Undiscovered Gems in Asia Three Promising Stocks for July 2025

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, Asian markets have shown resilience with modest gains in key indices like Japan's Nikkei 225 and China's CSI 300. Amidst this backdrop, identifying promising stocks requires a keen eye on companies that can leverage regional economic trends and demonstrate robust growth potential despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ampire | NA | -2.21% | 8.00% | ★★★★★★ |

| Orient Pharma | 17.16% | 26.65% | 68.11% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 39.11% | 5.91% | 0.76% | ★★★★★☆ |

| E J Holdings | 21.62% | 4.30% | 3.77% | ★★★★★☆ |

| Tokyo Tekko | 8.47% | 8.06% | 24.39% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Iljin DiamondLtd | 2.55% | -3.23% | 0.91% | ★★★★☆☆ |

| Shenzhen Leaguer | 63.12% | 1.96% | -16.52% | ★★★★☆☆ |

| Hui Lyu Ecological Technology GroupsLtd | 43.35% | -5.67% | -12.37% | ★★★★☆☆ |

| ASRock Rack Incorporation | 77.35% | 311.61% | 693.05% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Asia United Bank Corporation offers a range of banking and financial services to individual consumers, MSMEs, and corporations in the Philippines with a market capitalization of ₱70.18 billion.

Operations: Asia United Bank Corporation generates revenue primarily through interest income from loans and advances, as well as fees and commissions from various banking services. The bank's cost structure includes interest expenses on deposits and borrowings, alongside operational costs. Its net profit margin reflects the efficiency of its operations in generating profit relative to its total revenue.

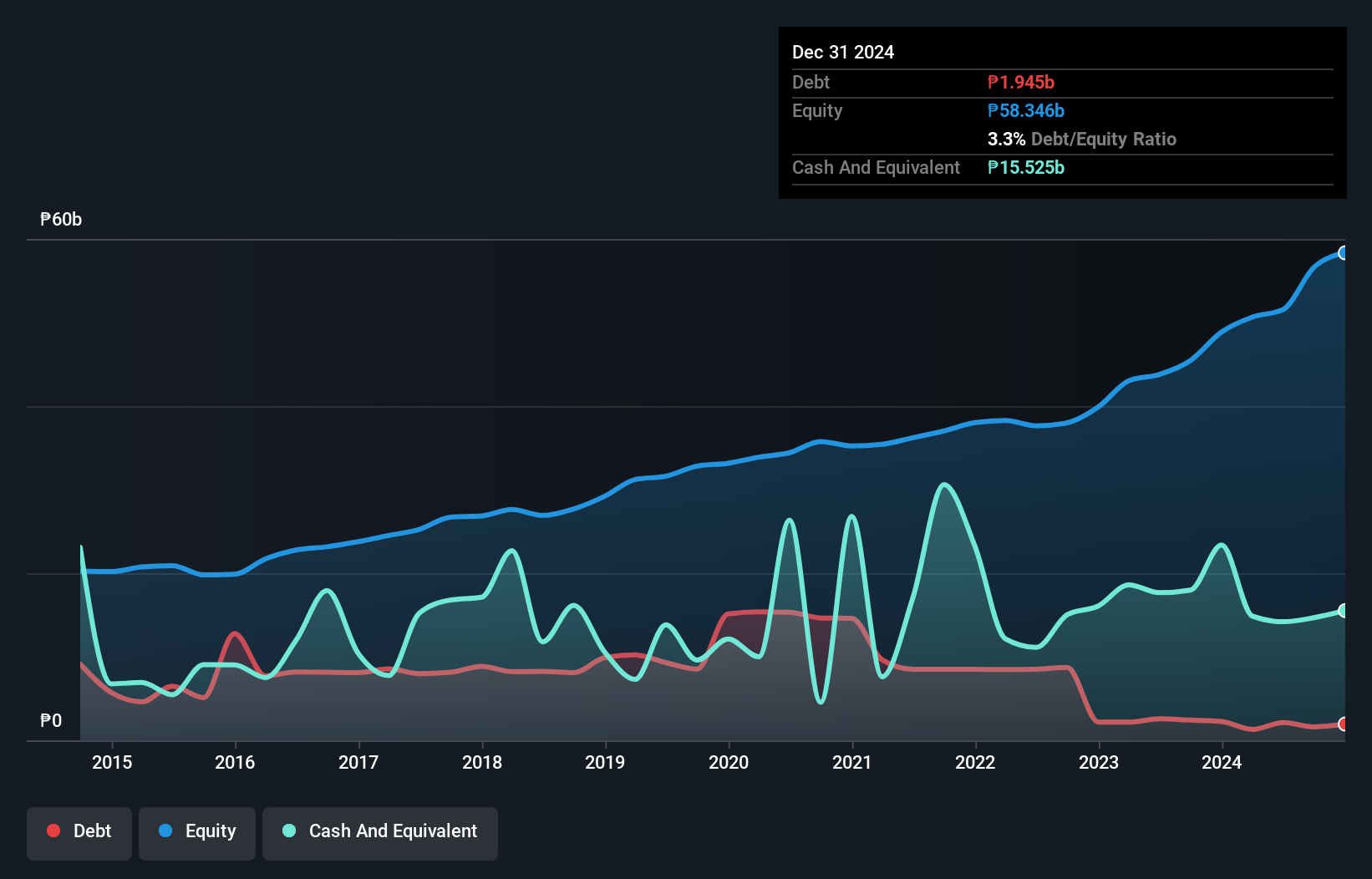

Asia United Bank (AUB) stands out with its robust financial health, boasting total assets of ₱352 billion and equity of ₱56.6 billion. With a price-to-earnings ratio of 6.5x, it appears undervalued compared to the Philippine market's 9.1x average. The bank's earnings growth over the past year was impressive at 38.8%, far surpassing the industry average of 10.9%. AUB relies heavily on low-risk funding sources, with customer deposits comprising 95% of liabilities, enhancing stability in volatile markets. Recent executive changes include Manuel R. Bengson Jr.'s appointment as Senior VP for Treasury Group, adding seasoned expertise to their leadership team.

- Get an in-depth perspective on Asia United Bank's performance by reading our health report here.

Explore historical data to track Asia United Bank's performance over time in our Past section.

Lingbao Gold Group (SEHK:3330)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lingbao Gold Group Company Ltd., along with its subsidiaries, is involved in the mining, processing, smelting, refining, and sale of gold products primarily in the People’s Republic of China and has a market capitalization of approximately HK$13.10 billion.

Operations: The company generates revenue primarily from smelting (CN¥12.04 billion) and mining operations in the People's Republic of China (CN¥2.31 billion). Retailing and mining in the Kyrgyz Republic contribute minimally to overall revenue.

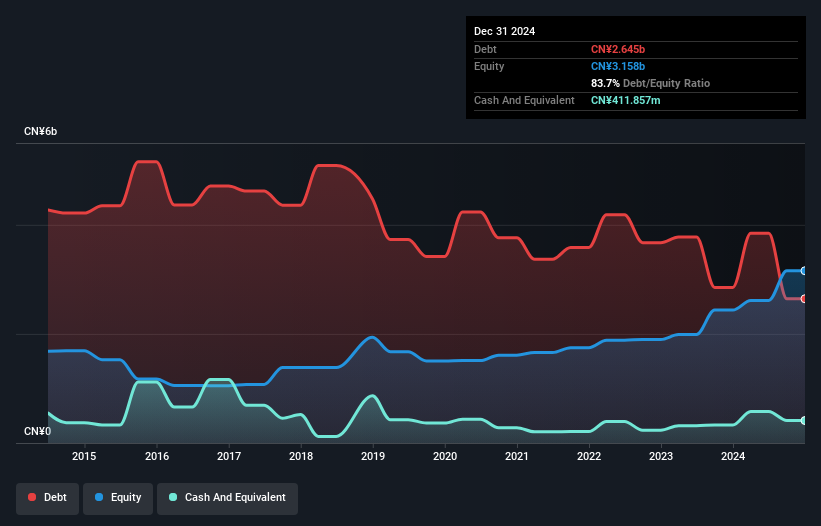

Lingbao Gold Group, a smaller player in the metals and mining sector, has shown impressive earnings growth of 119.4% over the past year, outpacing the industry average of 40.2%. Its debt to equity ratio has significantly improved from 227.4% to 83.7% in five years, though the current net debt to equity ratio at 70.7% is still high but manageable with EBIT covering interest payments by a factor of 9.1x. Recent guidance suggests a net profit exceeding RMB 250 million for Q1 2025 due to increased gold output and rising market prices, highlighting operational efficiency improvements and cost control efforts amidst favorable market conditions.

Ningbo Henghe Precision IndustryLtd (SZSE:300539)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ningbo Henghe Precision Industry Co., Ltd. operates in the precision manufacturing sector, focusing on producing high-quality components, with a market capitalization of approximately CN¥4.40 billion.

Operations: Henghe Precision generates revenue primarily through its precision manufacturing activities. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

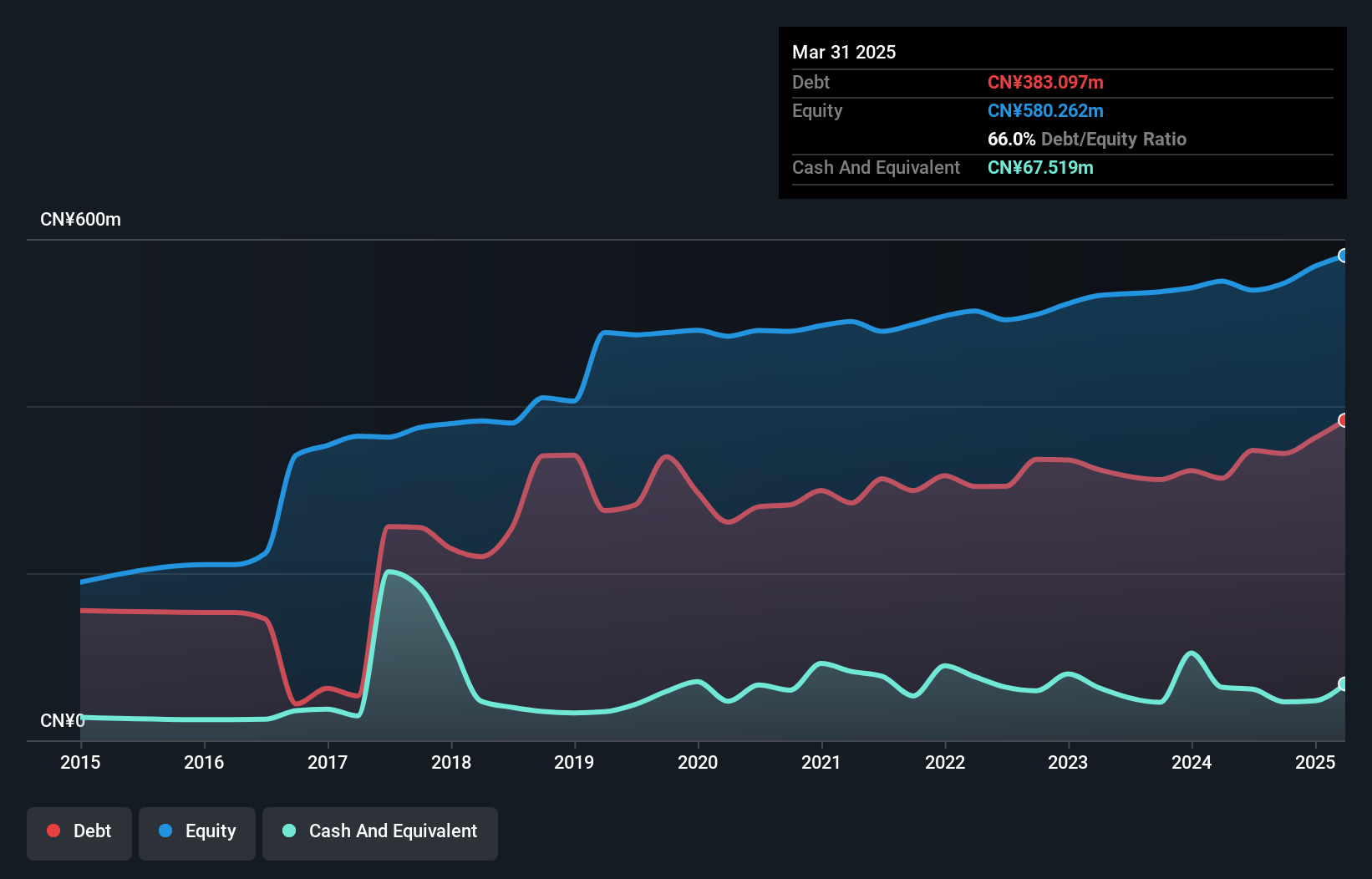

Ningbo Henghe Precision Industry Ltd. showcases a promising profile with its recent earnings growth of 25%, outpacing the Chemicals industry's 4% rise. Despite a high net debt to equity ratio of 54.4%, interest payments are well covered by EBIT at 4.3 times, indicating manageable debt servicing capabilities. The company reported first-quarter sales of CNY 203 million, up from CNY 166 million last year, and net income increased to CNY 11.18 million from CNY 8.12 million previously, reflecting robust performance amid volatility in share prices over the past three months. Additionally, a cash dividend was approved recently, signaling shareholder value focus.

Taking Advantage

- Dive into all 2605 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Henghe Precision IndustryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300539

Ningbo Henghe Precision IndustryLtd

Ningbo Henghe Precision Industry Co.,Ltd.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives