- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3788

Here's Why We Think China Hanking Holdings (HKG:3788) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like China Hanking Holdings (HKG:3788). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for China Hanking Holdings

China Hanking Holdings's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years China Hanking Holdings grew its EPS by 17% per year. That growth rate is fairly good, assuming the company can keep it up.

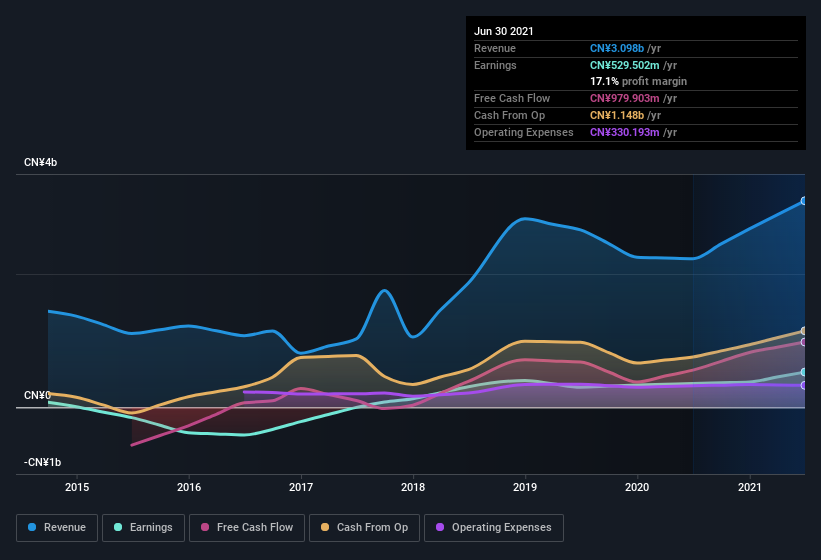

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. China Hanking Holdings maintained stable EBIT margins over the last year, all while growing revenue 39% to CN¥3.1b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check China Hanking Holdings's balance sheet strength, before getting too excited.

Are China Hanking Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The first bit of good news is that no China Hanking Holdings insiders reported share sales in the last twelve months. But the really good news is that Executive Director Xuezhi Zheng spent CN¥3.7m buying stock stock, at an average price of around CN¥1.61. Big buys like that give me a sense of opportunity; actions speak louder than words.

And the insider buying isn't the only sign of alignment between shareholders and the board, since China Hanking Holdings insiders own more than a third of the company. Indeed, with a collective holding of 78%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping CN¥2.4b. Now that's what I call some serious skin in the game!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Jiye Yang, is paid less than the median for similar sized companies. For companies with market capitalizations between CN¥1.3b and CN¥5.2b, like China Hanking Holdings, the median CEO pay is around CN¥2.1m.

China Hanking Holdings offered total compensation worth CN¥1.9m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does China Hanking Holdings Deserve A Spot On Your Watchlist?

One important encouraging feature of China Hanking Holdings is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for China Hanking Holdings that you should be aware of.

The good news is that China Hanking Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3788

China Hanking Holdings

Engages in the exploration, mining, processing, smelting, and sale of mineral resources in the People's Republic of China, Australia, and Japan.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives