As global markets grapple with economic uncertainty and inflation fears, investors are increasingly cautious about their next moves. Despite these challenges, penny stocks continue to offer intriguing opportunities for those interested in smaller or newer companies that may provide growth potential at lower price points. By focusing on financial strength and solid fundamentals, investors can identify penny stocks that stand out as hidden gems with the potential for rewarding outcomes.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.385 | SGD156.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.55 | SEK266.2M | ✅ 4 ⚠️ 3 View Analysis > |

| NEXG Berhad (KLSE:DSONIC) | MYR0.25 | MYR695.54M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.62 | £260.57M | ✅ 4 ⚠️ 5 View Analysis > |

| Warpaint London (AIM:W7L) | £3.825 | £309.01M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.365 | £381.26M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.926 | £2.17B | ✅ 5 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.46 | A$69.82M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,585 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Yunkang Group (SEHK:2325)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yunkang Group Limited is a medical operation service provider in the People's Republic of China with a market cap of HK$1.87 billion.

Operations: The company generates revenue from its Diagnostic Services segment, totaling CN¥711.88 million.

Market Cap: HK$1.87B

Yunkang Group Limited, with a market cap of HK$1.87 billion, faces challenges typical of many penny stocks. Despite generating CN¥711.88 million in revenue from its Diagnostic Services segment, the company reported a significant net loss of CN¥791.68 million for 2024, up from the previous year. Its board is relatively new with an average tenure of 2.9 years, and while it has more cash than debt and positive operating cash flow covering its debt well (24%), its share price remains highly volatile and trades at 55.4% below estimated fair value amidst intensified industry competition and strategic restructuring efforts.

- Unlock comprehensive insights into our analysis of Yunkang Group stock in this financial health report.

- Understand Yunkang Group's earnings outlook by examining our growth report.

Daisho Microline Holdings (SEHK:567)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Daisho Microline Holdings Limited is an investment holding company involved in the manufacture and trading of printed circuit boards across Hong Kong, Europe, the People’s Republic of China, South Korea, North America, and other international markets with a market cap of HK$262.97 million.

Operations: The company's revenue is derived from the manufacturing and trading of printed circuit boards, generating HK$28.84 million, and printing and packaging products, contributing HK$56.87 million.

Market Cap: HK$262.97M

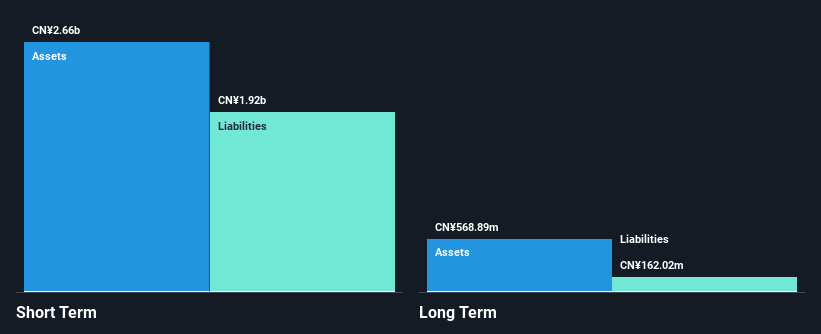

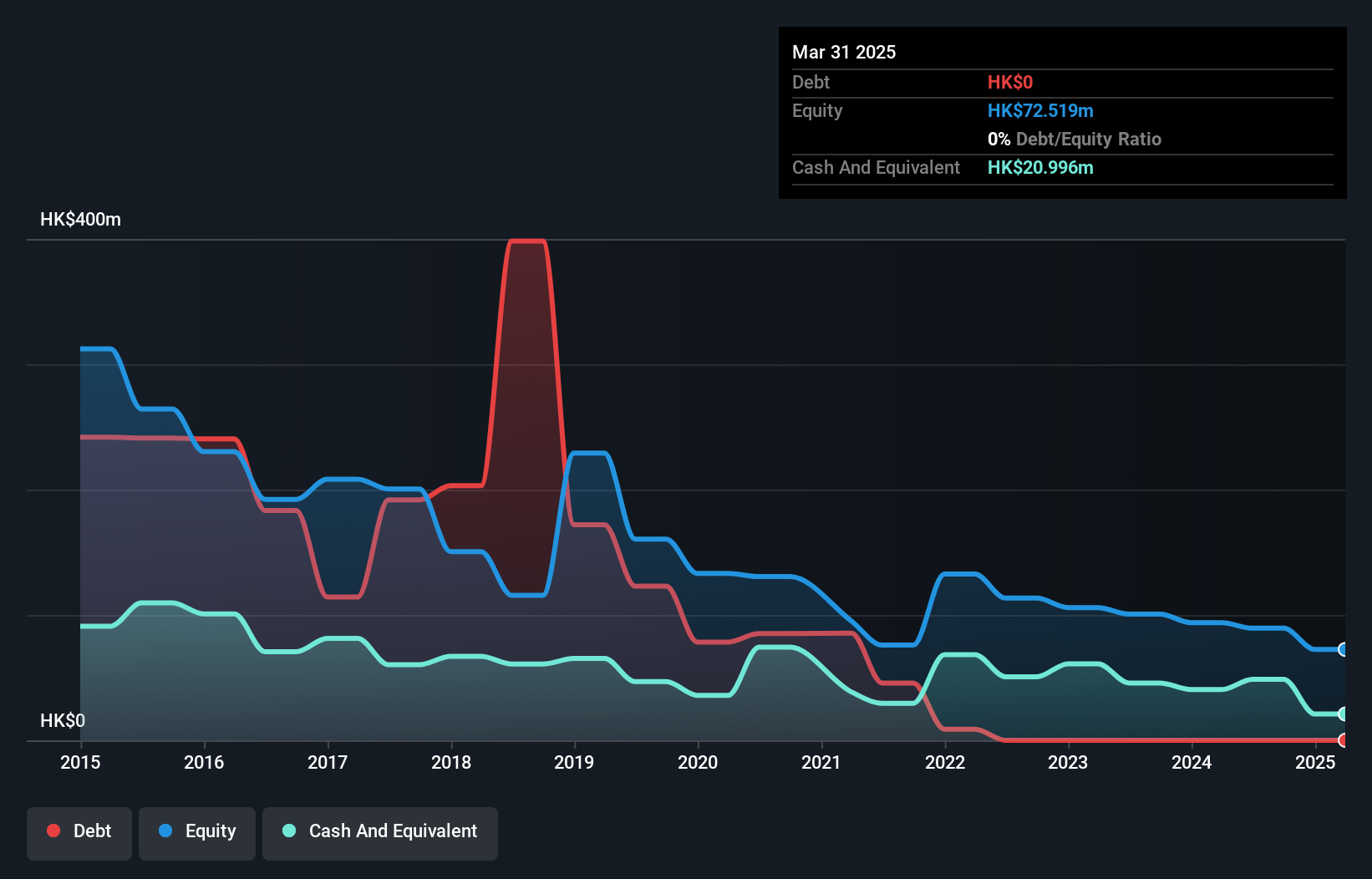

Daisho Microline Holdings Limited, with a market cap of HK$262.97 million, is unprofitable but has reduced its losses over the past five years and maintains a debt-free status. The company generates revenue from printed circuit boards (HK$28.84 million) and printing products (HK$56.87 million). Despite high weekly volatility, Daisho Microline's short-term assets exceed both its short and long-term liabilities, providing financial stability. Recent auditor changes saw Prism Hong Kong Limited replace Forvis Mazars after a disagreement on audit fees; however, this transition is not expected to impact the company's annual audit or results release significantly.

- Jump into the full analysis health report here for a deeper understanding of Daisho Microline Holdings.

- Evaluate Daisho Microline Holdings' historical performance by accessing our past performance report.

Guangdong Jialong Food (SZSE:002495)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Jialong Food Co., Ltd. engages in the research, development, production, and sale of food products in China with a market cap of CN¥2.27 billion.

Operations: The company's revenue primarily comes from its operations in China, amounting to CN¥241.98 million.

Market Cap: CN¥2.27B

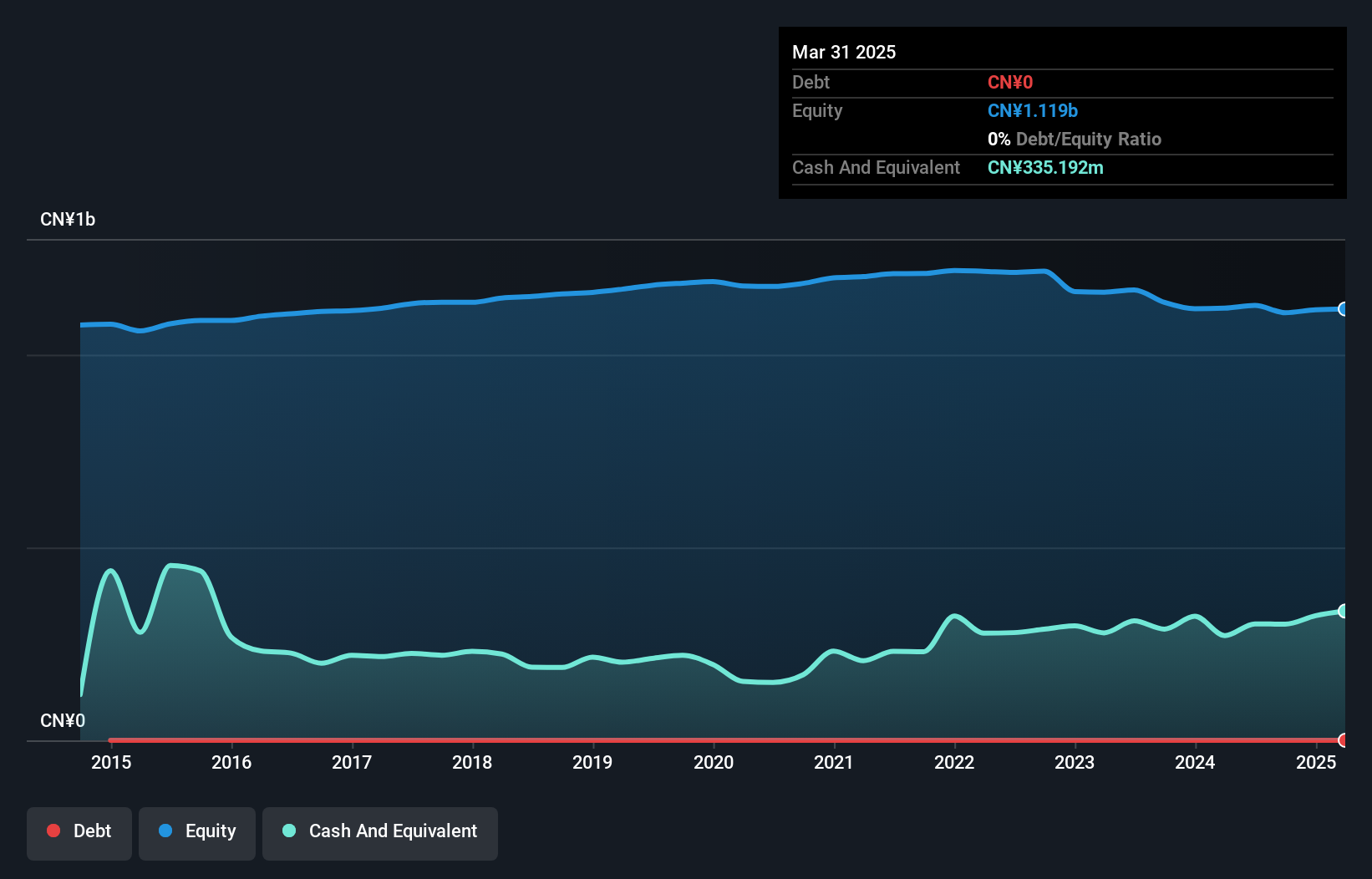

Guangdong Jialong Food, with a market cap of CN¥2.27 billion, is unprofitable and has seen its losses increase by 55.5% annually over the past five years. Despite this, the company remains debt-free and its short-term assets of CN¥393.2 million comfortably cover both short-term (CN¥44.4 million) and long-term liabilities (CN¥17.5 million). The board of directors is seasoned with an average tenure of 14.6 years, while shareholders have not faced significant dilution recently. However, earnings growth remains elusive as revenue primarily from China totals CN¥241.98 million without substantial improvement in profitability indicators.

- Click here and access our complete financial health analysis report to understand the dynamics of Guangdong Jialong Food.

- Gain insights into Guangdong Jialong Food's historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 5,585 Global Penny Stocks here.

- Ready To Venture Into Other Investment Styles? The latest GPUs need a type of rare earth metal called Neodymium and there are only 20 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:567

Daisho Microline Holdings

An investment holding company, engages in the manufacture and trading of printed circuit boards in Hong Kong, Europe, the People’s Republic of China, South Korea, North America, and internationally.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives