Uncovering Opportunities: 3 Penny Stocks With At Least US$700M Market Cap

Reviewed by Simply Wall St

As the year draws to a close, global markets have experienced a mixed bag of outcomes, with major U.S. stock indexes posting moderate gains despite declining consumer confidence and manufacturing data. In such fluctuating market conditions, investors often seek opportunities in areas that might not be immediately apparent. Penny stocks, though a term from past market eras, continue to offer potential for growth due to their affordability and the prospects they hold when backed by strong financials. This article explores several penny stocks that demonstrate financial strength and could present intriguing opportunities for investors seeking value in smaller or newer companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Inkeverse Group (SEHK:3700)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inkeverse Group Limited is an investment holding company that operates mobile live streaming platforms in the People's Republic of China, with a market cap of HK$4.40 billion.

Operations: The company generates revenue through its Live Streaming Business, which amounted to CN¥7.25 billion.

Market Cap: HK$4.4B

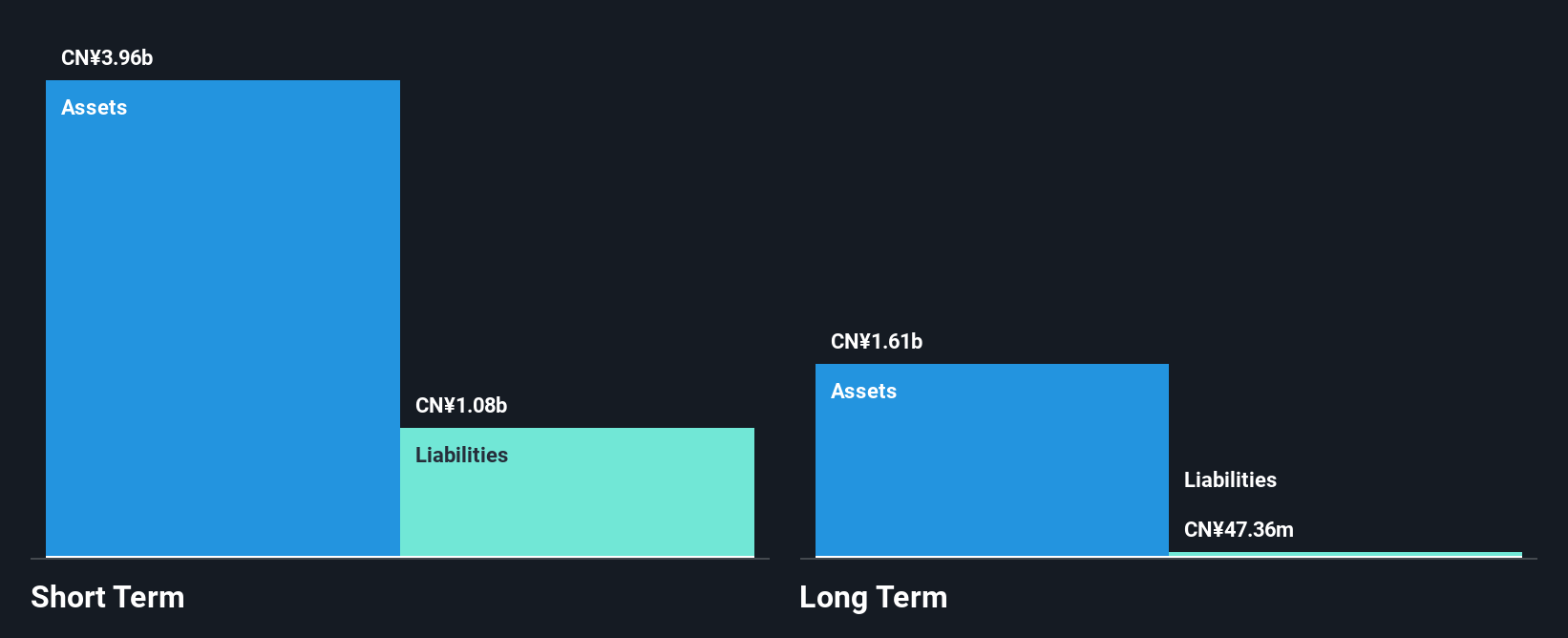

Inkeverse Group Limited, a mobile live streaming platform operator in China, has demonstrated significant earnings growth of 136.1% over the past year, surpassing its five-year average of 12.5%. The company maintains a strong financial position with no debt and short-term assets of CN¥4.2 billion exceeding both short and long-term liabilities. Despite this, its share price has been highly volatile recently. Recent board changes include the appointment of Ms. Zheng Congnan as an independent non-executive director, bringing extensive technology management experience from Silicon Valley to drive innovation within the company’s operations.

- Unlock comprehensive insights into our analysis of Inkeverse Group stock in this financial health report.

- Gain insights into Inkeverse Group's historical outcomes by reviewing our past performance report.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China, with a market capitalization of approximately HK$28.11 billion.

Operations: Dongguan Rural Commercial Bank Co., Ltd. has not reported specific revenue segments.

Market Cap: HK$28.11B

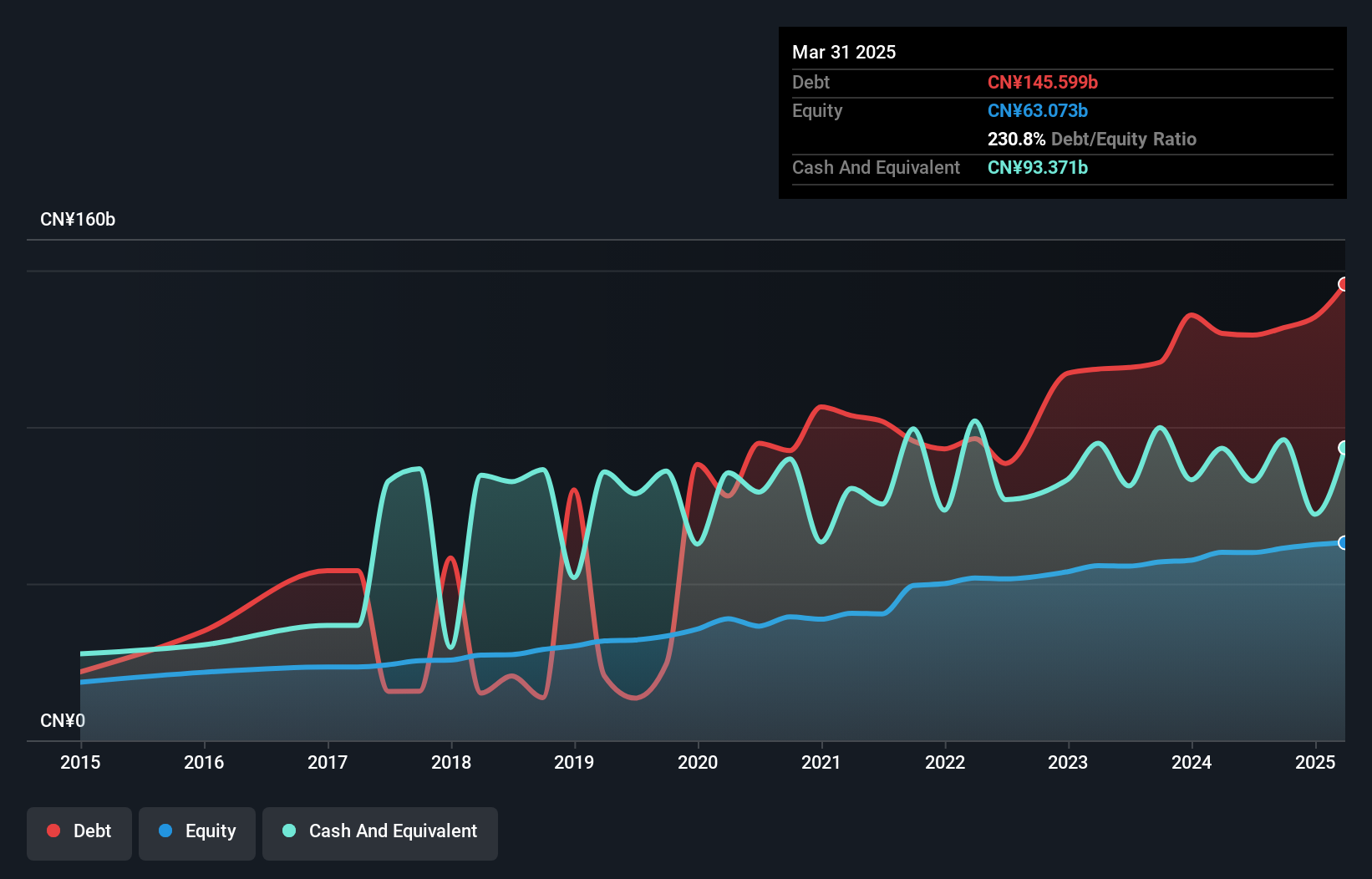

Dongguan Rural Commercial Bank Co., Ltd. has faced challenges with a negative earnings growth of 18.4% over the past year, contrasting with a modest industry growth average. Despite this, the bank maintains an appropriate loans to deposits ratio of 70% and a sufficient allowance for bad loans at 309%. The board and management team are experienced, enhancing governance stability. While net interest income and net income have declined compared to last year, the bank's funding primarily from low-risk sources like customer deposits mitigates external borrowing risks. The stock trades significantly below its estimated fair value, suggesting potential undervaluation.

- Click here to discover the nuances of Dongguan Rural Commercial Bank with our detailed analytical financial health report.

- Assess Dongguan Rural Commercial Bank's future earnings estimates with our detailed growth reports.

Japfa (SGX:UD2)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Japfa Ltd. is an agri-food company that produces and sells protein staples and packaged food products across Indonesia, Vietnam, India, Myanmar, and internationally, with a market cap of approximately SGD957.40 million.

Operations: The company's revenue is primarily derived from its Animal Protein segment, with PT Japfa Tbk (including Consumer Food) contributing $3.46 billion and Animal Protein - Other generating $1.07 billion.

Market Cap: SGD957.4M

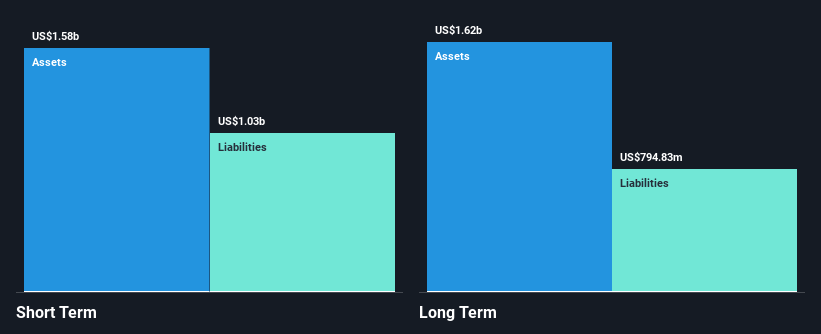

Japfa Ltd. has shown a turnaround by becoming profitable this year, with net income reaching US$87.54 million for the first nine months of 2024 compared to a net loss previously. The company's earnings per share improved significantly, and its short-term assets exceed both long-term and short-term liabilities, indicating solid liquidity management. However, it carries a high net debt to equity ratio of 69.9%, which could pose risks if not managed carefully. Japfa's recent dividend announcements reflect an unstable dividend track record but offer potential income for shareholders amidst its improved financial performance and trading value below estimated fair value.

- Dive into the specifics of Japfa here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Japfa's future.

Taking Advantage

- Unlock our comprehensive list of 5,815 Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9889

Dongguan Rural Commercial Bank

Provides various banking products and services in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives