As global markets navigate a landscape marked by fluctuating corporate earnings, AI competition fears, and central banks' varied approaches to interest rates, investors are keenly observing the potential impacts on their portfolios. Amidst this backdrop of volatility and strategic economic maneuvers, dividend stocks offer a compelling option for those seeking steady income streams in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.97% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.85% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

China Nonferrous Mining (SEHK:1258)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Nonferrous Mining Corporation Limited is an investment holding company involved in the exploration, mining, ore processing, leaching, smelting, and sale of copper products such as cathodes and anodes with a market cap of approximately HK$20.02 billion.

Operations: China Nonferrous Mining Corporation Limited generates revenue through its leaching operations, which contributed $1.04 billion, and smelting activities, which added $2.77 billion.

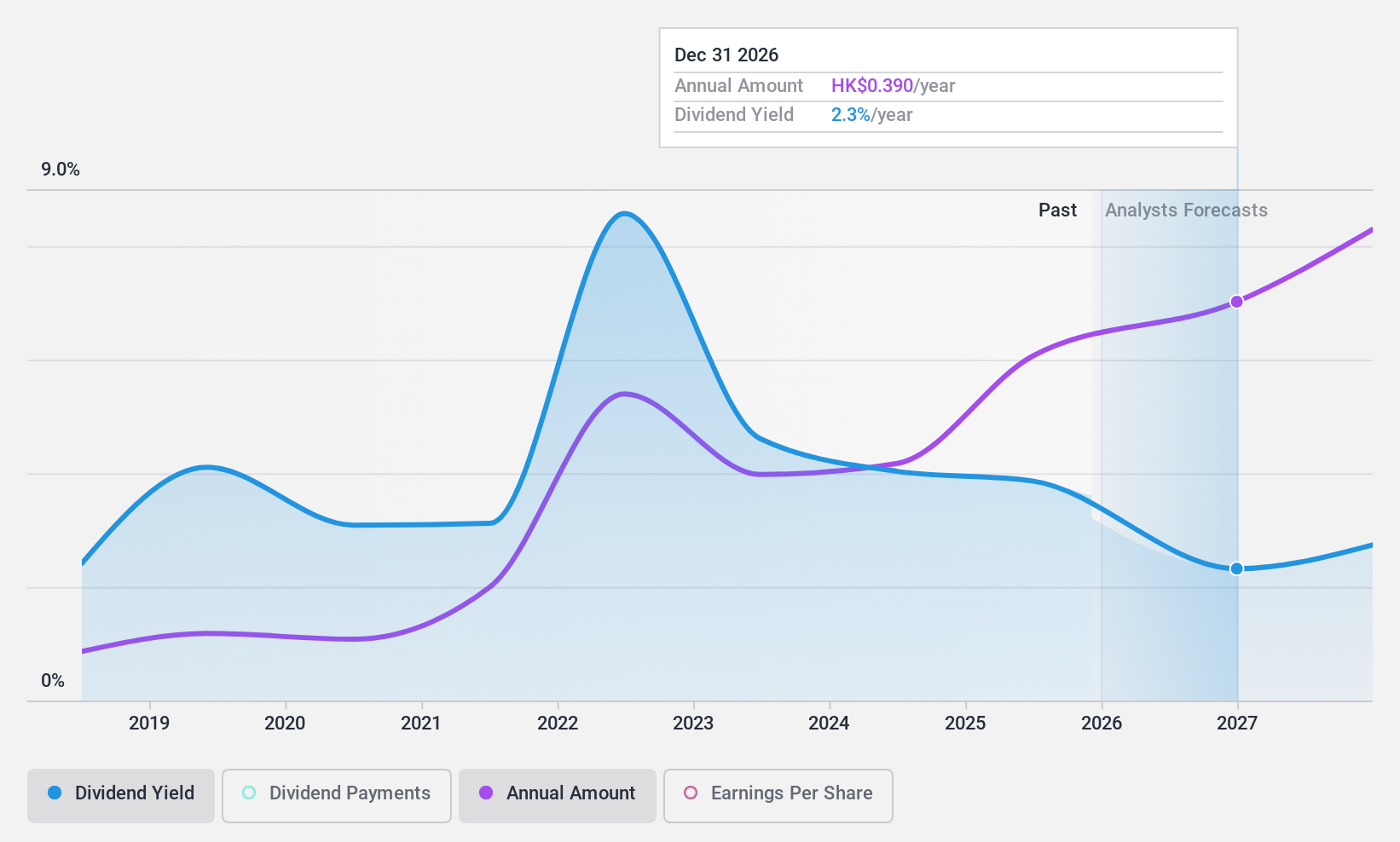

Dividend Yield: 4.4%

China Nonferrous Mining's dividend yield of 4.42% is below the top tier in Hong Kong, but dividends are well covered by earnings and cash flows with payout ratios of 36% and 30.3%, respectively. Despite a history of volatility, dividends have grown over the past decade. Recent guidance indicates a significant profit increase to approximately US$400 million for 2024, driven by higher copper prices, suggesting potential stability in future payouts if trends continue positively.

- Delve into the full analysis dividend report here for a deeper understanding of China Nonferrous Mining.

- The valuation report we've compiled suggests that China Nonferrous Mining's current price could be quite moderate.

Kanaden (TSE:8081)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kanaden Corporation operates as an electronics solutions company both in Japan and internationally, with a market cap of ¥35.43 billion.

Operations: Kanaden Corporation's revenue segments include Industrial Systems at ¥108.45 billion, Information and Communication Systems at ¥76.32 billion, and Electrical Equipment at ¥52.67 billion.

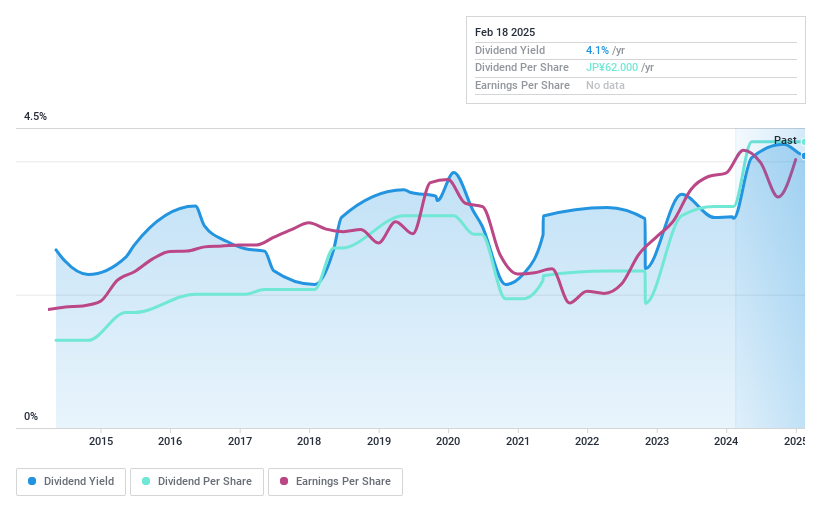

Dividend Yield: 4.1%

Kanaden's dividend yield of 4.06% ranks in the top 25% of JP market payers, supported by a low payout ratio of 20.3%, indicating strong earnings coverage despite a history of volatility over the past decade. Recent share buyback activity, totaling ¥1,739.34 million for 5.09% of shares, aims to enhance shareholder returns and capital efficiency, potentially benefiting future dividend stability and growth prospects amidst modest earnings growth of 3.4%.

- Click here and access our complete dividend analysis report to understand the dynamics of Kanaden.

- Insights from our recent valuation report point to the potential overvaluation of Kanaden shares in the market.

Taiwan Fire & Marine Insurance (TWSE:2832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Fire & Marine Insurance Co., Ltd. offers a range of insurance products and services in Taiwan, with a market cap of NT$10.54 billion.

Operations: The company's revenue primarily comes from Property Insurance, amounting to NT$7.27 billion.

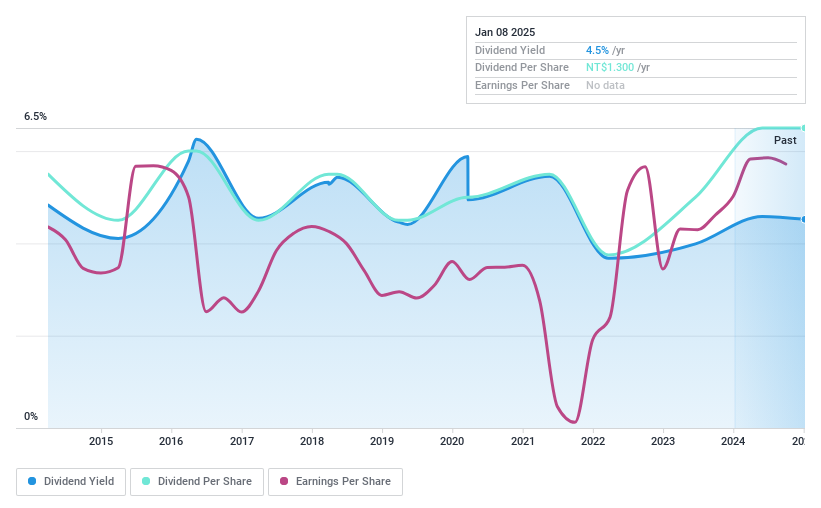

Dividend Yield: 4.4%

Taiwan Fire & Marine Insurance has seen dividend growth over the past decade, though payments have been volatile, with occasional drops exceeding 20%. Despite this instability, dividends are well-covered by both earnings and cash flows, with payout ratios of 42.2% and 65.7%, respectively. Trading at a significant discount to its estimated fair value, the stock's current yield of 4.39% is slightly below top-tier payers in Taiwan but remains sustainable given its financial coverage.

- Get an in-depth perspective on Taiwan Fire & Marine Insurance's performance by reading our dividend report here.

- Our valuation report unveils the possibility Taiwan Fire & Marine Insurance's shares may be trading at a discount.

Where To Now?

- Click through to start exploring the rest of the 1956 Top Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Fire & Marine Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2832

Taiwan Fire & Marine Insurance

Provides various insurance products and services in Taiwan.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives