- China

- /

- Real Estate

- /

- SZSE:000838

Promising Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

Global markets have been experiencing fluctuations, with U.S. stocks ending the week lower due to tariff uncertainties and mixed economic data, while European indices showed resilience despite trade policy concerns. Amid these market dynamics, investors might find opportunities in lesser-known sectors such as penny stocks, which refer to smaller or newer companies that can be full of surprises. Although the term "penny stock" may seem outdated, it remains a relevant investment area for those seeking growth potential backed by strong financial health.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.43B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.53M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £4.00 | £309.02M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.14 | HK$723.66M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.26 | £161.95M | ★★★★★☆ |

Click here to see the full list of 5,699 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

JW (Cayman) Therapeutics (SEHK:2126)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: JW (Cayman) Therapeutics Co. Ltd is a clinical stage cell therapy company focused on the R&D, manufacturing, and marketing of anti-tumor drugs in China, with a market cap of HK$647.36 million.

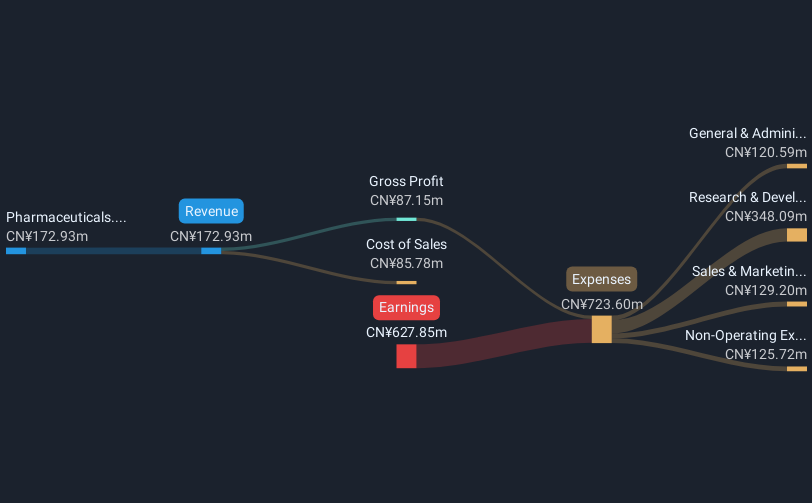

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to CN¥172.93 million.

Market Cap: HK$647.36M

JW (Cayman) Therapeutics, with a market cap of HK$647.36 million, is navigating the challenges typical of its biotech sector. The company is unprofitable but has reduced losses by 10.1% annually over five years and holds more cash than debt, suggesting financial resilience. Its recent Breakthrough Therapy Designation for Carteyva could be significant for future growth prospects in treating relapsed large B-cell lymphoma in China. Despite this potential, earnings are forecast to decline slightly over the next three years, and profitability remains elusive without clear near-term catalysts.

- Unlock comprehensive insights into our analysis of JW (Cayman) Therapeutics stock in this financial health report.

- Understand JW (Cayman) Therapeutics' earnings outlook by examining our growth report.

CASIN Real Estate Development GroupLtd (SZSE:000838)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CASIN Real Estate Development Group Co., Ltd. (ticker: SZSE:000838) operates in the real estate development sector and has a market cap of CN¥2.82 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥1.45 billion.

Market Cap: CN¥2.82B

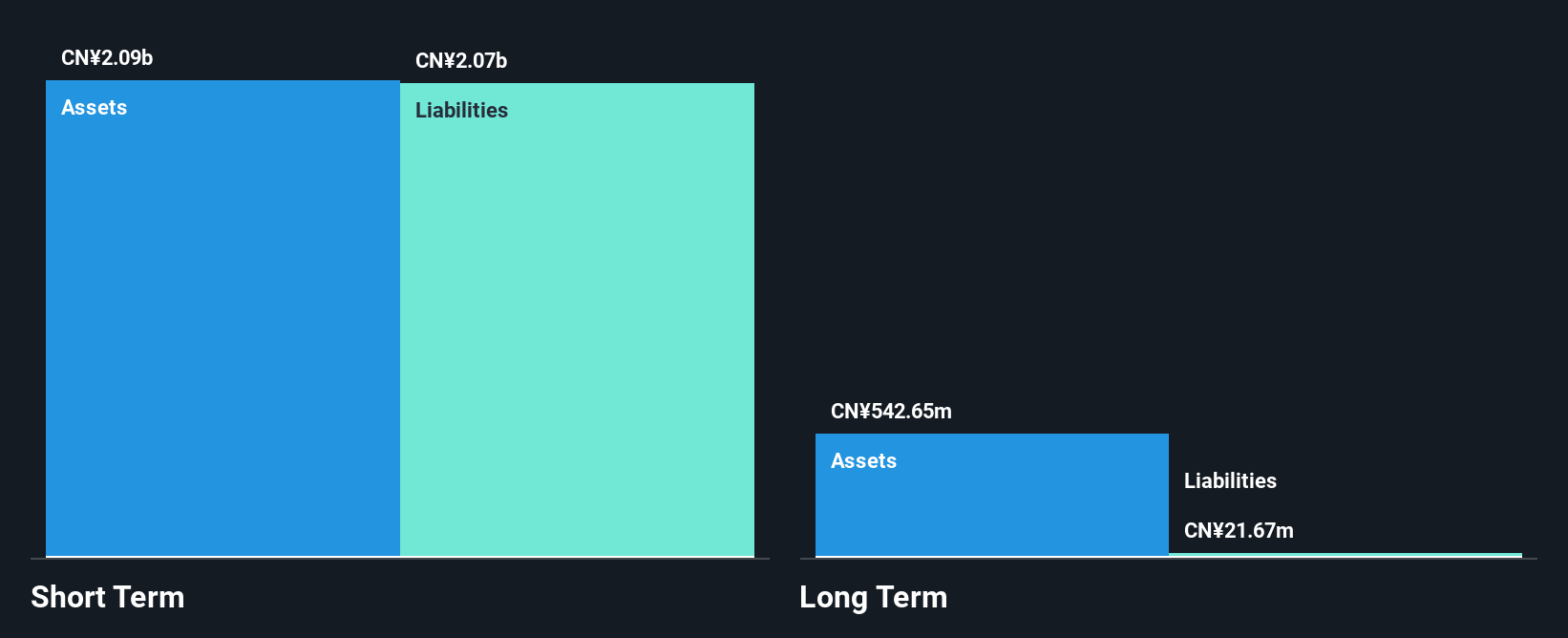

CASIN Real Estate Development Group, with a market cap of CN¥2.82 billion, faces challenges typical in the real estate sector. The company is currently unprofitable and has seen losses increase by 35.4% annually over five years, while earnings have declined at the same rate. Despite this, CASIN's financial position is relatively stable, with short-term assets of CN¥2.5 billion exceeding both short and long-term liabilities, and a satisfactory net debt to equity ratio of 29.8%. However, it has less than one year of cash runway if free cash flow continues to decline at historical rates.

- Dive into the specifics of CASIN Real Estate Development GroupLtd here with our thorough balance sheet health report.

- Learn about CASIN Real Estate Development GroupLtd's historical performance here.

Nanjing Xinlian Electronics (SZSE:002546)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nanjing Xinlian Electronics Co., Ltd specializes in manufacturing power consumption information collection systems for power grid enterprises and enterprise users in China, with a market cap of CN¥3.95 billion.

Operations: The company's revenue from China amounts to CN¥720.14 million.

Market Cap: CN¥3.95B

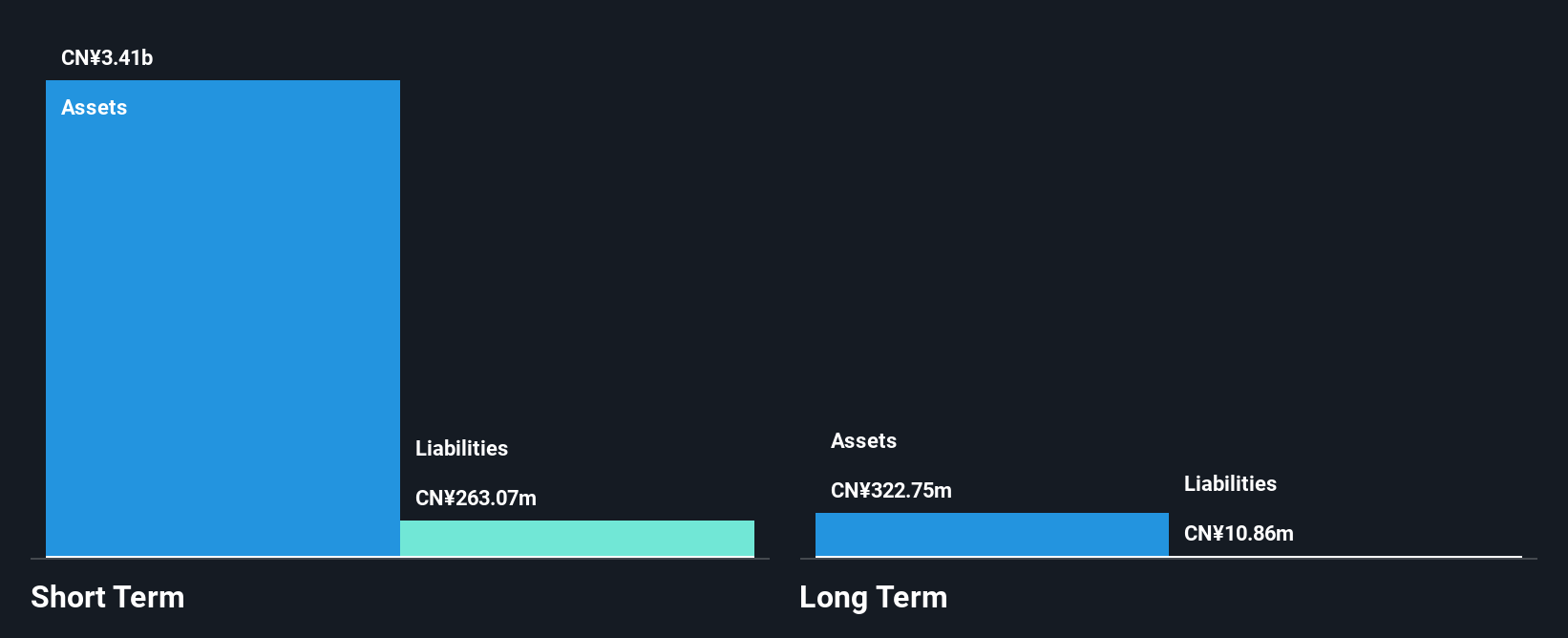

Nanjing Xinlian Electronics, with a market cap of CN¥3.95 billion, specializes in power consumption information systems for China's power grid sector. Despite facing negative earnings growth of 29.8% annually over five years and declining profit margins from 15.7% to 7.2%, the company maintains a strong balance sheet with short-term assets of CN¥3.2 billion surpassing both short and long-term liabilities significantly. While its dividend yield is not well covered by earnings, the company's debt is well managed, supported by sufficient operating cash flow coverage and more cash than total debt, indicating financial resilience amidst volatility challenges.

- Click to explore a detailed breakdown of our findings in Nanjing Xinlian Electronics' financial health report.

- Gain insights into Nanjing Xinlian Electronics' historical outcomes by reviewing our past performance report.

Key Takeaways

- Click through to start exploring the rest of the 5,696 Penny Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000838

CASIN Real Estate Development GroupLtd

CASIN Real Estate Development Group Co.,Ltd.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives