- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1478

3 Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and fluctuating interest rates, investors are navigating a complex environment marked by choppy market conditions and economic uncertainty. Despite these challenges, opportunities may arise for discerning investors to identify stocks that could be trading below their estimated value. In such a climate, a good stock often exhibits strong fundamentals and resilience against broader market volatility, making it potentially attractive for those seeking undervalued investments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥27.91 | CN¥55.68 | 49.9% |

| Alltop Technology (TPEX:3526) | NT$265.00 | NT$529.04 | 49.9% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.31 | 50% |

| FINDEX (TSE:3649) | ¥920.00 | ¥1836.04 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP578.96 | 49.9% |

| Zhende Medical (SHSE:603301) | CN¥20.94 | CN¥41.78 | 49.9% |

| Mobvista (SEHK:1860) | HK$8.05 | HK$16.06 | 49.9% |

| TaewoongLtd (KOSDAQ:A044490) | ₩12880.00 | ₩25739.32 | 50% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Prodways Group (ENXTPA:PWG) | €0.608 | €1.21 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

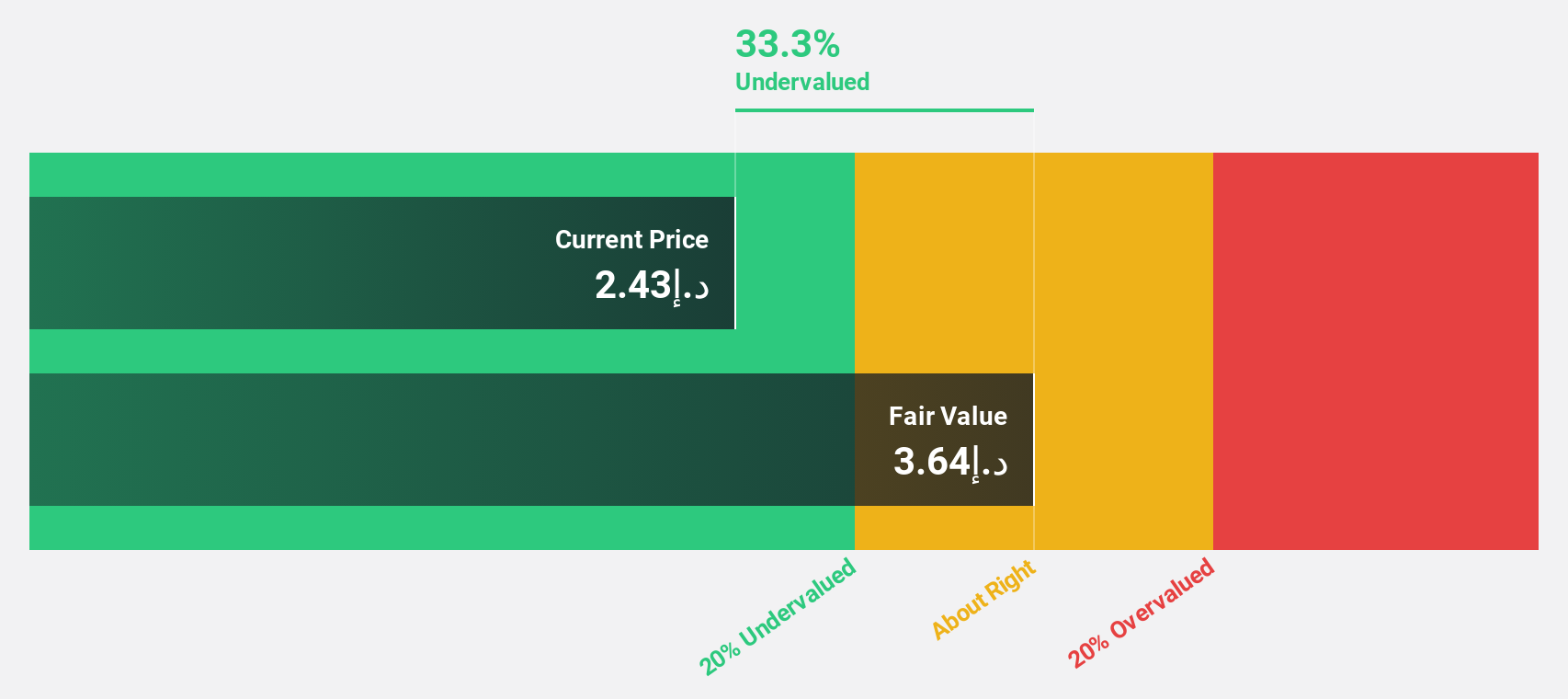

Pure Health Holding PJSC (ADX:PUREHEALTH)

Overview: Pure Health Holding PJSC operates in the healthcare services sector within the United Arab Emirates and has a market capitalization of AED40.11 billion.

Operations: The company's revenue segments include Diagnostic Services generating AED1.01 billion, Health Insurance Services contributing AED6.58 billion, Hospital and Other Related Services at AED15.77 billion, and Procurement and Supply of Medical Related Products amounting to AED4.97 billion.

Estimated Discount To Fair Value: 49.7%

Pure Health Holding PJSC is trading at AED3.75, significantly undervalued compared to its estimated fair value of AED7.45, offering potential upside based on discounted cash flow analysis. Despite a recent decline in profit margins from 15.2% to 4.8%, the company is poised for strong earnings growth, projected at 34.2% annually over the next three years, outpacing the broader AE market's growth expectations and indicating robust future cash flows despite current challenges.

- Insights from our recent growth report point to a promising forecast for Pure Health Holding PJSC's business outlook.

- Click here to discover the nuances of Pure Health Holding PJSC with our detailed financial health report.

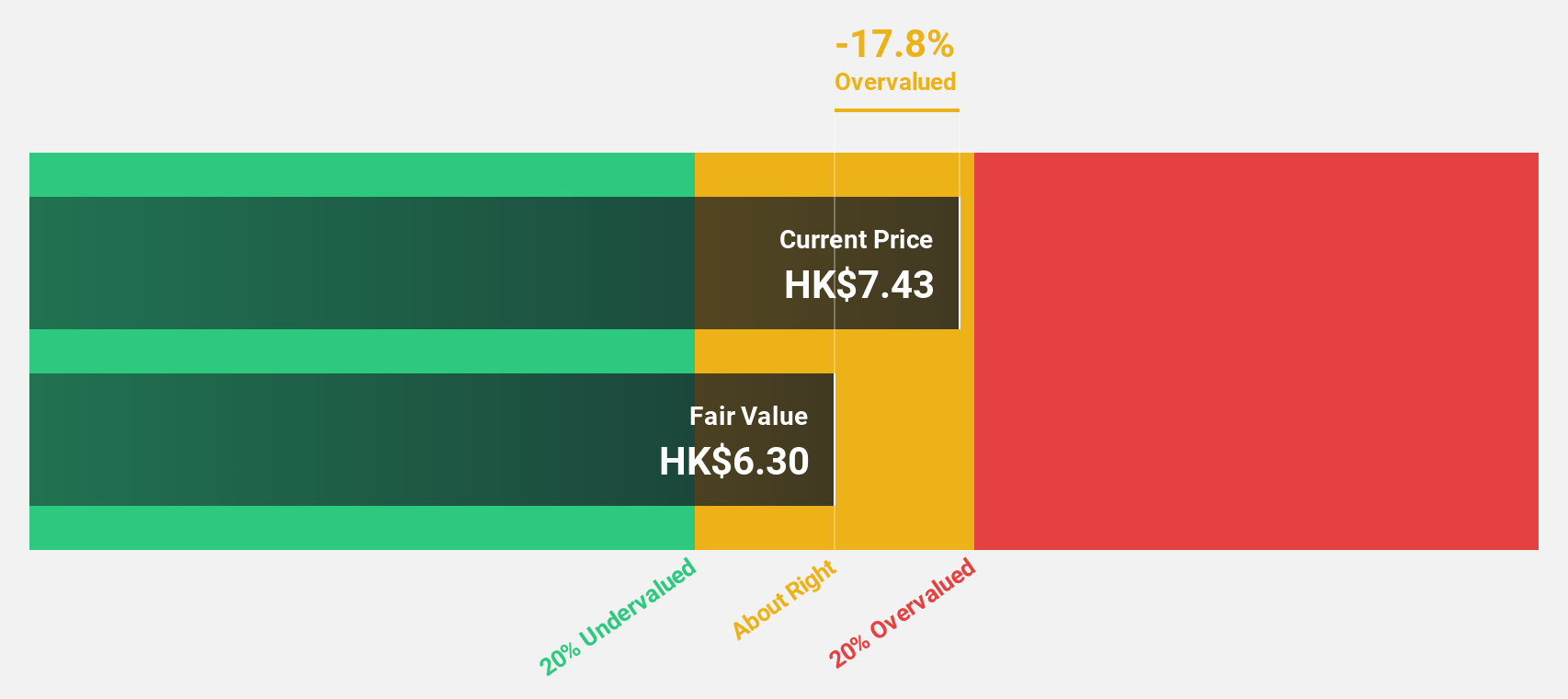

Q Technology (Group) (SEHK:1478)

Overview: Q Technology (Group) Company Limited is an investment holding company that designs, develops, manufactures, and sells camera and fingerprint recognition modules in Mainland China, Hong Kong, India, and internationally, with a market cap of HK$6.83 billion.

Operations: The company generates revenue primarily from its camera modules segment, amounting to CN¥13.79 billion, and its fingerprint recognition modules segment, which contributes CN¥781.23 million.

Estimated Discount To Fair Value: 40.7%

Q Technology (Group) is trading at HK$6.32, significantly undervalued relative to its estimated fair value of HK$10.66, suggesting potential upside based on discounted cash flow analysis. The company reported substantial sales volumes for camera and fingerprint recognition modules through November 2024, supporting growth prospects. Earnings are forecast to grow at 36.4% annually over the next three years, outpacing the Hong Kong market's average growth rate, despite a low projected return on equity of 9%.

- Our earnings growth report unveils the potential for significant increases in Q Technology (Group)'s future results.

- Take a closer look at Q Technology (Group)'s balance sheet health here in our report.

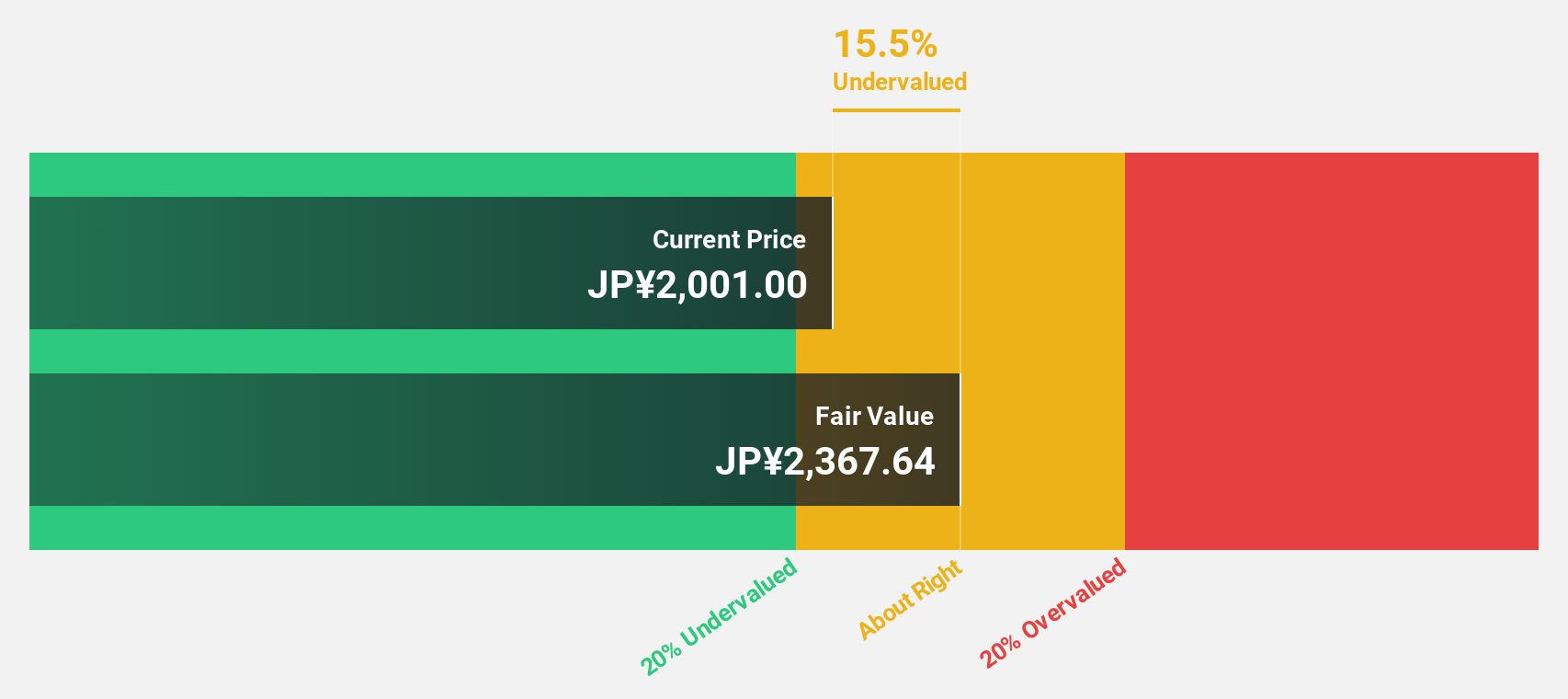

PAL GROUP Holdings (TSE:2726)

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market capitalization of ¥258.39 billion.

Operations: PAL GROUP Holdings CO., LTD. generates revenue through the planning, manufacturing, wholesale, and retail of clothing products and accessories for both men and women within Japan.

Estimated Discount To Fair Value: 34.3%

PAL GROUP Holdings is trading at ¥3,160, well below its estimated fair value of ¥4,807.59, indicating a significant undervaluation based on discounted cash flow analysis. Earnings are projected to grow at 18.4% annually, surpassing the Japanese market's average growth rate of 8%. Revenue growth is also expected to outpace the market at 8.7% per year. The company’s return on equity is forecasted to reach a robust 20.4% in three years.

- Our expertly prepared growth report on PAL GROUP Holdings implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of PAL GROUP Holdings with our comprehensive financial health report here.

Seize The Opportunity

- Dive into all 877 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1478

Q Technology (Group)

An investment holding company, engages in the design, research and development, manufacturing, and sale of camera and fingerprint recognition modules in the Mainland of China, Hong Kong, India, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives