class PD-1/VEGF bi-specific antibody for non-small cell lung cancer—highlighting its potential clinical value and market impact. The company's focus on groundbreaking therapies positions it well within the high-growth tech landscape in Hong Kong, with anticipated annual profit growth expected to outpace market averages at 54.95%.

- Navigate through the intricacies of Akeso with our comprehensive health report here.

Examine Akeso's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Dive into all 45 of the SEHK High Growth Tech and AI Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs.

Exceptional growth potential with adequate balance sheet.