- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:1883

Exploring Undiscovered Gems In Hong Kong July 2024

Reviewed by Simply Wall St

Amid a backdrop of global market fluctuations and specific economic events, the Hong Kong stock market presents a unique landscape for investors looking to explore potential opportunities. As small-cap stocks gain traction in broader indices, understanding the nuances of these 'undiscovered gems' becomes crucial in navigating through current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| China Leon Inspection Holding | 17.06% | 24.06% | 27.08% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Laopu Gold | 8.43% | 26.56% | 36.28% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

CITIC Telecom International Holdings (SEHK:1883)

Simply Wall St Value Rating: ★★★★★☆

Overview: CITIC Telecom International Holdings Limited operates globally as an investment holding company, specializing in international telecommunications services, with a market capitalization of approximately HK$9.88 billion.

Operations: The company generates revenue primarily through the sale of telecommunications services, evidenced by consistent year-over-year revenue growth, reaching HK$10.46 billion by mid-2023. It manages costs related to goods sold and operational expenses while achieving a net income margin increase from 21.34% in late 2013 to 12.81% by mid-2023, reflecting strategic financial management despite varying operating costs and depreciation expenses over the years.

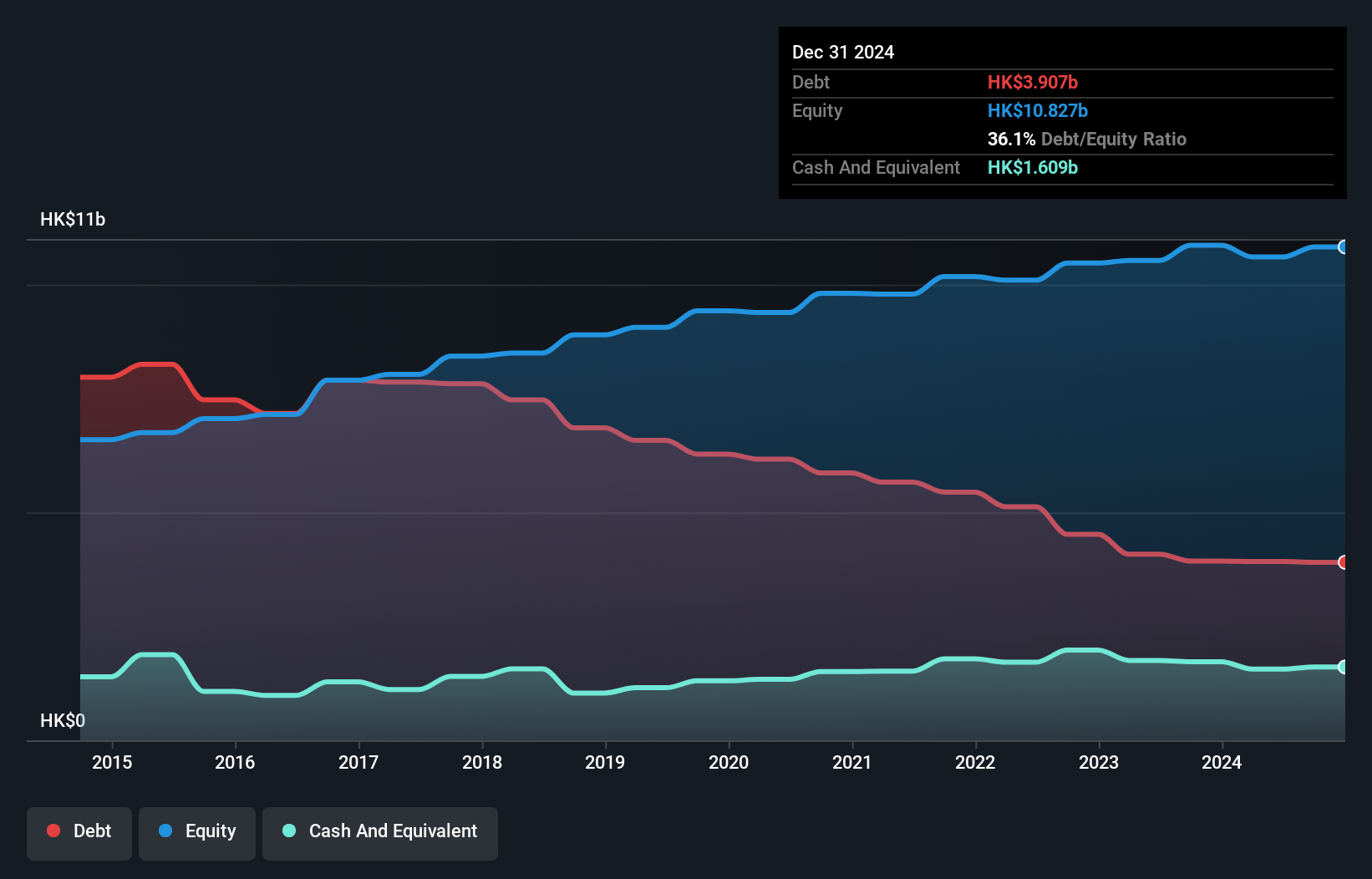

CITIC Telecom International Holdings, a lesser-known yet promising entity in Hong Kong's telecom sector, has demonstrated robust financial health and growth potential. With earnings growth of 3.4% over the past year and a net debt to equity ratio significantly reduced from 77.1% to 36.2%, the company is well-positioned within its industry. Recent strategic moves include a comprehensive service agreement with CITIC Group, enhancing its offerings in data services and cloud solutions, poised to bolster future performance.

C&D Property Management Group (SEHK:2156)

Simply Wall St Value Rating: ★★★★★★

Overview: C&D Property Management Group Co. Limited is an investment holding company specializing in property management for both residential and non-residential properties across the People's Republic of China, with a market capitalization of HK$3.91 billion.

Operations: C&D Property Management Group generates its revenue primarily through the provision of property management services and value-added services, with a notable gross profit margin increase to 28.06% by the end of 2023. The company has demonstrated a consistent ability to grow its net income, which reached CN¥467.35 million in the latest reported period.

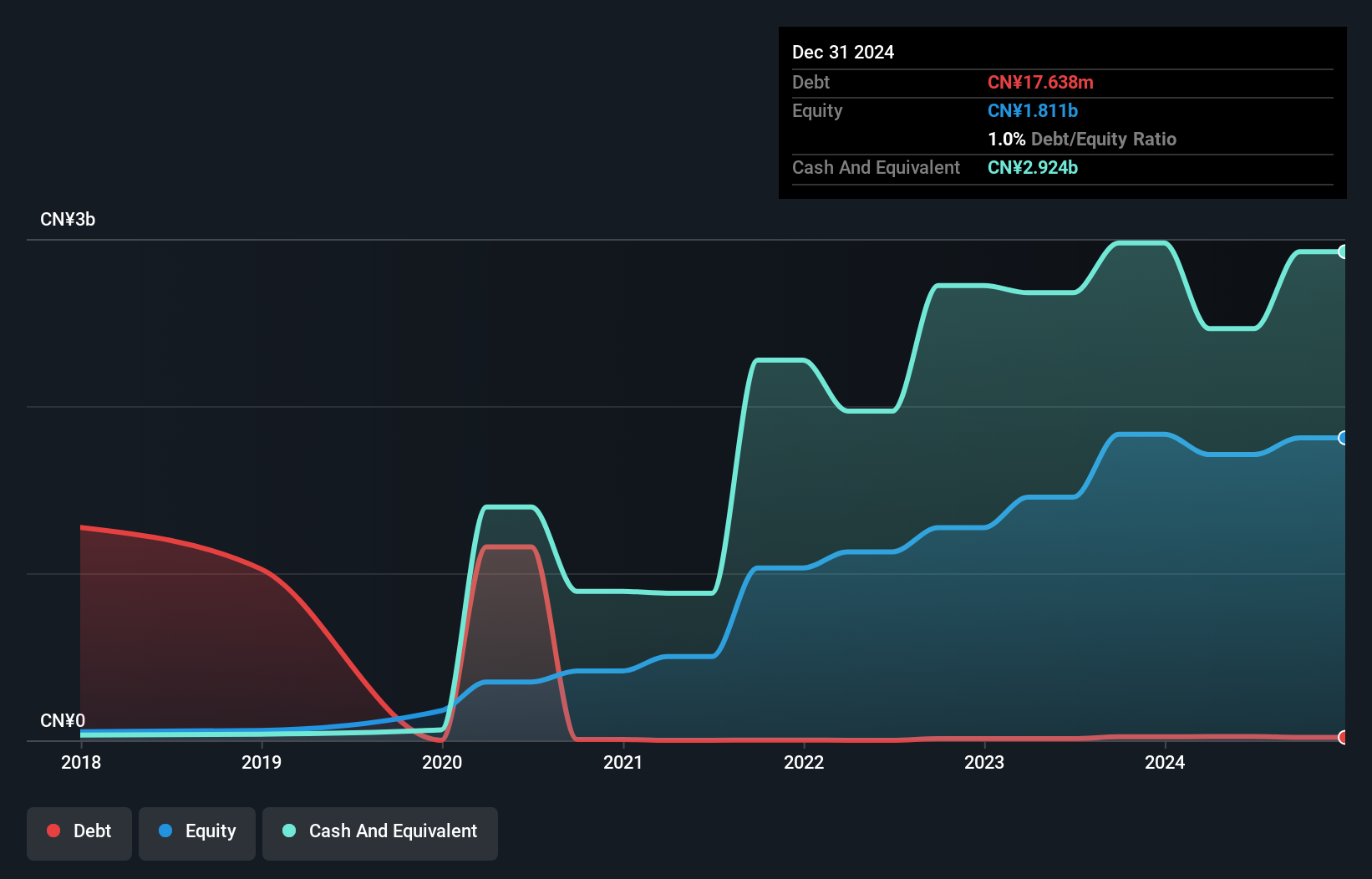

C&D Property Management Group Co. Limited, a notable player in Hong Kong's real estate sector, has demonstrated robust financial health and growth potential. Over the past five years, the company significantly reduced its debt-to-equity ratio from 1736% to 1.2%, indicating strong financial management. Recent performance highlights include an impressive 89% earnings growth over the past year, surpassing the industry average of 0.4%. Additionally, with a price-to-earnings ratio of 7.8x—below Hong Kong's market average of 9.4x—the company presents as undervalued relative to its peers. Recently, C&D declared a special dividend of HKD 0.1 per share and affirmed a final dividend of HKD 0.16 for the year ended December 2023 at their AGM on May 24th, reflecting confidence in ongoing profitability and cash flow stability.

- Unlock comprehensive insights into our analysis of C&D Property Management Group stock in this health report.

Understand C&D Property Management Group's track record by examining our Past report.

LEPU ScienTech Medical Technology (Shanghai) (SEHK:2291)

Simply Wall St Value Rating: ★★★★★★

Overview: LEPU ScienTech Medical Technology (Shanghai) Co., Ltd. is an investment holding company that specializes in the R&D, manufacturing, and sale of interventional medical devices globally, with a market capitalization of HK$6.42 billion.

Operations: The company primarily generates its revenue from the occluder business, which has consistently recorded a high gross profit margin, reaching 88.62% as of the latest reported period in 2024. It incurs significant operating expenses, particularly in research and development and sales and marketing, to support its technological advancements and market reach.

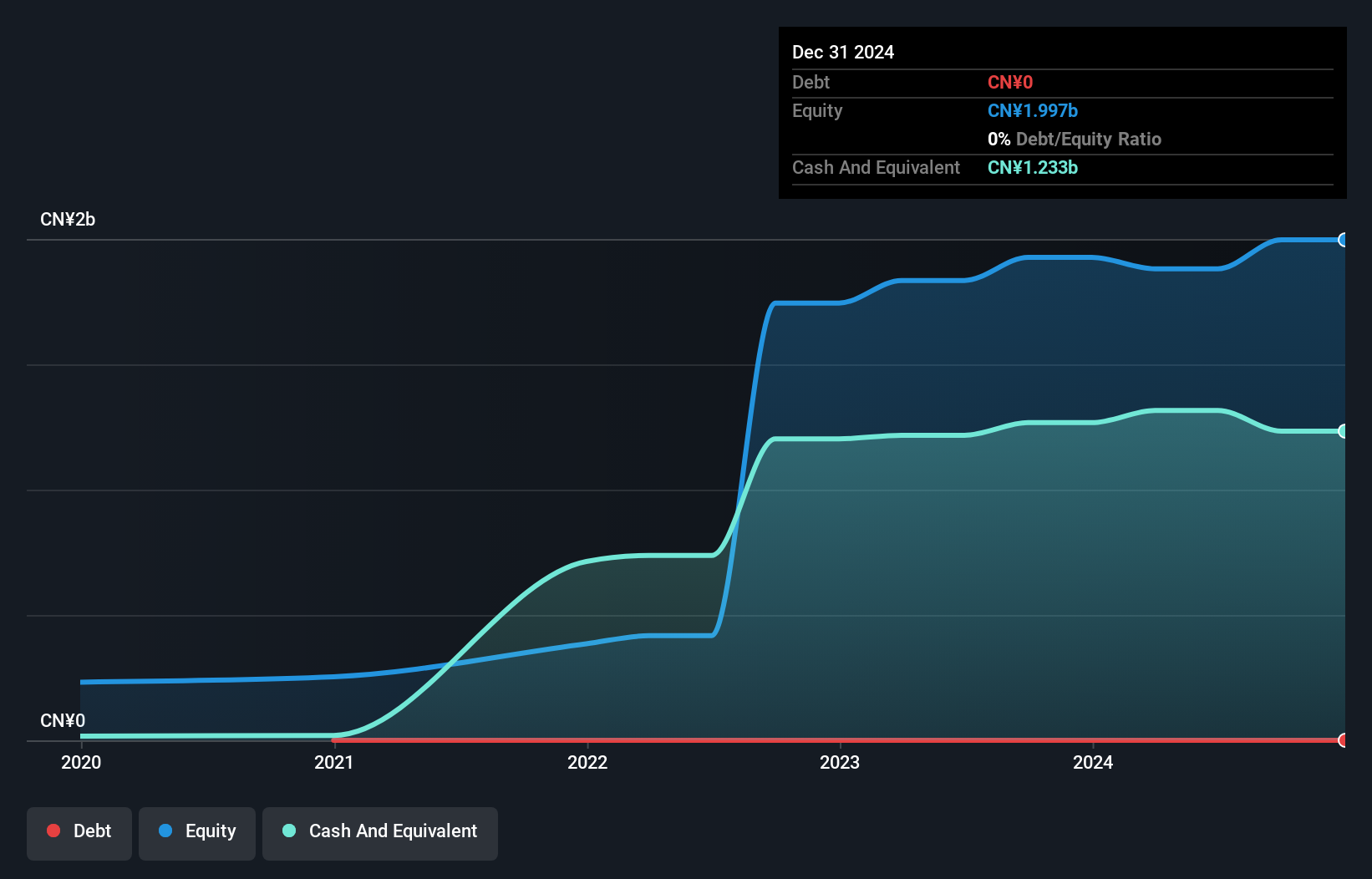

LEPU ScienTech Medical Technology (Shanghai) has emerged as a noteworthy contender in the Hong Kong market, especially with its innovative MemoSorb® device gaining traction after recent approvals. The company's financials reflect robust growth, with net profit predictions for mid-2024 showing an increase of up to 97% year-over-year. This surge is supported by effective commercial strategies and strong R&D capabilities. Additionally, the firm's commitment to shareholder value is evident from its recent dividend announcement of RMB 0.57 per share.

Seize The Opportunity

- Embark on your investment journey to our 177 SEHK Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1883

CITIC Telecom International Holdings

An investment holding company, engages in the provision of international telecommunications services in Hong Kong, China, Macau, Singapore, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)