Investors Still Aren't Entirely Convinced By Bright Future Technology Holdings Limited's (HKG:1351) Revenues Despite 26% Price Jump

Bright Future Technology Holdings Limited (HKG:1351) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

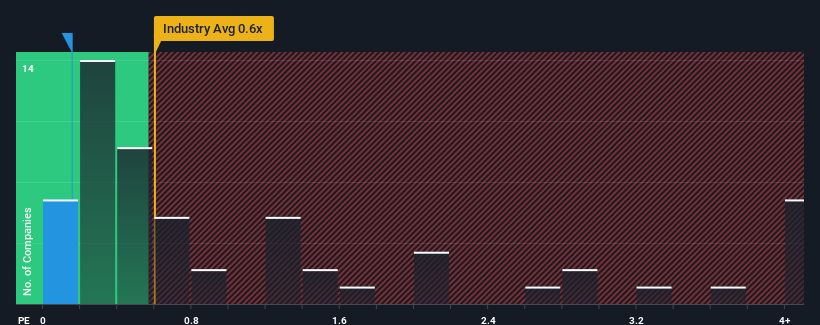

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Bright Future Technology Holdings' P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Media industry in Hong Kong is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Bright Future Technology Holdings

How Bright Future Technology Holdings Has Been Performing

Bright Future Technology Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bright Future Technology Holdings' earnings, revenue and cash flow.How Is Bright Future Technology Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Bright Future Technology Holdings' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 101% last year. The latest three year period has also seen an excellent 133% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 9.8% shows it's noticeably more attractive.

With this information, we find it interesting that Bright Future Technology Holdings is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Bright Future Technology Holdings' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Bright Future Technology Holdings currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Bright Future Technology Holdings (2 are a bit concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Bright Future Technology Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bright Future Technology Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1351

Bright Future Technology Holdings

An investment holding company, engages in the provision of intelligent marketing solutions in the People’s Republic of China.

Low and slightly overvalued.

Market Insights

Community Narratives