- New Zealand

- /

- Software

- /

- NZSE:SKO

Serko And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

Global markets have been buoyed by optimism surrounding potential trade deals and enthusiasm for artificial intelligence, with major U.S. indices reaching record highs. Amid these developments, investors are increasingly seeking stocks that combine growth potential with financial stability. Penny stocks, often associated with smaller or newer companies, offer such opportunities at lower price points. Despite being a somewhat outdated term, penny stocks remain relevant as they can present under-the-radar chances for growth when backed by strong fundamentals and balance sheets.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.01 | HK$641.14M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.07 | £780M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

Click here to see the full list of 5,708 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Serko (NZSE:SKO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Serko Limited is a Software-as-a-Service company that offers online travel booking software solutions and expense management services across New Zealand, Australia, North America, Europe, and internationally with a market cap of NZ$460.64 million.

Operations: The company's revenue primarily comes from its provision of software solutions, totaling NZ$74.45 million.

Market Cap: NZ$460.64M

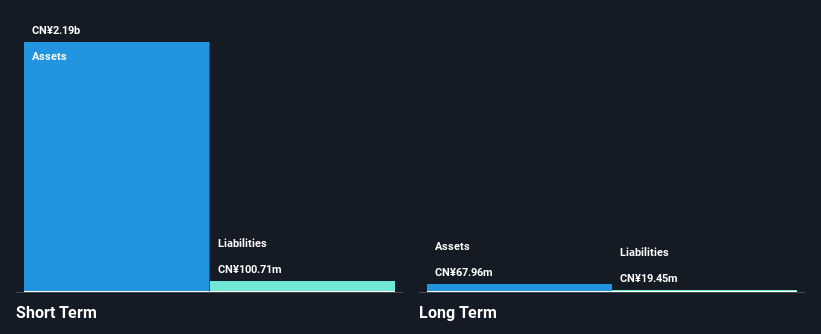

Serko Limited, with a market cap of NZ$460.64 million, is navigating its unprofitable status by focusing on strategic partnerships and product enhancements. The company recently announced an integration with Amadeus to expand its airline retailing capabilities through NDC content, set to enhance the Zeno platform in 2025. Despite losses increasing over the past five years at 7.4% annually, Serko's short-term assets significantly exceed liabilities, and it remains debt-free with a cash runway exceeding three years. Revenue for the first half of 2025 was NZ$42.72 million, showing growth from the previous year despite ongoing net losses.

- Click here to discover the nuances of Serko with our detailed analytical financial health report.

- Gain insights into Serko's outlook and expected performance with our report on the company's earnings estimates.

Abbisko Cayman (SEHK:2256)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Abbisko Cayman Limited is a clinical-stage biopharmaceutical company focused on discovering and developing small molecule oncology therapies in Mainland China, with a market cap of HK$2.96 billion.

Operations: The company generates revenue from the development of innovative medicines, amounting to CN¥497.27 million.

Market Cap: HK$2.96B

Abbisko Cayman, with a market cap of HK$2.96 billion, has made strides in its clinical-stage biopharmaceutical endeavors by securing a significant out-licensing agreement with Merck Healthcare KGaA, resulting in an upfront payment of US$70 million. This deal notably contributed to the expected revenue of approximately RMB 504 million for 2024, marking a substantial increase from the previous year. Despite being unprofitable and not forecasted to achieve profitability soon, Abbisko's strategic moves have improved its financial outlook. The company remains debt-free and possesses sufficient cash runway for over three years.

- Get an in-depth perspective on Abbisko Cayman's performance by reading our balance sheet health report here.

- Examine Abbisko Cayman's earnings growth report to understand how analysts expect it to perform.

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Comba Telecom Systems Holdings Limited is an investment holding company that researches, develops, manufactures, and sells wireless telecommunications network system equipment and related engineering services globally, with a market cap of approximately HK$2.86 billion.

Operations: The company's revenue is primarily derived from Wireless Telecommunications Network System Equipment and Services, which generated HK$4.94 billion, and Operator Telecommunication Services, contributing HK$156.22 million.

Market Cap: HK$2.86B

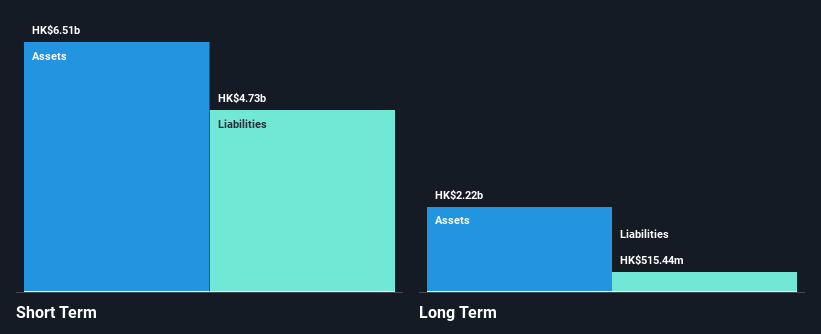

Comba Telecom Systems Holdings, with a market cap of approximately HK$2.86 billion, is currently unprofitable but maintains a solid financial position with short-term assets of HK$6.5 billion exceeding both its short and long-term liabilities. The company has reduced its debt to equity ratio from 48.5% to 32.6% over five years and holds more cash than total debt, reflecting prudent financial management despite ongoing losses which have increased by 1.7% annually over five years. Recent leadership changes include the appointment of Ms. Huo Xinru as president, potentially impacting strategic direction positively given her extensive industry experience and background in engineering and management.

- Take a closer look at Comba Telecom Systems Holdings' potential here in our financial health report.

- Explore historical data to track Comba Telecom Systems Holdings' performance over time in our past results report.

Next Steps

- Unlock more gems! Our Penny Stocks screener has unearthed 5,705 more companies for you to explore.Click here to unveil our expertly curated list of 5,708 Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SKO

Serko

A Software-as-a-Service technology business, provides online travel booking software solutions and expense management services in New Zealand, Australia, North America, Europe, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives