- Hong Kong

- /

- Healthcare Services

- /

- SEHK:6606

New Horizon Health (HKG:6606) soars 11% this week, taking one-year gains to 72%

New Horizon Health Limited (HKG:6606) shareholders might be concerned after seeing the share price drop 17% in the last quarter. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. After all, the share price is up a market-beating 72% in that time.

The past week has proven to be lucrative for New Horizon Health investors, so let's see if fundamentals drove the company's one-year performance.

Check out our latest analysis for New Horizon Health

Because New Horizon Health made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

New Horizon Health grew its revenue by 260% last year. That's well above most other pre-profit companies. While the share price gain of 72% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at New Horizon Health. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

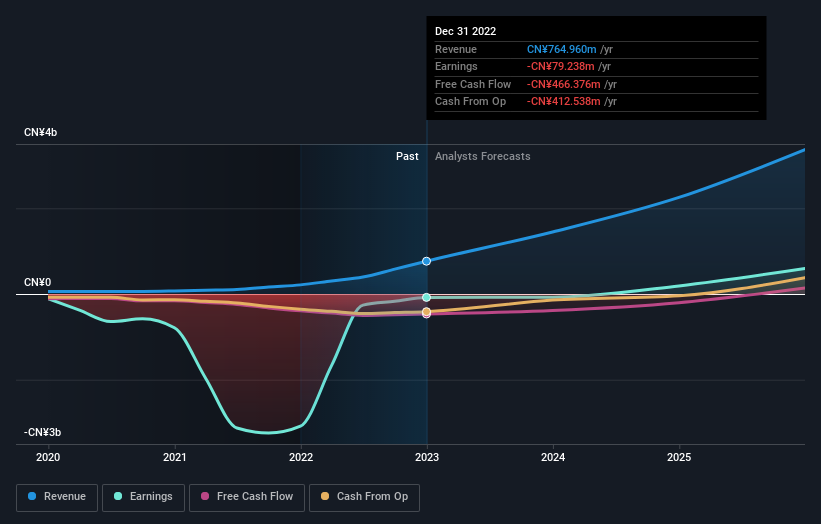

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that New Horizon Health shareholders have gained 72% over the last year. Unfortunately the share price is down 17% over the last quarter. Shorter term share price moves often don't signify much about the business itself. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for New Horizon Health that you should be aware of before investing here.

New Horizon Health is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

If you're looking to trade New Horizon Health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if New Horizon Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6606

New Horizon Health

An investment holding company, engages in the research and development of screening products for colorectal, cervical, and other types of cancer in the People’s Republic of China.

High growth potential and fair value.

Market Insights

Community Narratives