- Hong Kong

- /

- Real Estate

- /

- SEHK:755

January 2025's Promising Penny Stocks To Watch

Reviewed by Simply Wall St

Global markets have been experiencing significant volatility, with U.S. equities declining amid inflation concerns and political uncertainty, while European stocks showed resilience despite economic challenges. In such a fluctuating market landscape, investors often look for opportunities that might not be immediately apparent in the major indices. Penny stocks, though sometimes considered an outdated term, continue to represent a niche investment area where smaller or newer companies can offer unique growth potential. By focusing on those with strong financial health and balance sheets, investors may uncover promising prospects in this underexplored segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$40.41B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.976 | £744.58M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$526.87M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.32 | THB2.58B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.715 | MYR443.74M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$140.36M | ★★★★☆☆ |

Click here to see the full list of 5,708 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Jilin Jiutai Rural Commercial Bank (SEHK:6122)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jilin Jiutai Rural Commercial Bank Corporation Limited offers commercial banking and financial services to personal, corporate, and small business customers in China with a market cap of HK$2 billion.

Operations: Jilin Jiutai Rural Commercial Bank Corporation Limited has not reported any specific revenue segments.

Market Cap: HK$2B

Jilin Jiutai Rural Commercial Bank faces challenges typical of penny stocks, with its recent net loss of CNY 87.13 million highlighting profitability issues. The bank's return on equity is negative, and earnings have declined over the past five years. Despite this, it maintains a sufficient allowance for bad loans at 154% and an appropriate loans-to-deposits ratio of 78%. Its funding is primarily low-risk customer deposits, which adds stability. However, high bad loan levels at 2.4% and increased share price volatility suggest caution. Trading significantly below estimated fair value may attract speculative interest in the stock.

- Click here to discover the nuances of Jilin Jiutai Rural Commercial Bank with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Jilin Jiutai Rural Commercial Bank's track record.

DevGreat Group (SEHK:755)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: DevGreat Group Limited is an investment holding company involved in property development, investment, and management activities in China with a market cap of HK$148.79 million.

Operations: The company generates revenue of HK$259.57 million from its properties rental, management, and agency services segment.

Market Cap: HK$148.79M

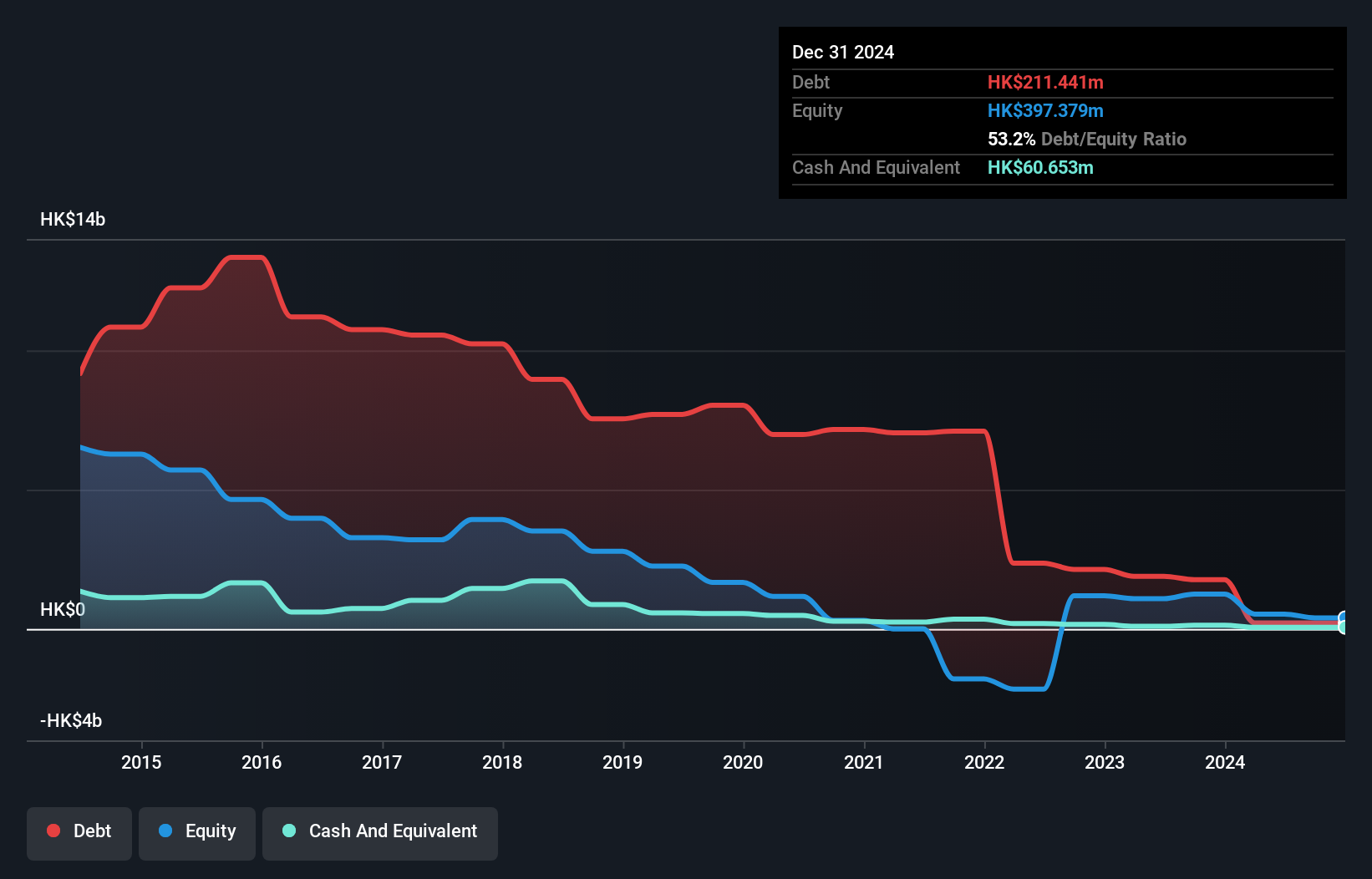

DevGreat Group Limited, with a market cap of HK$148.79 million, operates in property development and management in China. Despite being unprofitable, the company has managed to reduce its losses by 40.2% annually over the past five years and maintains a satisfactory net debt to equity ratio of 30.5%. It boasts sufficient cash runway for over three years with positive free cash flow. Recent executive changes include Ms. Li Zhen's appointment as CEO, potentially bringing strategic shifts given her extensive investment banking experience. However, high share price volatility remains a concern for investors considering this stock's speculative nature.

- Click to explore a detailed breakdown of our findings in DevGreat Group's financial health report.

- Gain insights into DevGreat Group's historical outcomes by reviewing our past performance report.

Zhefu Holding Group (SZSE:002266)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhefu Holding Group Co., Ltd. focuses on the research, development, manufacture, installation, and service of hydropower equipment both in China and internationally, with a market cap of CN¥15.34 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥15.34B

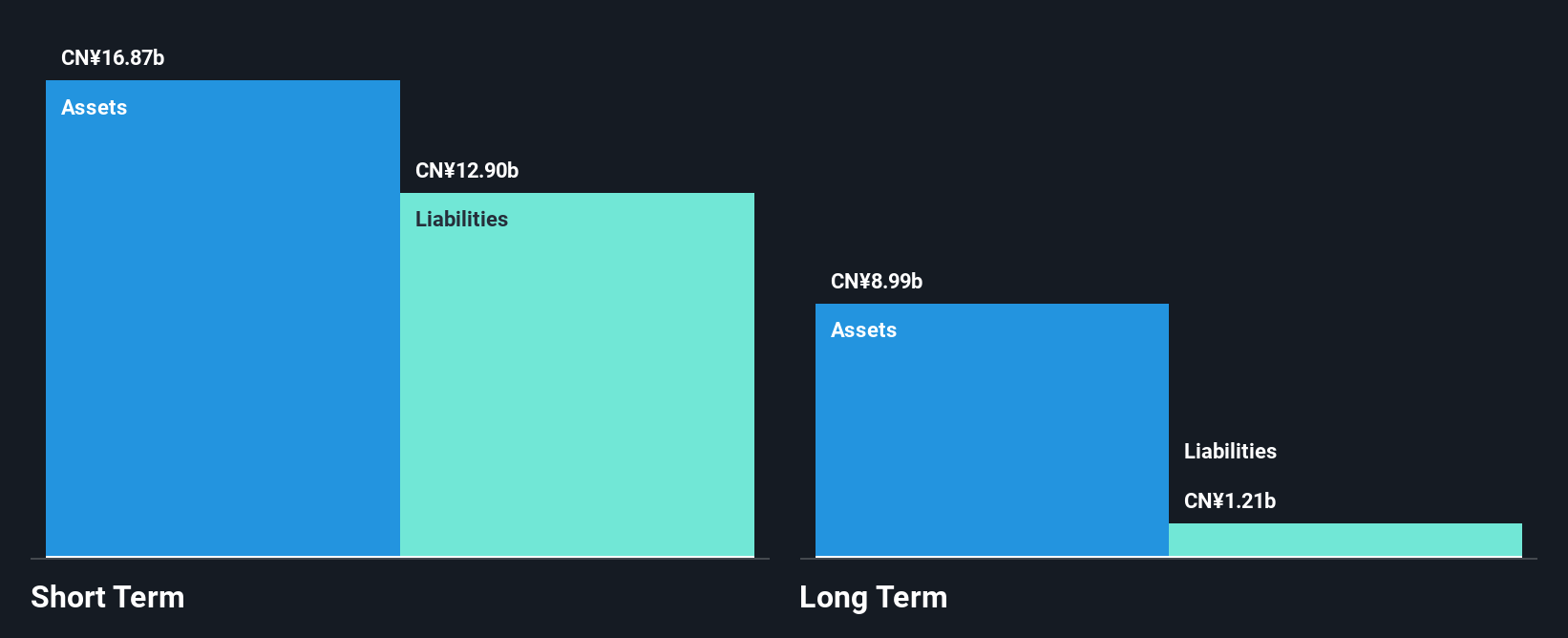

Zhefu Holding Group, with a market cap of CN¥15.34 billion, has shown resilience in its financials despite some challenges. The company reported sales of CN¥15.26 billion for the first nine months of 2024, indicating steady revenue growth from the previous year. However, net income declined to CN¥775.69 million due to lower profit margins and large one-off gains impacting results. The company's price-to-earnings ratio suggests it is trading at good value relative to the Chinese market average, and its short-term assets comfortably exceed liabilities. While debt levels have increased over time, interest payments are well covered by EBIT.

- Get an in-depth perspective on Zhefu Holding Group's performance by reading our balance sheet health report here.

- Evaluate Zhefu Holding Group's prospects by accessing our earnings growth report.

Taking Advantage

- Investigate our full lineup of 5,708 Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:755

DevGreat Group

An investment holding company, engages in property development, property investment, and property management and agency activities in the People’s Republic of China.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives