- Hong Kong

- /

- Entertainment

- /

- SEHK:799

High Growth Tech Stocks in Hong Kong for August 2024

Reviewed by Simply Wall St

As global markets continue to recover, the Hong Kong market has shown resilience with the Hang Seng Index up 1.99% recently, reflecting growing investor optimism despite economic uncertainties. In this environment, identifying high-growth tech stocks can be pivotal for investors looking to capitalize on emerging opportunities in the region's dynamic technology sector.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.71% | 25.80% | ★★★★★☆ |

| Be Friends Holding | 33.82% | 32.27% | ★★★★★★ |

| MedSci Healthcare Holdings | 45.88% | 45.90% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 21.83% | 38.02% | ★★★★★☆ |

| iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

| Cowell e Holdings | 30.96% | 35.72% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.21% | 50.78% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.35% | 100.10% | ★★★★★☆ |

| Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our SEHK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

iDreamSky Technology Holdings (SEHK:1119)

Simply Wall St Growth Rating: ★★★★★★

Overview: iDreamSky Technology Holdings Limited is an investment holding company that operates a digital entertainment platform, publishing games through mobile apps and websites in the People’s Republic of China, with a market cap of approximately HK$3.65 billion.

Operations: iDreamSky Technology Holdings generates revenue primarily from its Game and Information Services segment, which includes SaaS and related services, totaling CN¥1.92 billion. The company focuses on publishing games through mobile apps and websites in China.

iDreamSky Technology Holdings, a prominent player in the tech industry, has shown impressive revenue growth forecasts of 29.8% per year, significantly outpacing the Hong Kong market's 7.4%. The company recently completed a follow-on equity offering worth HKD 257.68 million at HKD 2.15 per share, highlighting its strategic financial maneuvers to fuel expansion and innovation. With earnings projected to grow by an astonishing 104.1% annually and expected profitability within three years, iDreamSky is poised for substantial future gains. In terms of R&D investment, iDreamSky has consistently allocated significant resources to enhance its technological capabilities and product offerings; specific figures underscore this commitment but are not detailed here. Software firms like iDreamSky are increasingly adopting SaaS models to secure recurring revenue streams from subscriptions, which could further bolster their financial stability and growth trajectory in the competitive tech landscape.

Inspur Digital Enterprise Technology (SEHK:596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inspur Digital Enterprise Technology Limited, an investment holding company with a market cap of HK$3.77 billion, provides software development, other software services, and cloud services in the People’s Republic of China.

Operations: Inspur Digital Enterprise Technology generates revenue primarily from three segments: Cloud Services (CN¥2.00 billion), Management Software (CN¥2.47 billion), and Internet of Things (IoT) Solutions (CN¥3.83 billion). The company focuses on providing specialized software and cloud-based solutions within China.

Inspur Digital Enterprise Technology's R&D expenses, comprising 21.8% of revenue, underscore its commitment to innovation. The company's forecasted annual earnings growth of 38% significantly outpaces the Hong Kong market's 10.9%. Notably, Inspur's software segment has seen substantial traction, particularly in cloud services and AI-driven solutions which are increasingly adopted by enterprises seeking digital transformation. With a strong focus on high-profile clients and strategic investments in cutting-edge technology, Inspur positions itself well for future expansion in the tech landscape.

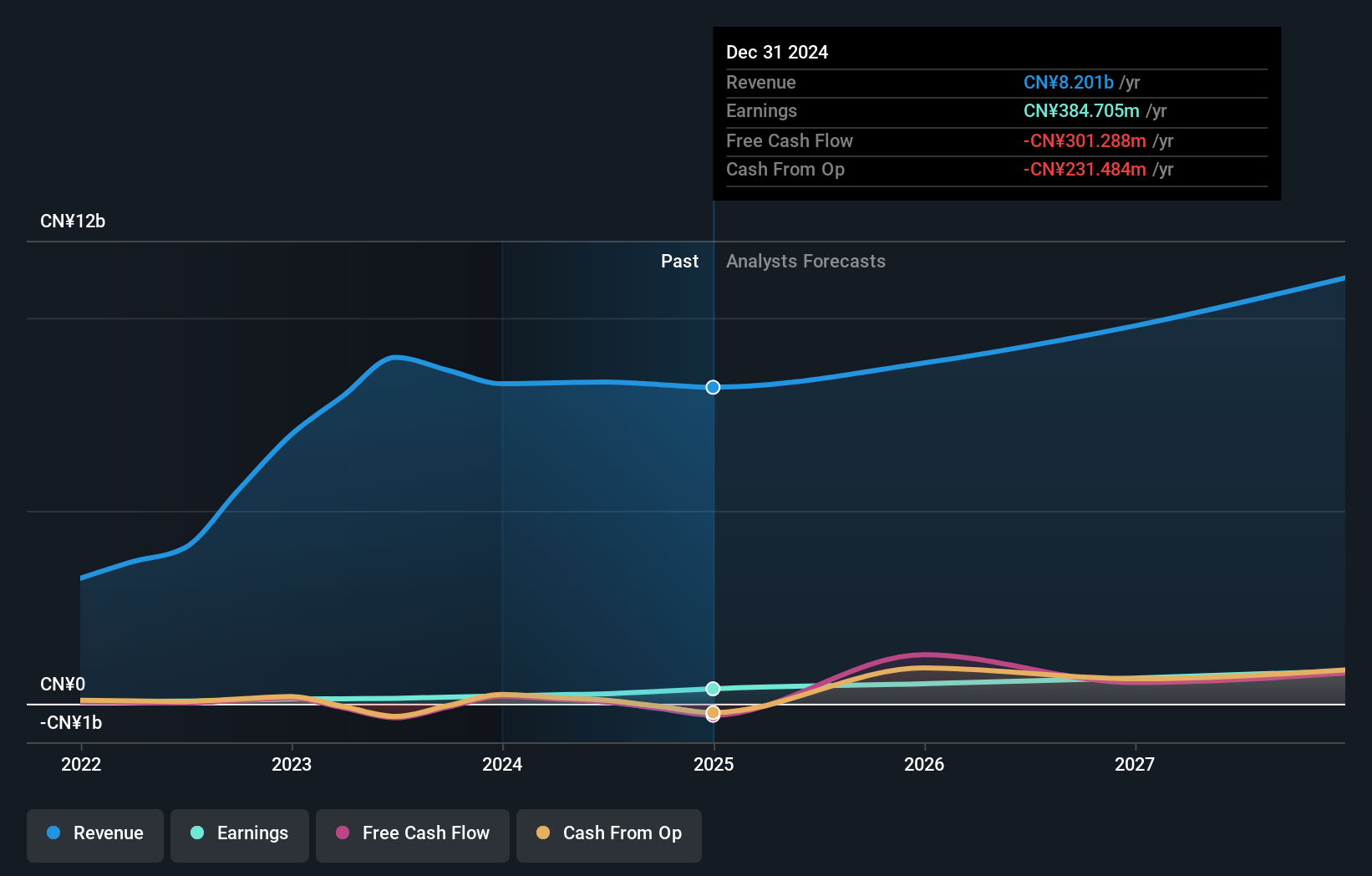

IGG (SEHK:799)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IGG Inc, an investment holding company, develops and operates mobile and online games in Asia, North America, Europe, and internationally with a market cap of HK$28.20 billion.

Operations: The company generates revenue primarily from the development and operation of online games, with a reported HK$5.27 billion in this segment. The business spans multiple regions including Asia, North America, and Europe.

IGG Inc. has shown significant potential with its earnings projected to grow at 51.2% annually, outpacing the Hong Kong market's 10.9%. Despite a modest revenue growth forecast of 4.2%, the company’s strategic focus on gaming and software development positions it well for future gains, especially given the rising popularity of mobile gaming globally. Notably, IGG's R&D expenses represent a substantial commitment to innovation, ensuring continued competitiveness in an evolving tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of IGG.

Evaluate IGG's historical performance by accessing our past performance report.

Next Steps

- Get an in-depth perspective on all 47 SEHK High Growth Tech and AI Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:799

IGG

An investment holding company, develops and operates mobile and online games in Asia, North America, Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives