As global markets react to escalating geopolitical tensions and economic data, Hong Kong's tech sector has been a focal point of investor interest, buoyed by optimism around Beijing's supportive measures despite broader market volatility. In this environment, identifying high-growth tech stocks involves assessing companies' adaptability to market changes and their ability to leverage technological advancements for sustained growth.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Akeso | 33.22% | 52.58% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★★☆

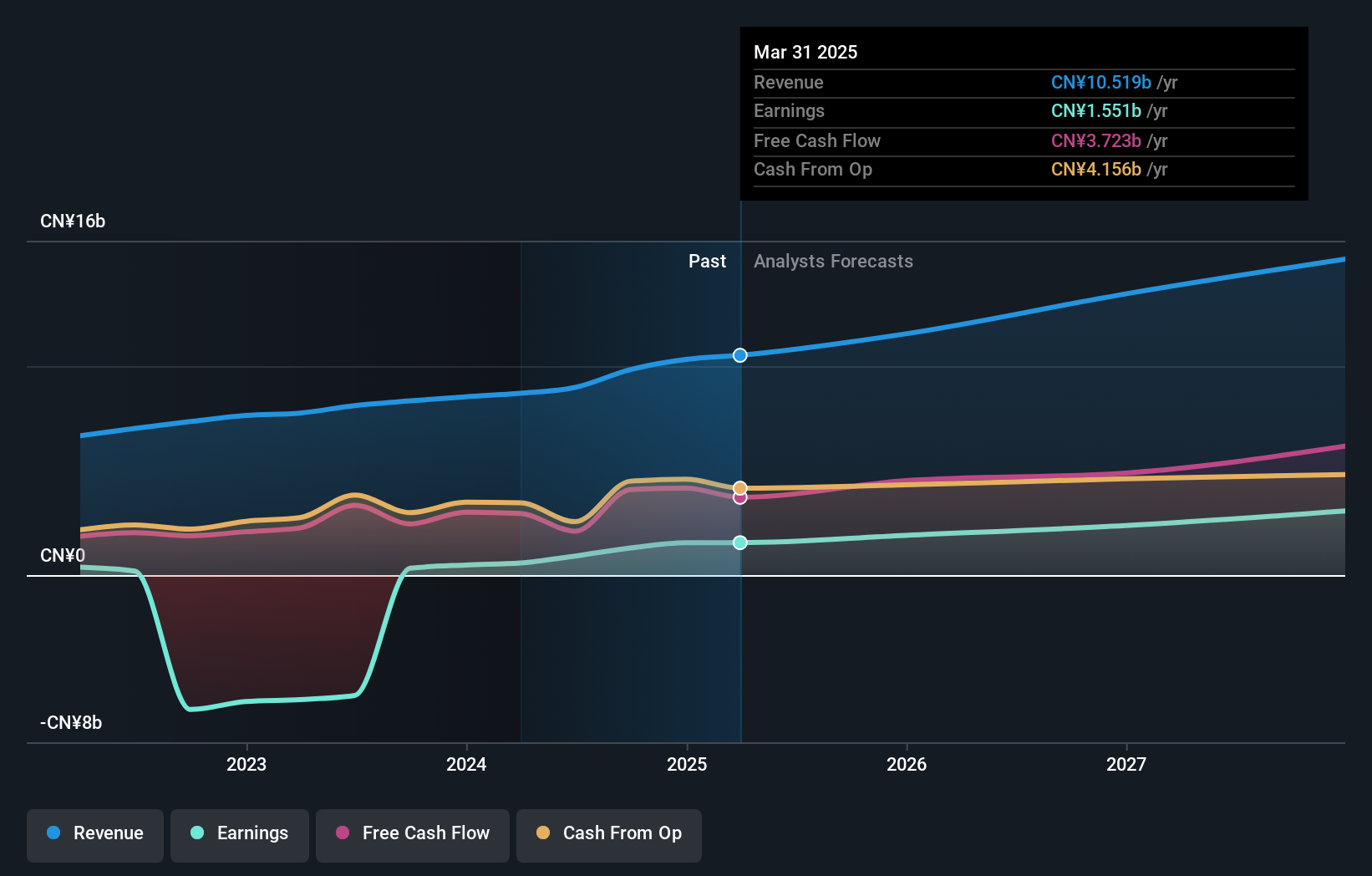

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that focuses on developing and commercializing monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in China, with a market cap of approximately HK$80 billion.

Operations: Innovent Biologics generates revenue primarily from its biotechnology segment, amounting to CN¥7.46 billion. The company focuses on developing and commercializing treatments for various diseases in China.

Innovent Biologics, a player in the high-growth tech scene of Hong Kong's biotech sector, is making significant strides with its recent strategic collaboration for limertinib and the acceptance of NDAs for picankibart. The company's commitment to innovation is underscored by its R&D spending which has been integral to these developments. Notably, Innovent's revenue is projected to surge by 22.2% annually, outpacing the local market growth of 7.4%, while earnings could soar by 59.4% each year. This financial trajectory coupled with recent clinical advancements positions Innovent as a formidable entity in addressing complex medical needs through cutting-edge biotechnologies.

- Click here to discover the nuances of Innovent Biologics with our detailed analytical health report.

Explore historical data to track Innovent Biologics' performance over time in our Past section.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market cap of HK$38.87 billion.

Operations: Kingsoft Corporation Limited generates revenue primarily from its office software and services segment, contributing CN¥4.80 billion, and its entertainment software segment, which adds CN¥4.18 billion.

Kingsoft's recent financial performance underscores its potential in Hong Kong's tech landscape, with a revenue jump to CNY 2.47 billion in Q2 2024, up from CNY 2.19 billion the previous year, and a significant rise in net income to CNY 393.35 million from CNY 57.19 million. This growth trajectory is mirrored by an anticipated annual earnings increase of 24.5% over the next three years, outpacing the local market forecast of 12.5%. Additionally, Kingsoft's commitment to innovation is evident from its R&D investments which are crucial for sustaining its competitive edge in software development and cloud services amidst evolving technological demands.

- Navigate through the intricacies of Kingsoft with our comprehensive health report here.

Evaluate Kingsoft's historical performance by accessing our past performance report.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

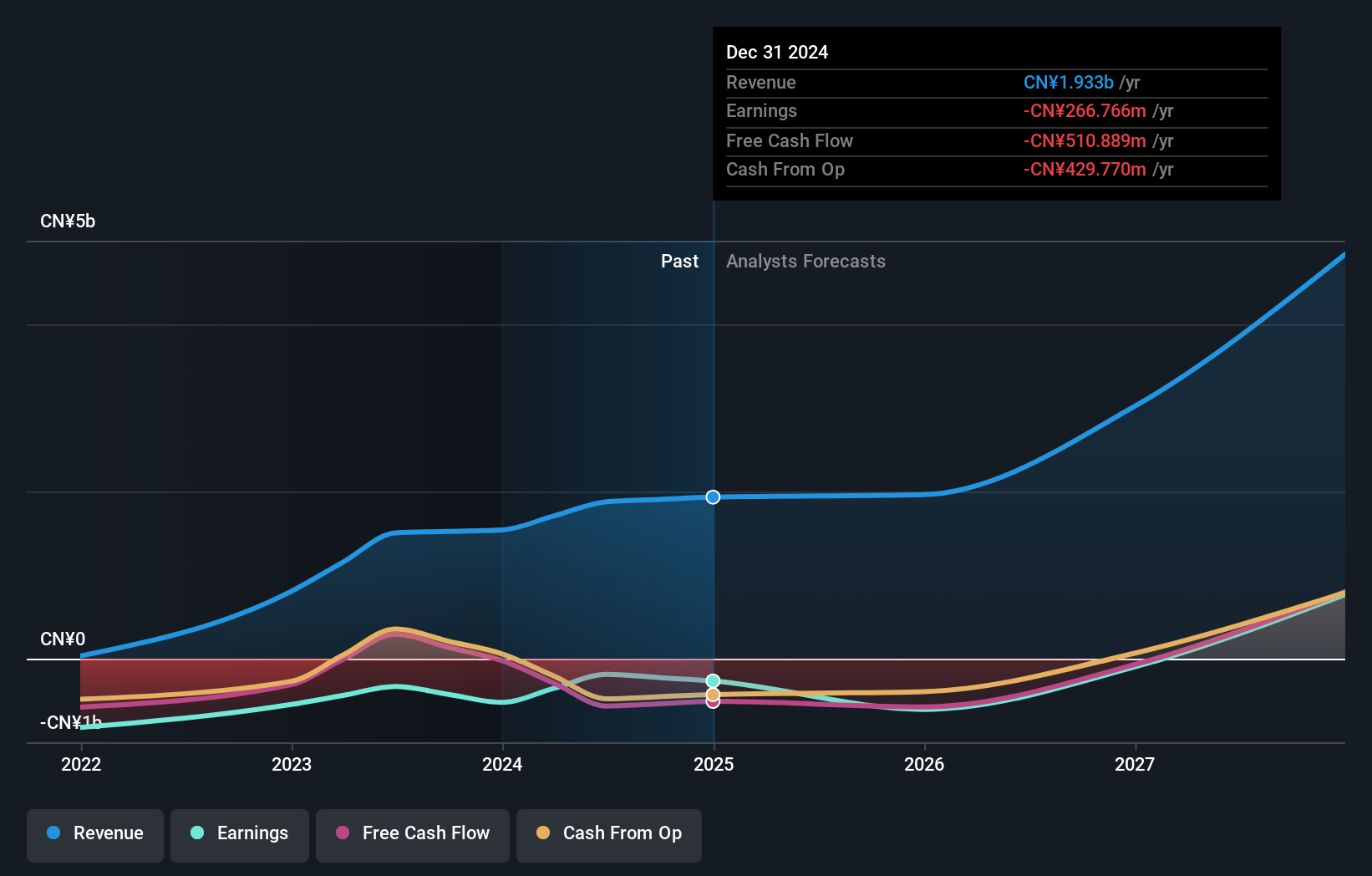

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs for unmet medical needs in China and globally, with a market cap of HK$42.96 billion.

Operations: Kelun-Biotech operates in the biopharmaceutical sector, primarily generating revenue from its pharmaceuticals segment, which reported CN¥1.88 billion. The company is involved in creating innovative drugs to meet medical needs both domestically and internationally.

Sichuan Kelun-Biotech Biopharmaceutical has demonstrated a compelling growth trajectory, with revenue surging by 24.7% over the past year, significantly outpacing the industry average. This growth is underpinned by robust R&D investments, crucial for advancing their biopharmaceutical innovations. Recently, the company presented promising clinical results at multiple medical conferences, notably showing a 68% reduction in disease progression risk with their sacituzumab tirumotecan treatment compared to conventional chemotherapy. These developments not only highlight Sichuan Kelun-Biotech's commitment to addressing unmet medical needs but also position it favorably for future growth in high-stakes markets like triple-negative breast cancer and non-small cell lung cancer treatments.

Make It Happen

- Unlock more gems! Our SEHK High Growth Tech and AI Stocks screener has unearthed 40 more companies for you to explore.Click here to unveil our expertly curated list of 43 SEHK High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, engages in the research and development of antibody and protein medicine products in the People’s Republic of China, the United States, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)