- South Korea

- /

- Personal Products

- /

- KOSE:A278470

3 Growth Companies With High Insider Ownership Expecting Up To 39% Revenue Growth

Reviewed by Simply Wall St

In a week marked by market volatility and shifting investor sentiment due to policy uncertainties from the incoming Trump administration, global indices experienced mixed performances. Amid these fluctuations, growth companies with high insider ownership can offer unique investment insights, as their leadership's vested interest often aligns with shareholder value creation.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.5% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA is a global cybersecurity specialist focused on digital infrastructure, with a market capitalization of €2.16 billion.

Operations: The company's revenue segments include €0.48 billion from APAC, €4.19 billion from EMEA, and €0.71 billion from the Americas.

Insider Ownership: 13.1%

Revenue Growth Forecast: 12.7% p.a.

Exclusive Networks SA is poised for growth, with earnings forecasted to rise significantly at 34.55% annually, outpacing the French market's 12.5%. Revenue growth is also expected at 12.7%, surpassing the market average of 5.6%. Despite a recent dip in profit margins from 5.5% to 2.7%, insider ownership remains high, indicating confidence in future performance amid projected gross sales growth of up to 12% for Fiscal Year 2024.

- Unlock comprehensive insights into our analysis of Exclusive Networks stock in this growth report.

- Our valuation report here indicates Exclusive Networks may be overvalued.

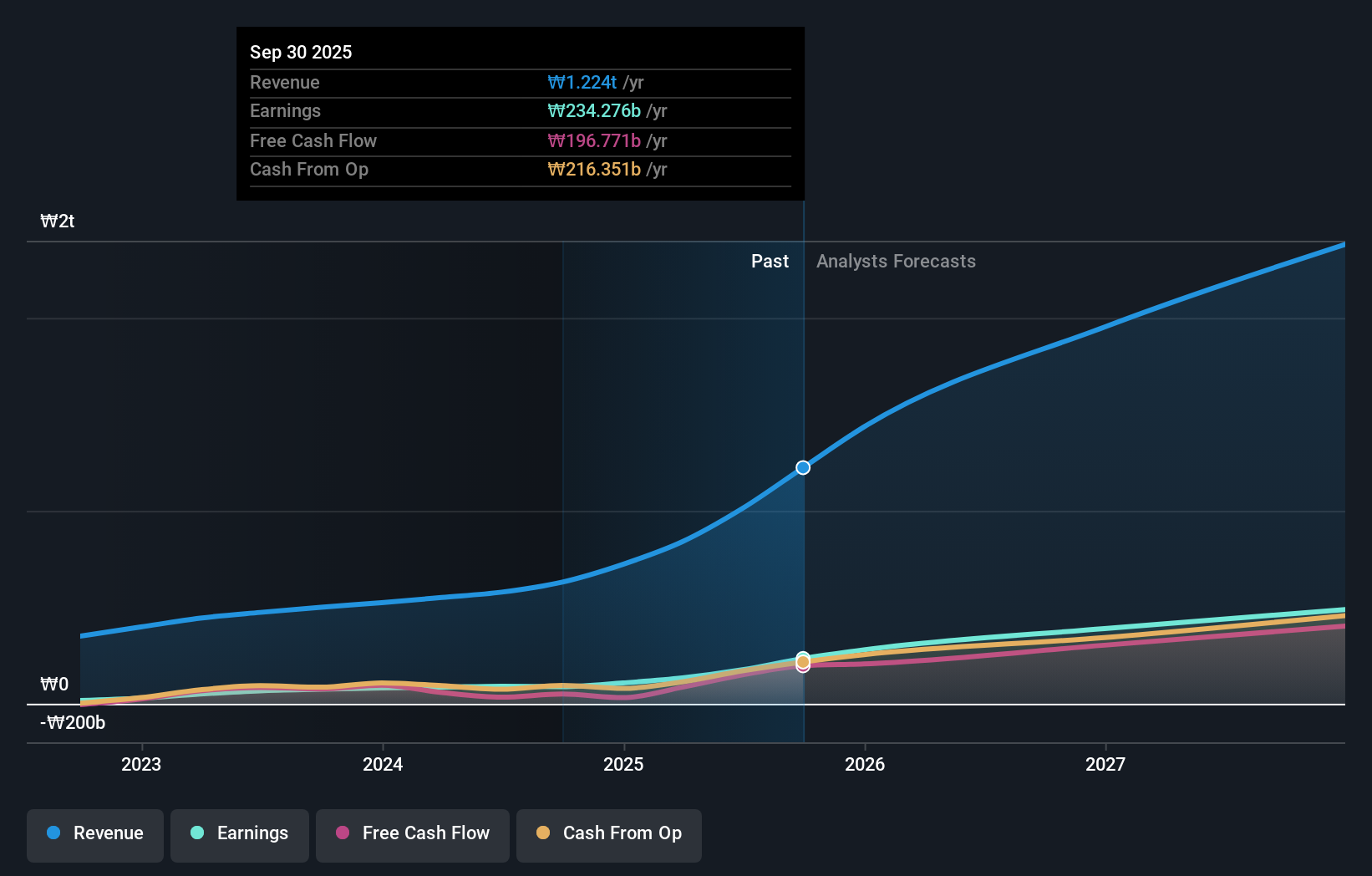

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for both men and women, with a market cap of ₩1.80 trillion.

Operations: The company's revenue is primarily derived from its cosmetics segment, which accounts for ₩614.77 billion, complemented by ₩64.46 billion from apparel fashion sales.

Insider Ownership: 32.8%

Revenue Growth Forecast: 22% p.a.

APR Co., Ltd. is set for substantial growth, with revenue anticipated to increase by 22% annually, surpassing the KR market's 9.8%. Despite high share price volatility recently, the stock trades at a significant discount of 53.2% below its estimated fair value. Earnings are projected to grow significantly at 25.6% annually over the next three years, although slightly slower than the market average of 29%. Recent activities include completing a share buyback and being added to the S&P Global BMI Index.

- Get an in-depth perspective on APR's performance by reading our analyst estimates report here.

- The analysis detailed in our APR valuation report hints at an deflated share price compared to its estimated value.

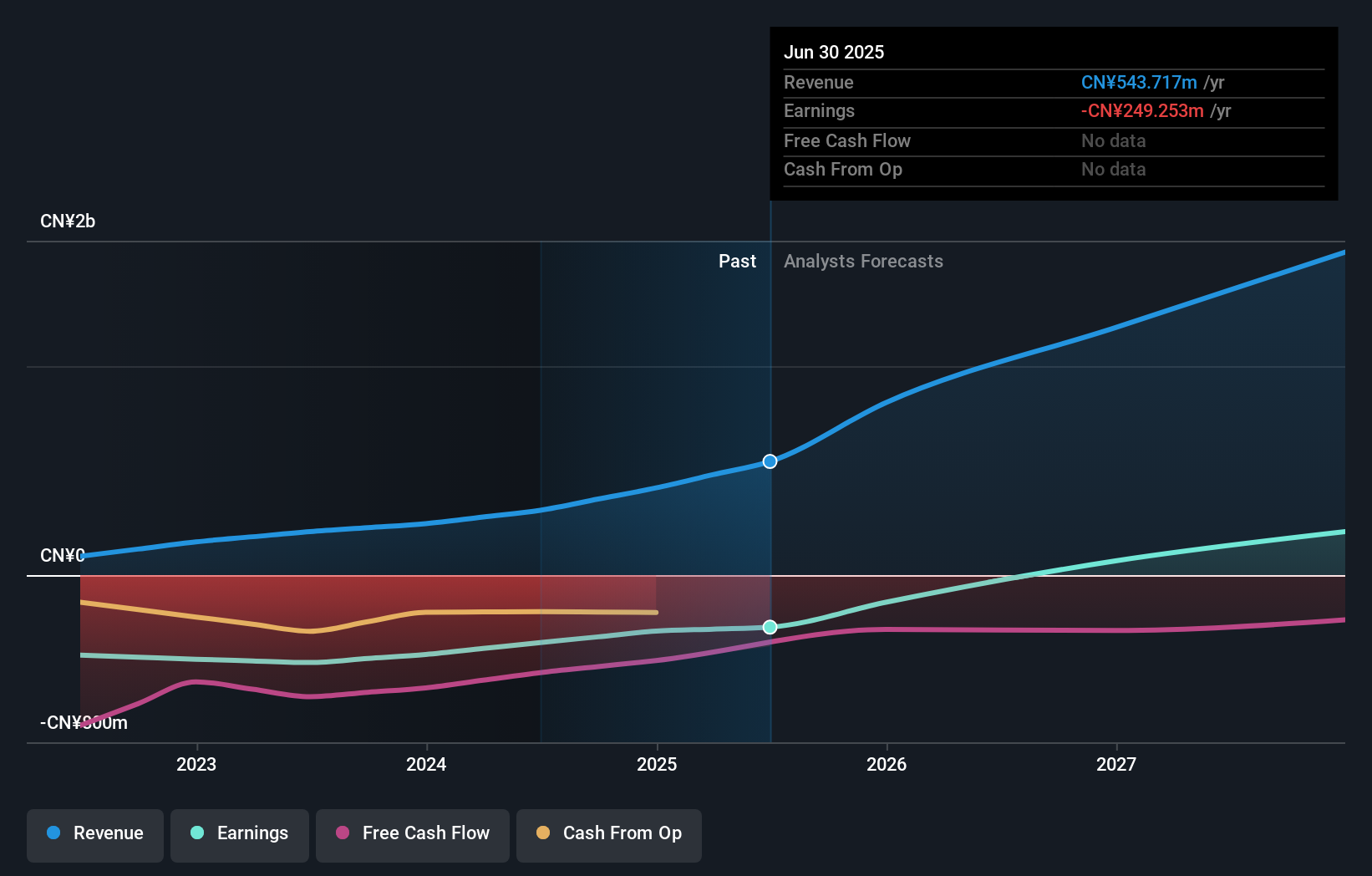

Ocumension Therapeutics (SEHK:1477)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ocumension Therapeutics, with a market cap of HK$4.30 billion, operates as an ophthalmic pharmaceutical platform company in the People's Republic of China.

Operations: The company's revenue primarily stems from its activities in discovering, developing, and commercializing ophthalmic therapies, generating CN¥310.29 million.

Insider Ownership: 15.4%

Revenue Growth Forecast: 39.3% p.a.

Ocumension Therapeutics is expected to see robust revenue growth of 39.3% annually, outpacing the Hong Kong market's 7.8%. Despite recent shareholder dilution, the stock trades at a significant discount of 59% below its estimated fair value. The company aims to become profitable in three years and has seen substantial earnings growth of 50.6% annually over the past five years. Recent developments include new drug approvals and strategic acquisitions enhancing its product pipeline in China and Southeast Asia.

- Click here and access our complete growth analysis report to understand the dynamics of Ocumension Therapeutics.

- Our valuation report unveils the possibility Ocumension Therapeutics' shares may be trading at a discount.

Key Takeaways

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1538 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A278470

APR

APR Co.,Ltd manufactures and sells cosmetic products for men and women.

Flawless balance sheet and good value.