National Bank of Umm Al-Qaiwain (PSC) And 2 Other Promising Penny Stocks For Savvy Investors

Reviewed by Simply Wall St

Global markets have recently experienced a mix of volatility and resilience, with U.S. stocks facing pressure from AI competition fears and tariff risks, while European indices benefited from strong earnings and interest rate cuts. In this context, investors may find value in exploring smaller or newer companies that offer growth potential at lower price points. Penny stocks, despite their somewhat outdated name, can still present compelling opportunities when backed by solid financials and strong fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.08B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.75 | £178.85M | ★★★★★★ |

| China Lilang (SEHK:1234) | HK$4.00 | HK$4.79B | ★★★★★☆ |

| Starflex (SET:SFLEX) | THB2.82 | THB2.19B | ★★★★☆☆ |

Click here to see the full list of 5,711 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates, with a market capitalization of AED4.60 billion.

Operations: The bank's revenue is primarily derived from Treasury and Investments, contributing AED418.58 million, followed by Retail and Corporate Banking with AED192.74 million.

Market Cap: AED4.6B

National Bank of Umm Al-Qaiwain (PSC) has a market capitalization of AED4.60 billion, with revenue streams primarily from Treasury and Investments and Retail and Corporate Banking. The bank maintains a stable financial structure with an appropriate Loans to Deposits ratio of 71% and primarily low-risk funding through customer deposits. The Price-To-Earnings ratio is favorable at 8.9x compared to the AE market average, suggesting good value. However, NBQ faces challenges such as high levels of bad loans at 4.2% and declining net profit margins year-on-year, which may impact future profitability stability in this volatile segment.

- Click here to discover the nuances of National Bank of Umm Al-Qaiwain (PSC) with our detailed analytical financial health report.

- Assess National Bank of Umm Al-Qaiwain (PSC)'s previous results with our detailed historical performance reports.

IGG (SEHK:799)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGG Inc is an investment holding company that develops and operates mobile and online games across Asia, North America, Europe, and other international markets with a market cap of HK$4.58 billion.

Operations: The company generates revenue of HK$5.50 billion from its development and operation of online games.

Market Cap: HK$4.58B

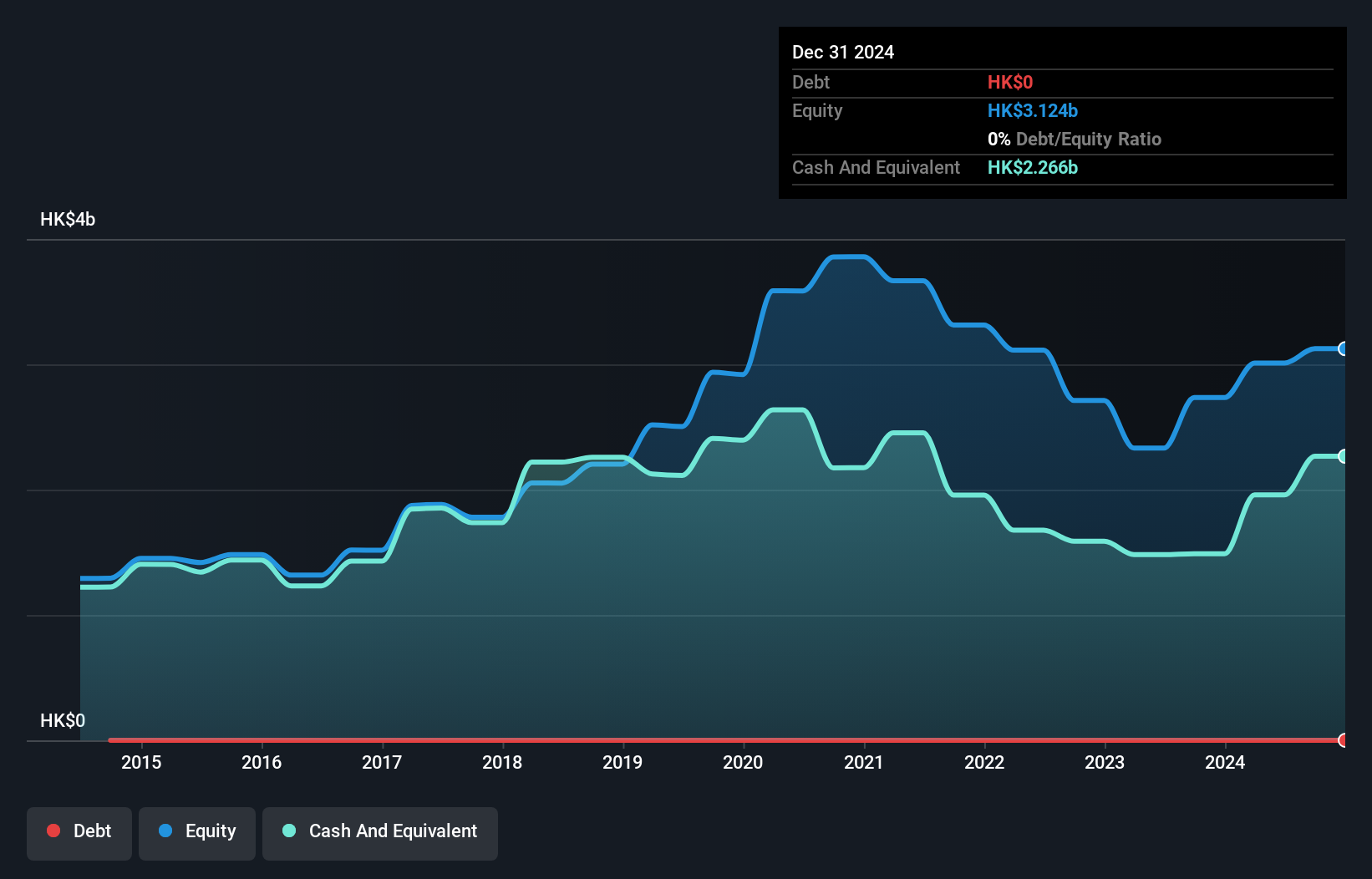

IGG Inc, with a market cap of HK$4.58 billion, has transitioned to profitability recently, complicating comparisons with its past earnings growth. The company is trading at 79.8% below its estimated fair value and has no debt, enhancing its financial stability. Its high Return on Equity of 25.4% indicates efficient profit generation from shareholders' equity. Short-term assets comfortably cover both short and long-term liabilities, reflecting robust liquidity management. However, the company's earnings are forecast to decline by an average of 11.5% annually over the next three years despite being considered a good relative value compared to industry peers.

- Dive into the specifics of IGG here with our thorough balance sheet health report.

- Learn about IGG's future growth trajectory here.

Hong Leong Asia (SGX:H22)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Leong Asia Ltd. is an investment holding company that manufactures and distributes powertrain solutions, building materials, and rigid packaging products across China, Singapore, Malaysia, and internationally with a market cap of SGD744.24 million.

Operations: The company's revenue primarily comes from Powertrain Solutions, generating SGD3.57 billion, and Building Materials, contributing SGD665.81 million.

Market Cap: SGD744.24M

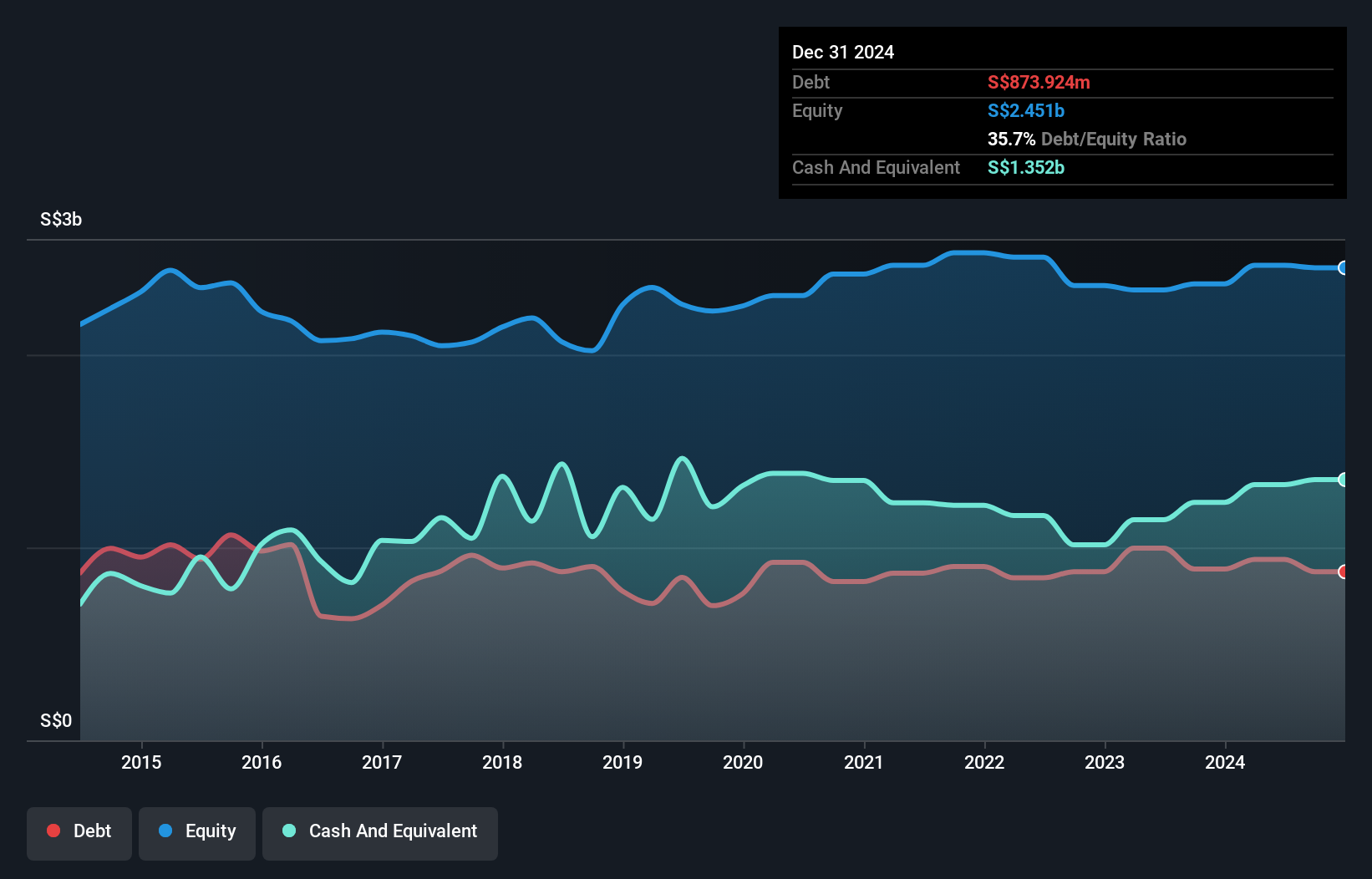

Hong Leong Asia Ltd., with a market cap of SGD744.24 million, has shown strong financial performance, notably with earnings growing 94.4% over the past year and surpassing industry growth rates. The company trades at 48.7% below its estimated fair value, suggesting potential undervaluation relative to peers and industry standards. Its short-term assets of SGD4.4 billion exceed both short-term liabilities (SGD2.9 billion) and long-term liabilities (SGD566.2 million), indicating solid liquidity management. Recent board changes include the appointment of Ng Chee Khern as an Independent Non-Executive Director, enhancing governance focus on sustainability issues.

- Click here and access our complete financial health analysis report to understand the dynamics of Hong Leong Asia.

- Review our growth performance report to gain insights into Hong Leong Asia's future.

Summing It All Up

- Click this link to deep-dive into the 5,711 companies within our Penny Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Leong Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H22

Hong Leong Asia

An investment holding company, manufactures and distributes powertrain solutions and related products, building materials, and rigid packaging products in the People’s Republic of China, Singapore, Malaysia, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives