- Hong Kong

- /

- Entertainment

- /

- SEHK:2400

Optimistic Investors Push XD Inc. (HKG:2400) Shares Up 28% But Growth Is Lacking

Despite an already strong run, XD Inc. (HKG:2400) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 155% in the last year.

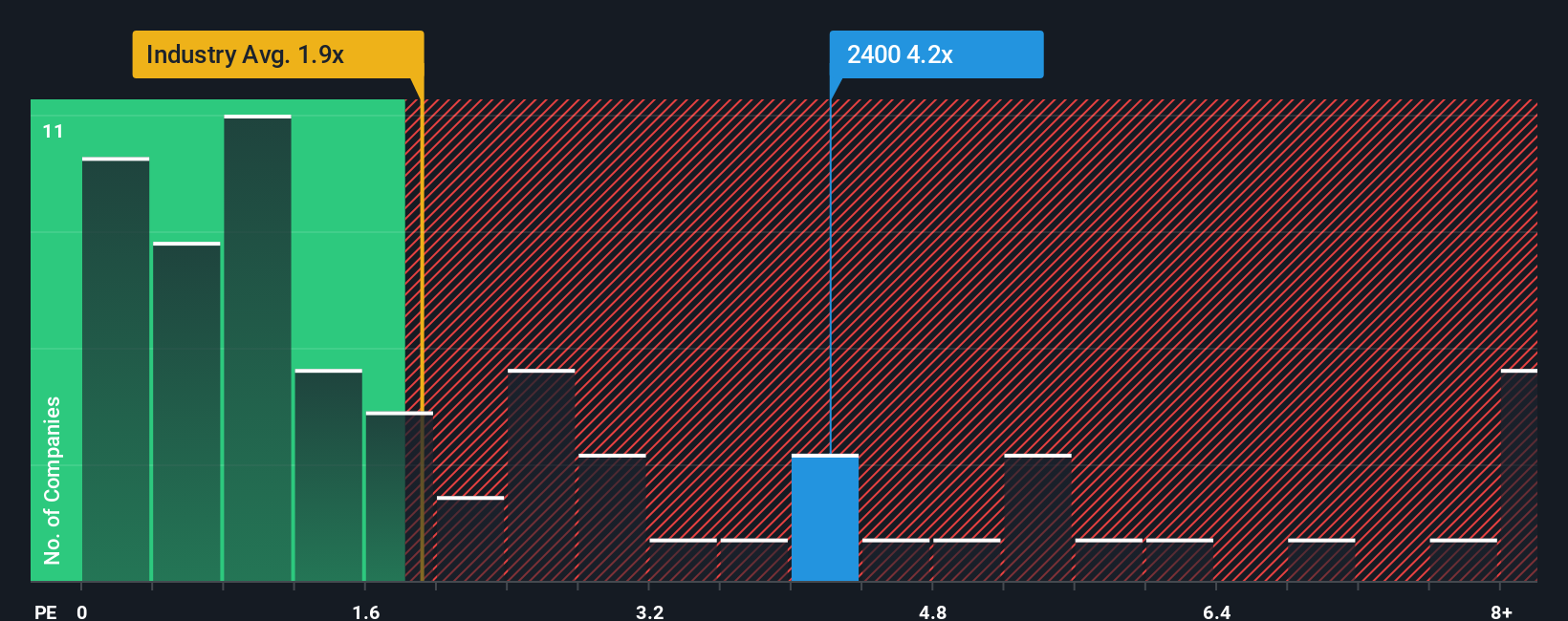

After such a large jump in price, given around half the companies in Hong Kong's Entertainment industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider XD as a stock to avoid entirely with its 4.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for XD

What Does XD's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, XD has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on XD will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like XD's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 48%. Pleasingly, revenue has also lifted 85% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 6.8% per annum as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 10.0% each year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that XD's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does XD's P/S Mean For Investors?

Shares in XD have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for XD, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with XD, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2400

XD

An investment holding company, develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives