Here's Why I Think China Reinsurance (Group) (HKG:1508) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like China Reinsurance (Group) (HKG:1508). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for China Reinsurance (Group)

How Fast Is China Reinsurance (Group) Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, China Reinsurance (Group) has grown EPS by 16% per year. That's a good rate of growth, if it can be sustained.

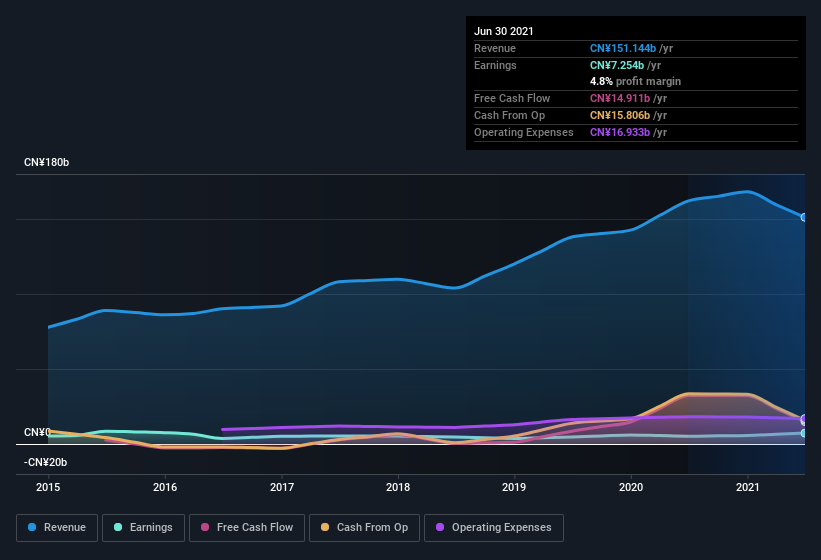

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of China Reinsurance (Group)'s revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. China Reinsurance (Group)'s EBIT margins are flat but, of some concern, its revenue is actually down. And that does make me a little more cautious of the stock.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for China Reinsurance (Group)?

Are China Reinsurance (Group) Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One shining light for China Reinsurance (Group) is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction Chiu Fai Choi paid HK$10m, for stock at HK$0.91 per share. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

Along with the insider buying, another encouraging sign for China Reinsurance (Group) is that insiders, as a group, have a considerable shareholding. To be specific, they have CN¥262m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.8% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does China Reinsurance (Group) Deserve A Spot On Your Watchlist?

One important encouraging feature of China Reinsurance (Group) is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. What about risks? Every company has them, and we've spotted 2 warning signs for China Reinsurance (Group) you should know about.

As a growth investor I do like to see insider buying. But China Reinsurance (Group) isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1508

China Reinsurance (Group)

Operates as a reinsurance company in the People's Republic of China and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives