- Hong Kong

- /

- Entertainment

- /

- SEHK:9958

Litian Pictures Holdings Limited's (HKG:9958) 56% Share Price Surge Not Quite Adding Up

Those holding Litian Pictures Holdings Limited (HKG:9958) shares would be relieved that the share price has rebounded 56% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 180% following the latest surge, making investors sit up and take notice.

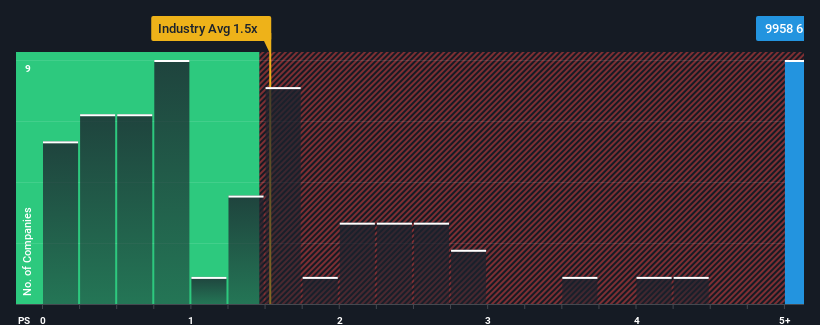

After such a large jump in price, you could be forgiven for thinking Litian Pictures Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.5x, considering almost half the companies in Hong Kong's Entertainment industry have P/S ratios below 1.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Litian Pictures Holdings

How Litian Pictures Holdings Has Been Performing

With revenue growth that's exceedingly strong of late, Litian Pictures Holdings has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Litian Pictures Holdings will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Litian Pictures Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as Litian Pictures Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an explosive gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 75% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 21% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Litian Pictures Holdings' P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Shares in Litian Pictures Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Litian Pictures Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

You should always think about risks. Case in point, we've spotted 2 warning signs for Litian Pictures Holdings you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9958

Litian Pictures Holdings

A drama series distribution company, develops, markets, and distributes films and television (TV) dramas in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives