- Hong Kong

- /

- Paper and Forestry Products

- /

- SEHK:2689

Nine Dragons Paper (Holdings) (HKG:2689) shareholders have endured a 62% loss from investing in the stock three years ago

Investing in stocks inevitably means buying into some companies that perform poorly. Long term Nine Dragons Paper (Holdings) Limited (HKG:2689) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 63% decline in the share price in that time. The falls have accelerated recently, with the share price down 30% in the last three months.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Nine Dragons Paper (Holdings)

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Nine Dragons Paper (Holdings) moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

Arguably the revenue decline of 4.4% per year has people thinking Nine Dragons Paper (Holdings) is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

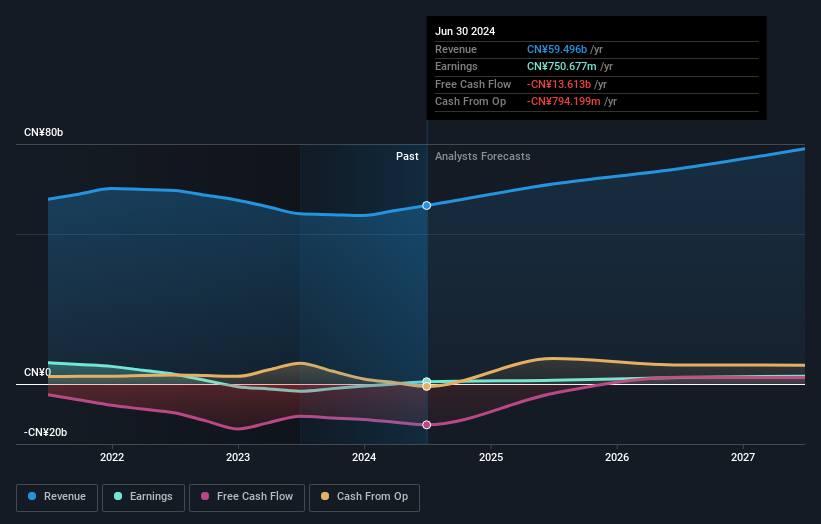

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Nine Dragons Paper (Holdings) is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Nine Dragons Paper (Holdings) shareholders are down 17% for the year, but the market itself is up 23%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Nine Dragons Paper (Holdings) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nine Dragons Paper (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2689

Nine Dragons Paper (Holdings)

Manufactures and sells packaging paper, printing and writing paper, and specialty paper products and pulp in the People’s Republic of China.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives