Global markets have been marked by mixed performances recently, with major indexes mostly declining except for the Nasdaq Composite, which reached a record high. As investors navigate these fluctuating conditions, penny stocks—often representing smaller or newer companies—remain an intriguing segment of the market. Despite being considered a throwback term, penny stocks continue to offer potential growth opportunities at lower price points when backed by strong financial health and fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.12 | £798.74M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.97 | HK$44.05B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.775 | £180.04M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.97 | £153.01M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,762 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Union Insurance Company P.J.S.C (ADX:UNION)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Union Insurance Company P.J.S.C. provides insurance products across the United Arab Emirates, Gulf Cooperation Council, and internationally with a market capitalization of AED195.25 million.

Operations: The company generates revenue from Life Insurance amounting to AED16.33 million and General Insurance totaling AED254.56 million.

Market Cap: AED195.25M

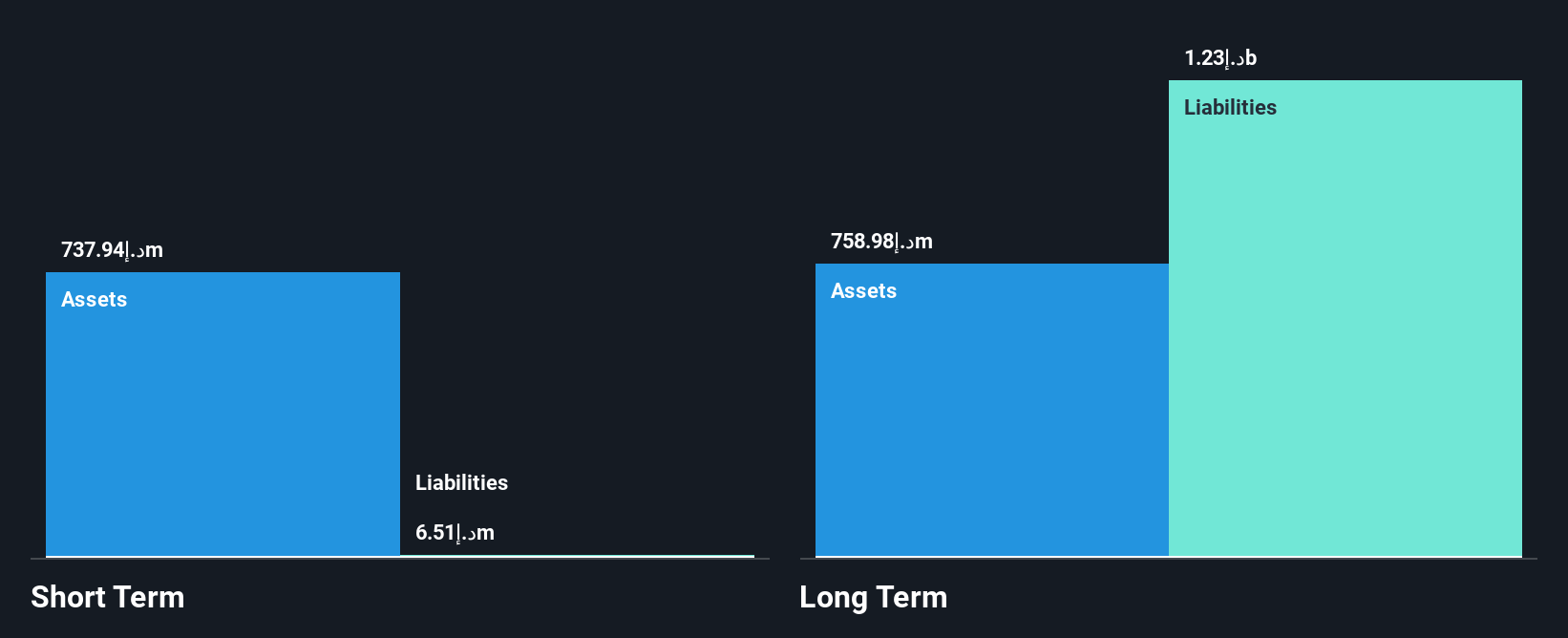

Union Insurance Company P.J.S.C. has shown improvement in profitability, reporting a net income of AED 9.82 million for the third quarter of 2024, reversing a loss from the previous year. The company is debt-free and maintains strong short-term liquidity with assets exceeding liabilities significantly. However, its long-term liabilities remain uncovered by short-term assets. Despite becoming profitable recently, earnings have declined over the past five years by an average of 15.9% per year, and return on equity remains low at 7.9%. The price-to-earnings ratio is slightly below the market average, suggesting potential value for investors cautious about volatility risks in penny stocks.

- Take a closer look at Union Insurance Company P.J.S.C's potential here in our financial health report.

- Assess Union Insurance Company P.J.S.C's previous results with our detailed historical performance reports.

Dawnrays Pharmaceutical (Holdings) (SEHK:2348)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dawnrays Pharmaceutical (Holdings) Limited is an investment holding company that develops, manufactures, and sells non-patented pharmaceutical medicines in Mainland China and internationally, with a market cap of HK$1.77 billion.

Operations: The company's revenue is primarily derived from its Finished Drugs segment, which generated CN¥1.04 billion, and its Intermediates and Bulk Medicines segment, contributing CN¥130.31 million.

Market Cap: HK$1.77B

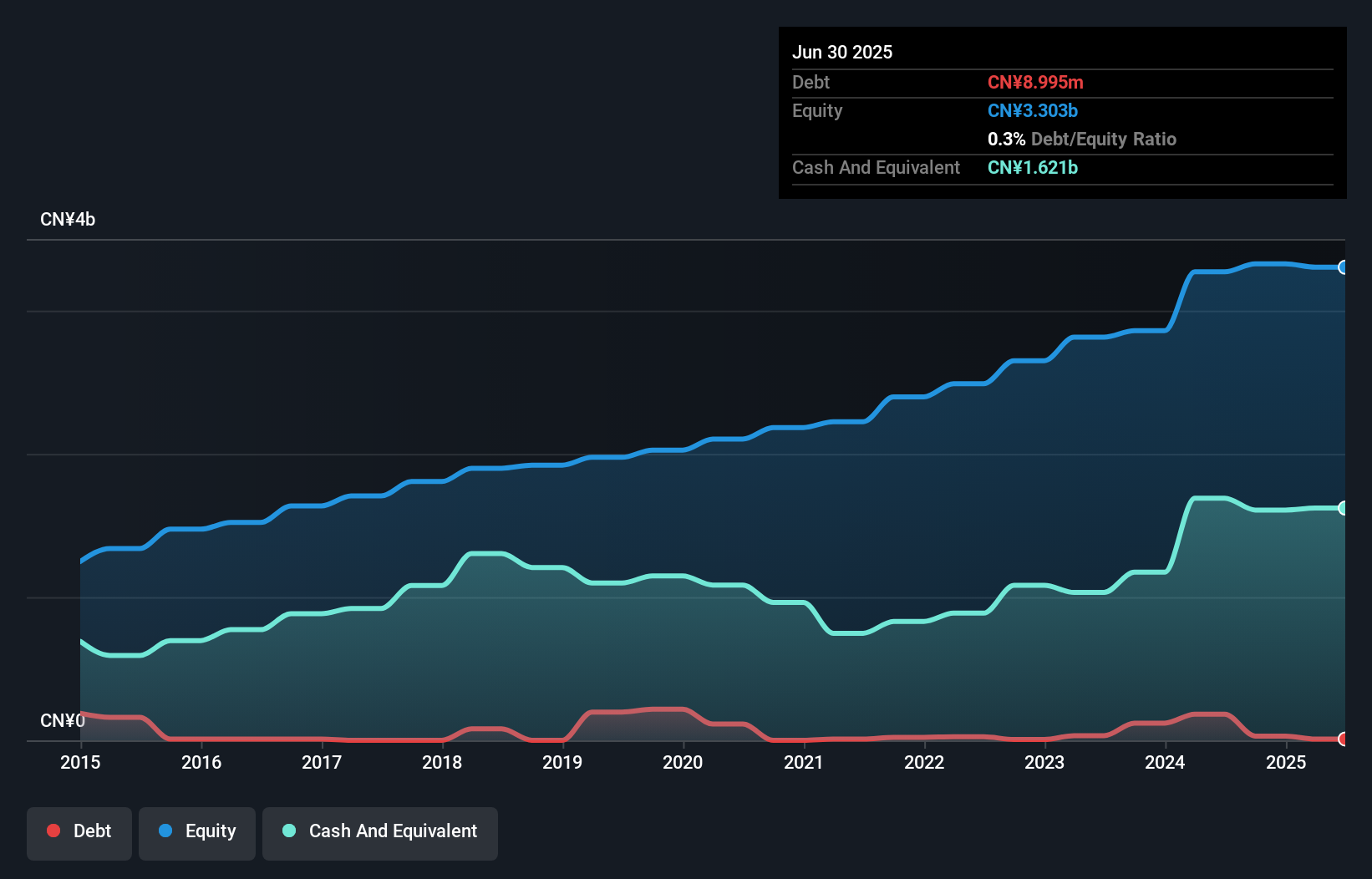

Dawnrays Pharmaceutical (Holdings) demonstrates financial stability with its debt well-covered by operating cash flow and more cash than total debt. The company’s earnings growth of 27.3% over the past year surpasses both its five-year average and industry growth rates, indicating strong performance in a competitive market. Its price-to-earnings ratio of 3x suggests it may be undervalued compared to the broader Hong Kong market. While profit margins have improved significantly, a low return on equity at 17.1% could be a concern for some investors. The seasoned management team and board add to the company's governance strength amidst volatility considerations in penny stocks.

- Dive into the specifics of Dawnrays Pharmaceutical (Holdings) here with our thorough balance sheet health report.

- Understand Dawnrays Pharmaceutical (Holdings)'s track record by examining our performance history report.

Kinetix Systems Holdings (SEHK:8606)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kinetix Systems Holdings Limited is an investment holding company that offers information technology services across Hong Kong, Macau, Singapore, the People’s Republic of China, and the United Kingdom with a market cap of HK$130.13 million.

Operations: The company's revenue is primarily derived from IT Infrastructure Solutions Services at HK$177.42 million, followed by IT Development Solutions Services contributing HK$131.21 million, and IT Maintenance and Support Services generating HK$43.63 million.

Market Cap: HK$130.13M

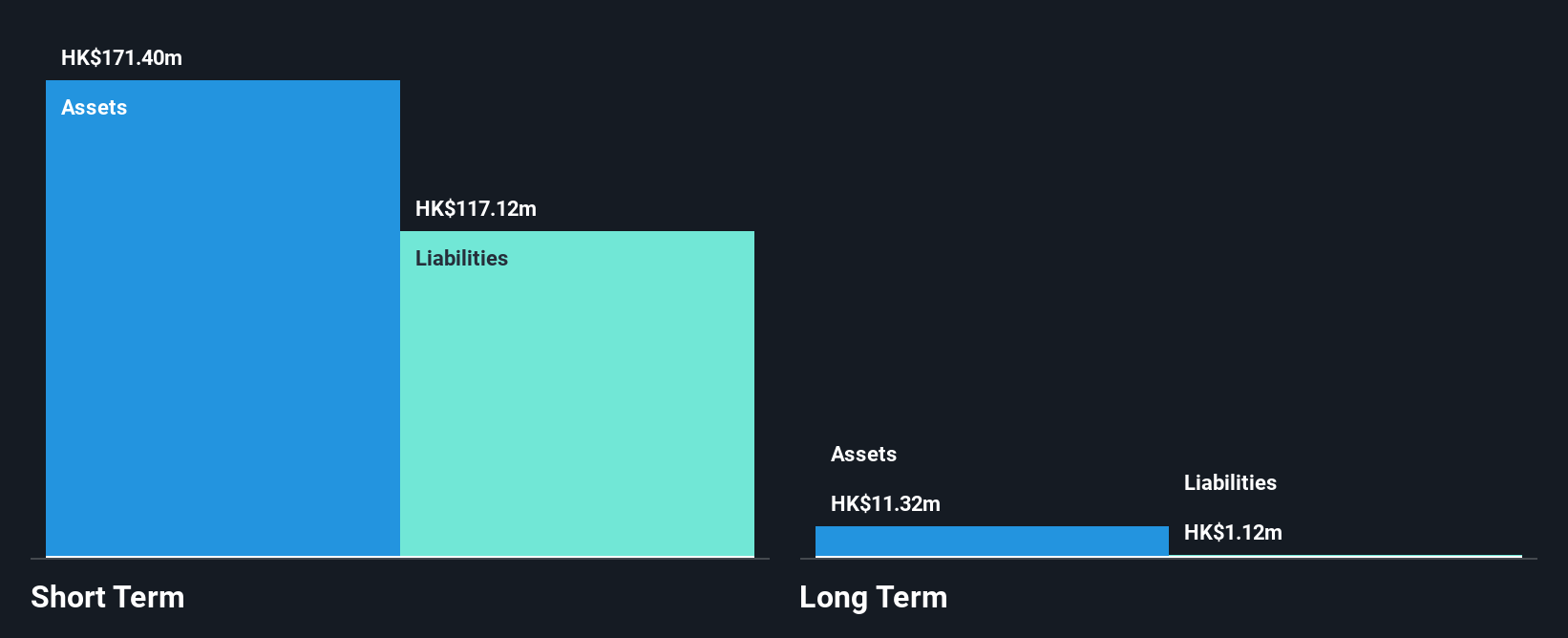

Kinetix Systems Holdings faces challenges as it remains unprofitable, with earnings declining by 49.1% annually over the past five years. However, its financial position is bolstered by more cash than debt and a sufficient cash runway exceeding three years due to positive free cash flow growth. The company’s short-term assets of HK$175.1 million comfortably cover both short- and long-term liabilities, indicating strong liquidity management. Despite trading significantly below estimated fair value, negative return on equity at -16.93% reflects ongoing profitability issues. The experienced management and board provide stability in navigating these financial hurdles common among similar stocks.

- Navigate through the intricacies of Kinetix Systems Holdings with our comprehensive balance sheet health report here.

- Evaluate Kinetix Systems Holdings' historical performance by accessing our past performance report.

Next Steps

- Reveal the 5,762 hidden gems among our Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2348

Dawnrays Pharmaceutical (Holdings)

An investment holding company, develops, manufactures, and sells non-patented pharmaceutical medicines in Mainland China and internationally.

Flawless balance sheet with proven track record and pays a dividend.