- South Korea

- /

- Personal Products

- /

- KOSE:A278470

Three Stocks That May Be Trading Below Estimated Value In December 2024

Reviewed by Simply Wall St

In December 2024, global markets are navigating a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, leading to fluctuations in major indices. Despite these challenges, the U.S. economy has shown resilience with strong economic data, creating an environment where discerning investors might find stocks trading below their estimated value. In such a market climate, identifying undervalued stocks requires careful analysis of fundamentals and potential growth prospects amidst broader economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Bank (SHSE:601187) | CN¥5.63 | CN¥11.34 | 50.4% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| NCSOFT (KOSE:A036570) | ₩202000.00 | ₩409572.10 | 50.7% |

| T'Way Air (KOSE:A091810) | ₩2485.00 | ₩4994.21 | 50.2% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥12.97 | CN¥26.38 | 50.8% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.47 | 49.7% |

Let's explore several standout options from the results in the screener.

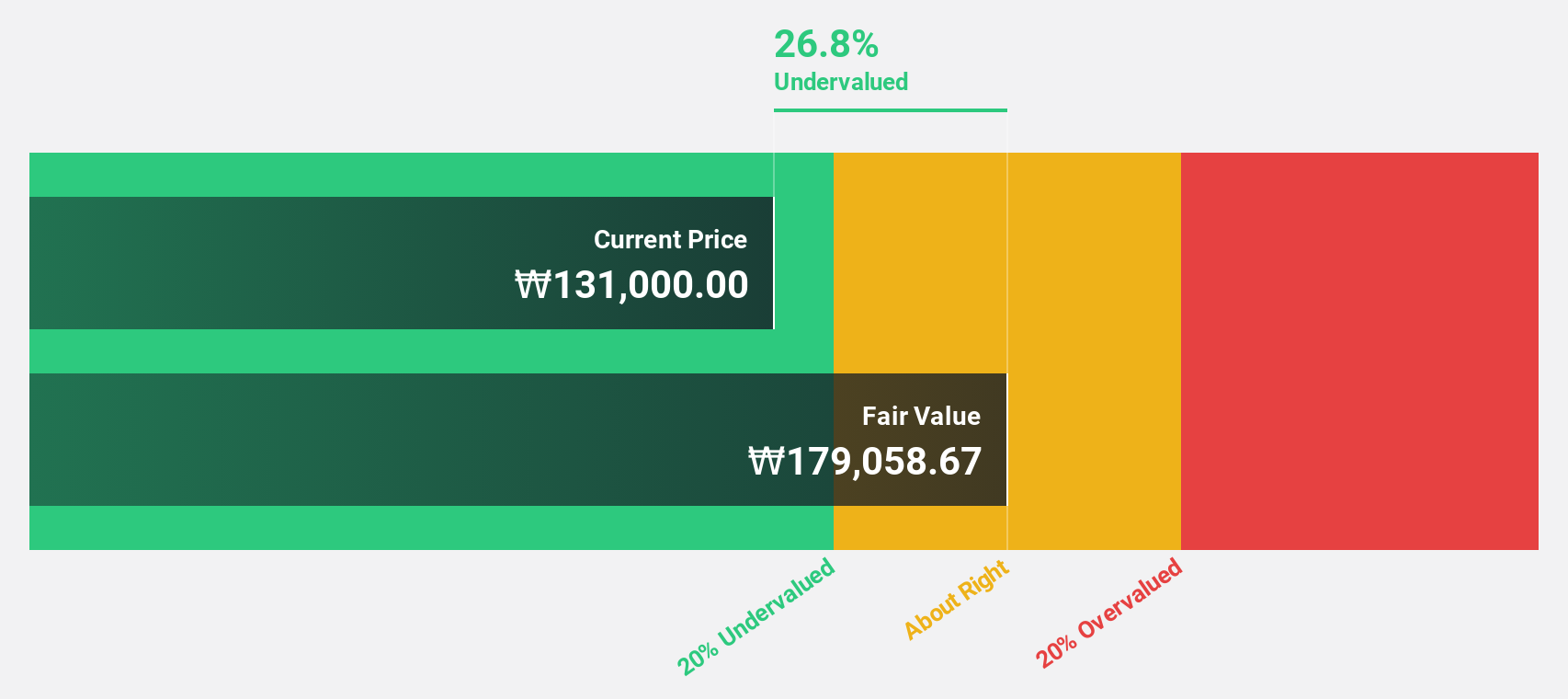

APR (KOSE:A278470)

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for both men and women, with a market cap of ₩1.89 trillion.

Operations: The company's revenue is primarily derived from the Cosmetics Sector, contributing ₩693.18 million, followed by the Clothing Fashion Sector with ₩57.97 million.

Estimated Discount To Fair Value: 38%

APR Co., Ltd. appears undervalued as it trades 38% below its estimated fair value of ₩80,937.71, with a current price of ₩50,200. Despite high volatility in recent months, earnings have grown significantly at 66.5% annually over the past five years and are expected to continue growing at nearly 24% per year. The company completed a share buyback plan worth KRW 59,943.89 million and was recently added to the KOSPI 200 Index.

- Insights from our recent growth report point to a promising forecast for APR's business outlook.

- Take a closer look at APR's balance sheet health here in our report.

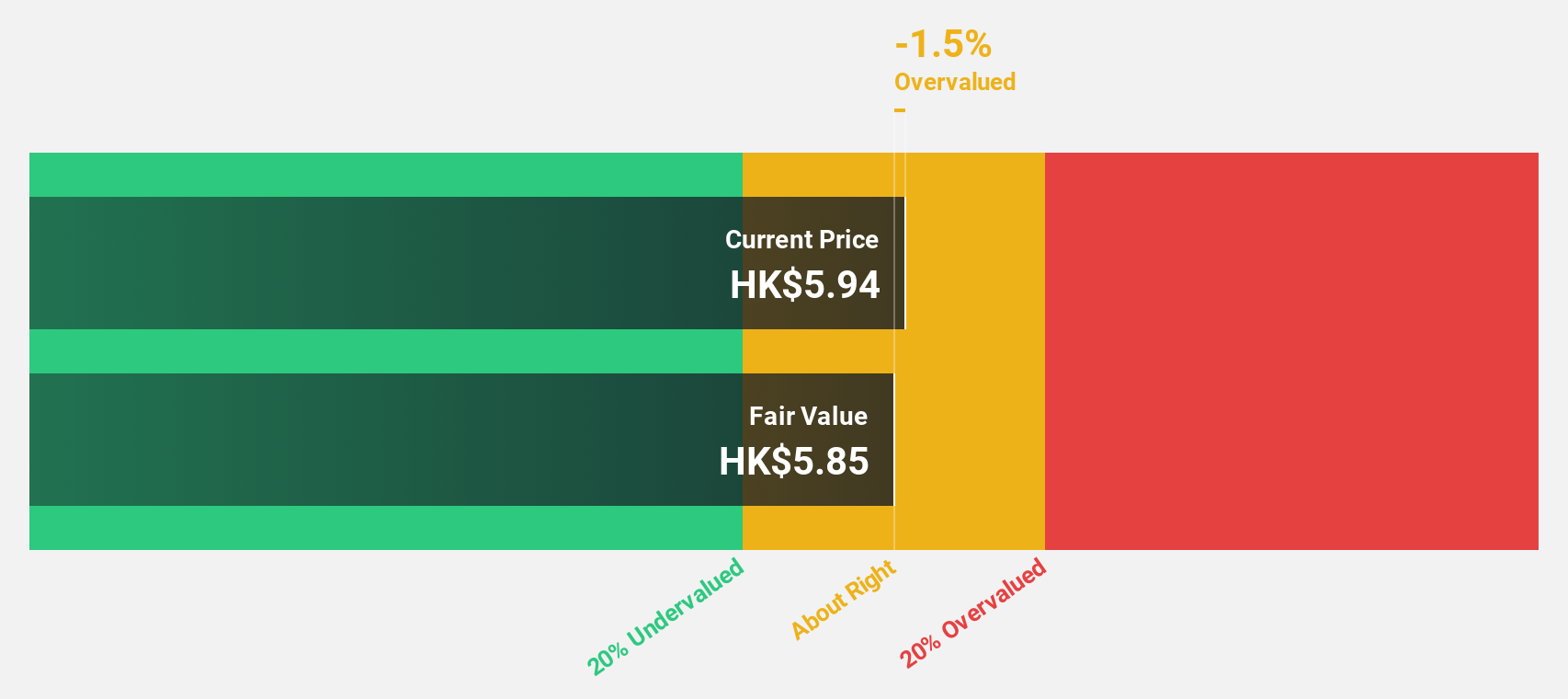

AK Medical Holdings (SEHK:1789)

Overview: AK Medical Holdings Limited is an investment holding company that designs, develops, produces, and markets orthopedic joint implants and related products in China and internationally, with a market cap of HK$5.62 billion.

Operations: The company generates revenue from its orthopedic joint implants and related products, with CN¥989.17 million coming from the Chinese market and CN¥159.06 million from the United Kingdom market.

Estimated Discount To Fair Value: 37.5%

AK Medical Holdings is currently trading at HK$5.01, significantly undervalued compared to its estimated fair value of HK$8.02, representing a 37.5% discount. Its revenue and earnings are forecast to grow rapidly at 24.7% and 28.8% per year respectively, outpacing the broader Hong Kong market growth rates of 7.8% for revenue and 11.5% for earnings annually, although its Return on Equity is expected to remain modest at 12.9%.

- According our earnings growth report, there's an indication that AK Medical Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of AK Medical Holdings stock in this financial health report.

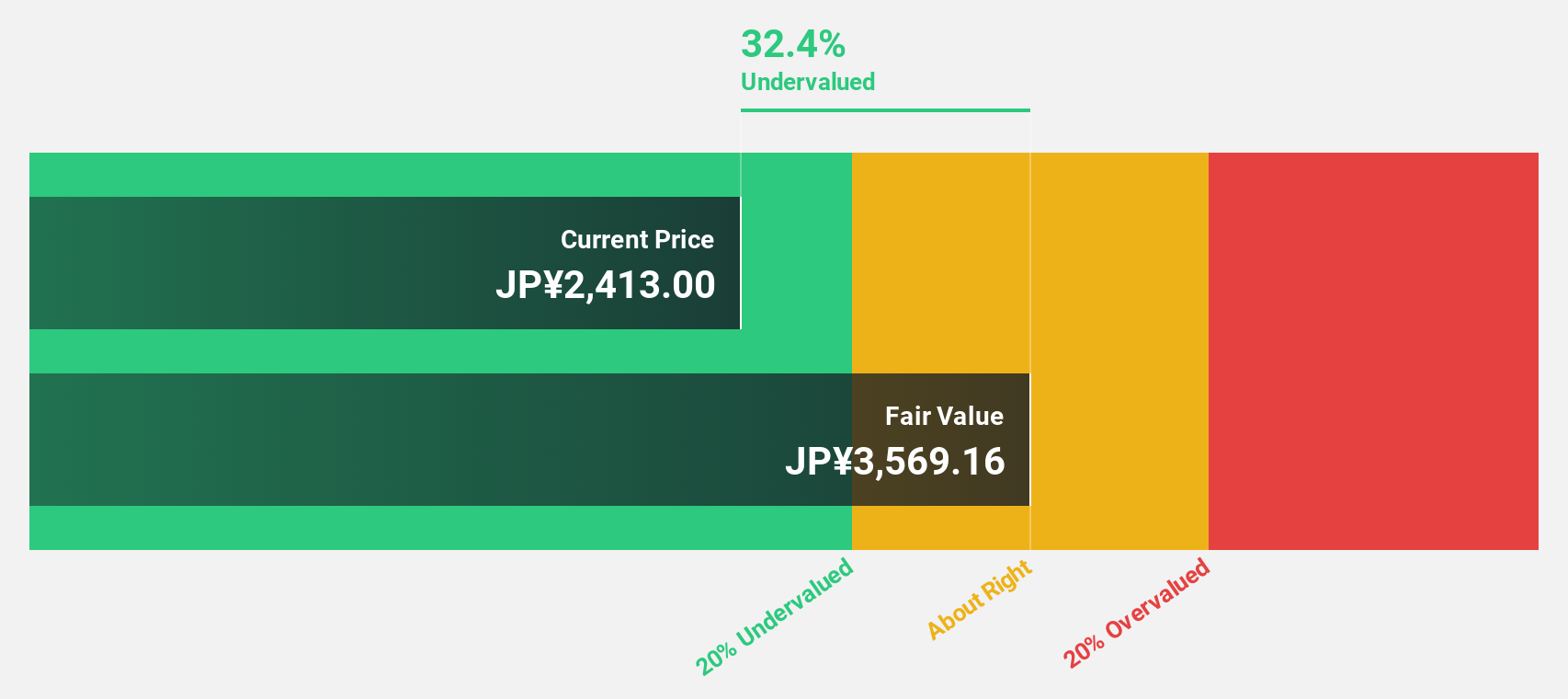

KATITAS (TSE:8919)

Overview: KATITAS CO., Ltd. specializes in surveying, purchasing, refurbishing, remodeling, and selling used homes to individuals and families in Japan with a market cap of ¥171.56 billion.

Operations: The company's revenue primarily comes from its activities in acquiring, renovating, and reselling pre-owned residential properties within Japan.

Estimated Discount To Fair Value: 37.9%

KATITAS is trading at ¥2,238, significantly undervalued compared to its estimated fair value of ¥3,603.07, reflecting a 37.9% discount. Its earnings are projected to grow at 9.7% annually, surpassing the Japanese market's growth rate of 7.9%. Despite slower revenue growth of 8%, it exceeds the market average of 4.2%. However, its dividend history remains unstable despite a recent increase to ¥28 per share for the second quarter of 2024.

- Our comprehensive growth report raises the possibility that KATITAS is poised for substantial financial growth.

- Get an in-depth perspective on KATITAS' balance sheet by reading our health report here.

Turning Ideas Into Actions

- Click here to access our complete index of 868 Undervalued Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A278470

APR

APR Co.,Ltd manufactures and sells cosmetic products for men and women.

Flawless balance sheet and good value.

Market Insights

Community Narratives